Pension Providers and Life Insurers

Help your customers

prepare for the future

For many, protecting assets and preparing for the future

means meeting particular needs; whether it be to have

enough money for a comfortable retirement or

maximize the amount to provide for loved ones.

additiv removes retirement planning silos and combines investment,

insurance and pension experiences throughout your client’s lifespan.

Address the

pension gap

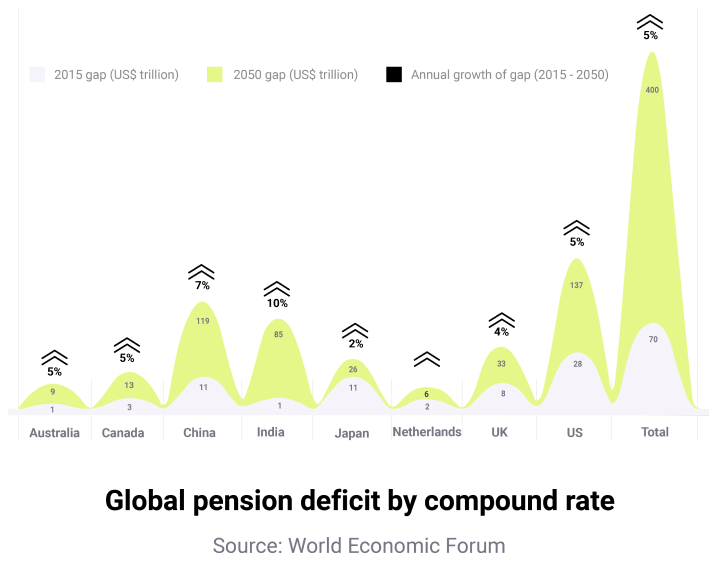

There will be a $400 trillion deficit in pension assets globally by 2050. This deficit is a result of rising life expectancy, interest rates below inflation and conservative investment strategies. This leaves individuals looking for alternative ways to protect their future.

Life insurance and pension providers can now help customers overcome these challenges by embedding savings and investments into their everyday lives.

Gain oversight and remove retirement planning silos

Retain clients and grow wallet share by offering related insurance, investment and pension experiences in a single place.

Allow your customers to…

Select financial goals to review and understand current retirement situation

Model their pension pots to suit individual goals

Understand the opportunities and risks associated with investment adjustments