Consumer Platforms

Let consumers

accomplish more

Consumers like the convenience of a single app for their everyday life. Consumer platforms can increase profitability and drive customer stickiness by offering embedded financial services.

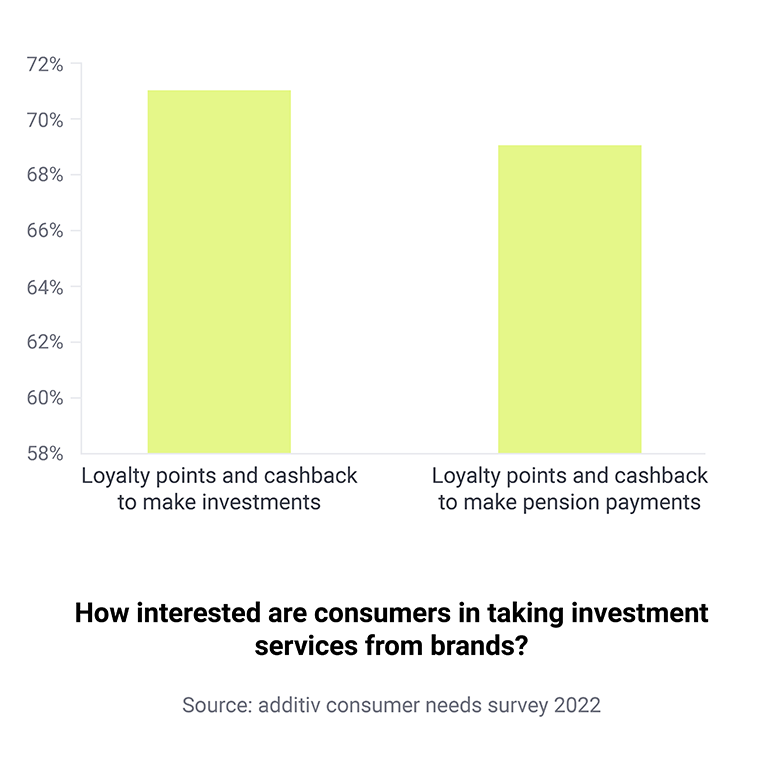

Integrating ready and easy-to-use regulated financial services helps meeting

consumers’ unmet needs to turn excess cash, loyalty points or cash-back into

savings, helping your customers save, invest and protect their future.

Get paid to offer financial services

Offering and maintaining market relevant, efficient financial services in this increasingy regulated environment is a full-time job. It’s a job for specialists, however, that doesn’t mean that non-financial brands can’t offer savings and investments.

Embedded financial services offers the easiest, fastest route to market with the best economics. Regulated, trusted services. No IT costs. Minimal lead time. Out-of-the-box and into your app.

Differentiate and grow wallet share

Increase customer life-time value, trust and loyalty by embedding regulated financial services at competitive prices.

Enable consumers to invest discounts to stay financially healthy

Offer a smart investing service to your customers, embedded in your digital user-journeys

Enrich your platform with engaging investing services

Help consumers stay financially healthy

Offer engaging investing services to help consumers achieve their life goals

Raise user-engagement and brand loyalty

Incentivize goal achievement by connecting to existing loyalty programs

Offer context-driven financial services to amplify your business model