Health Insurance Providers

Make people’s health insurance affordable

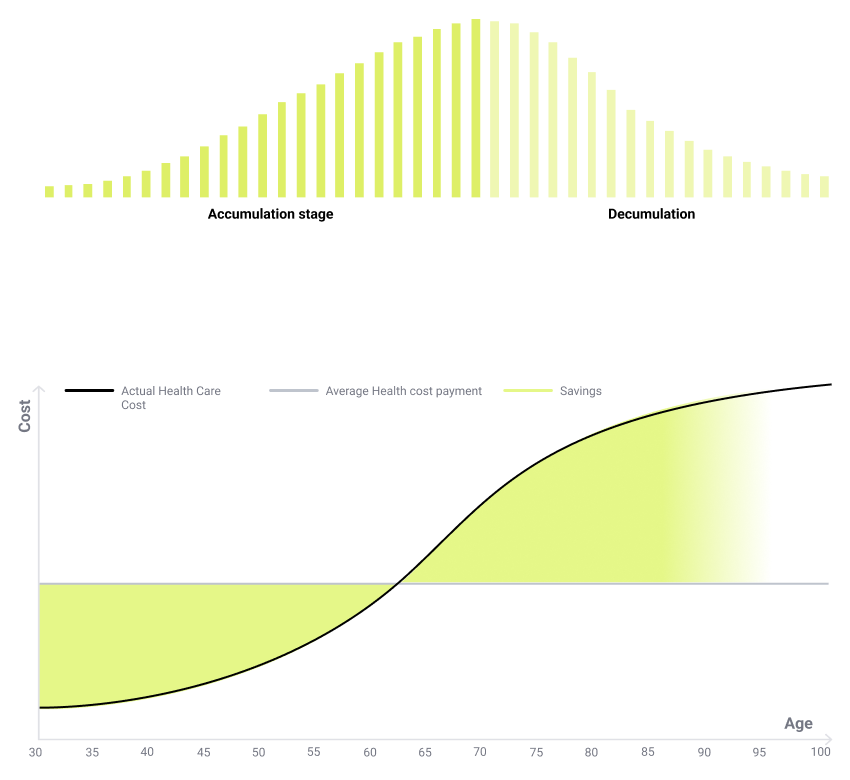

Health insurance should work like wealth management. Set aside money when you’re young to pay for your needs when you’re older.

In health insurance, this spreads the cost of premiums which rise as you get older.

The best way to do this is by combining a savings and health insurance

solution, and offering this to health insurance consumers.

Help consumers prepare early to afford later

Globally, life expectancy is rising and so are health care premiums.

Health care also represents a growing relative share of costs with age, so managing these costs is essential.

Preparing early to afford later is key. Embedding savings and investments with health insurance when consumers are young helps protect against rising premiums when they’re older.

Move to a high value, high retention model

Transform your business model to transform your customer experience. Embed savings into health insurance to achieve higher

engagement, lower switching rates and greater life time value.

Enable consumers to finance their rising health costs

Save and invest a portion of income to afford rising health insurance costs in a later lifecycle

Add saving to an an individualized portfolio and let their money work

Afford higher health insurance costs through passive income from their portfolio

Enable consumers to maintain their lifestyle after retirement

Save and invest a portion of their income during their employment period

Add saving to an an individualized portfolio and let their money work

Maintain lifestyle after retirement through passive income from their portfolio