Financial services and capabilities you can

arrange into relevant and comprehensive solutions

Use our ready to run omnichannel

financial white-label apps

White-label Apps

Use our ready-to-run omnichannel financial apps

to enhance your customer experience

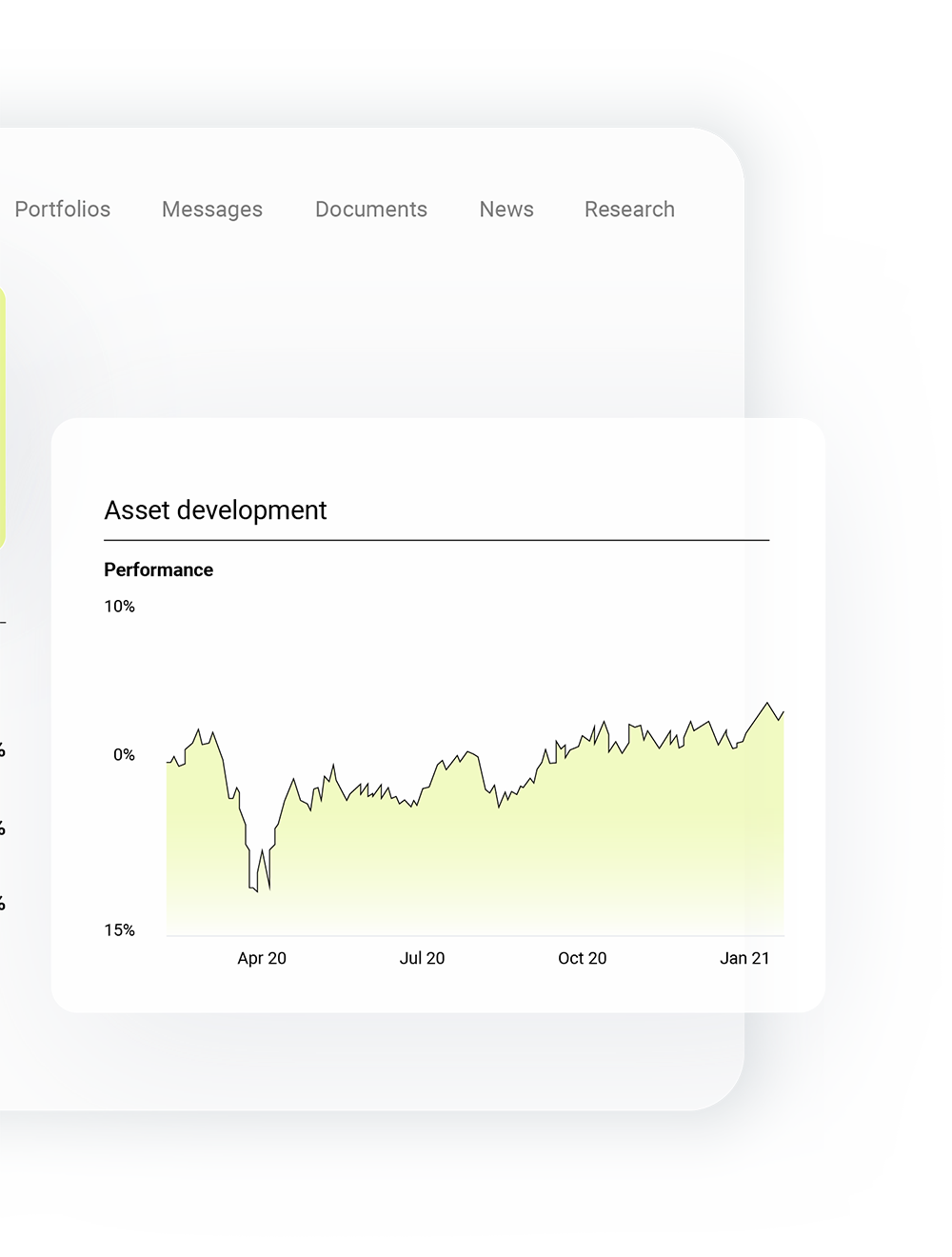

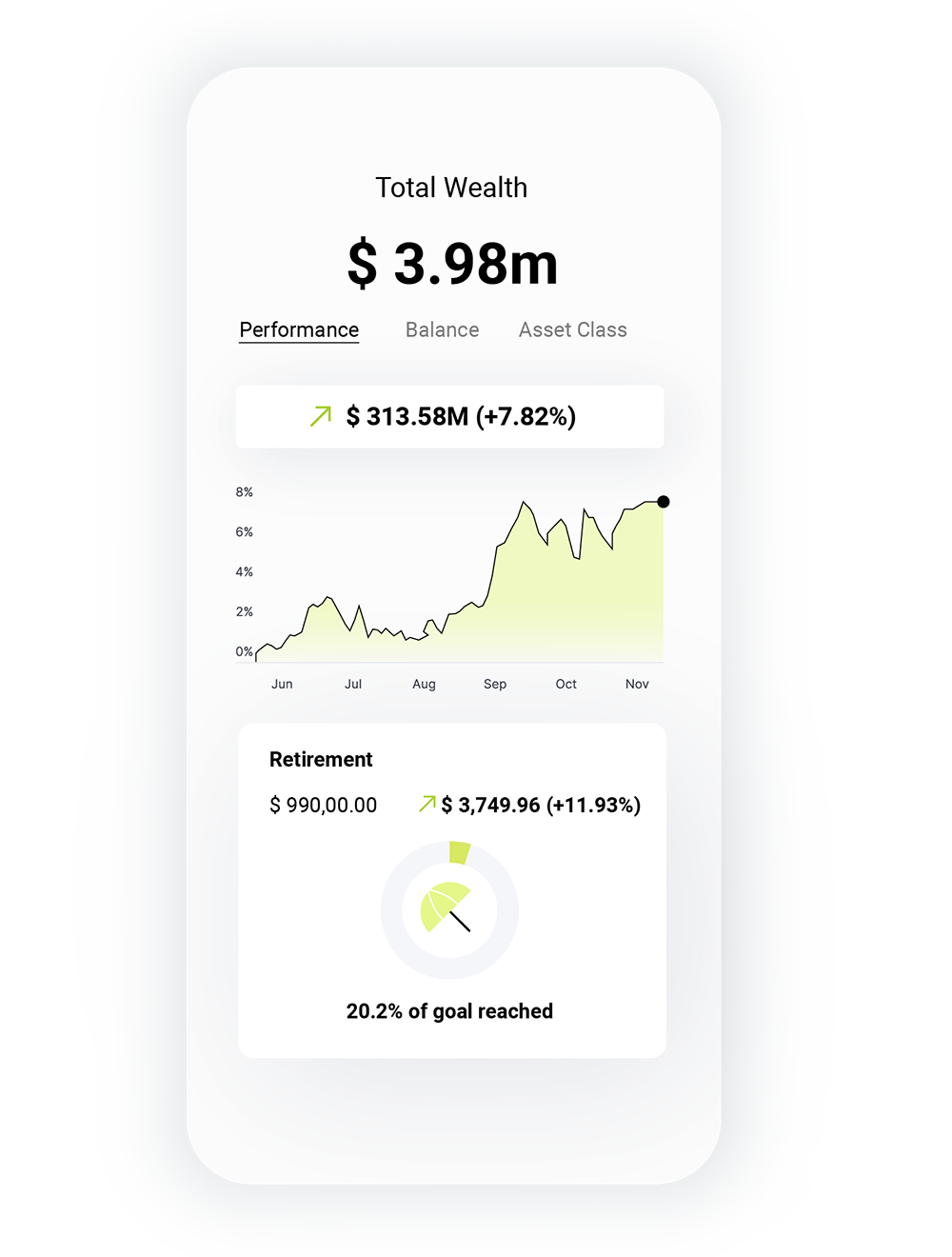

Hybrid Wealth

Our Hybrid Wealth app gives a seamless customer experience across all client touchpoints.

It empowers users to intuitively manage their investments by themselves or work with their advisor. It also gives operations teams comprehensive service and productivity tools.

Robo Advisor

Wealth Robo allows you to give great service with the efficiency of an automated approach. It makes it easier for your clients to select best-fit investment products at lower costs.

Advisor Copilot

Advisor Copilot uses generative AI to supercharge your advisors and enable them to instantly answer all of their own and their clients’ queries, with full compliance.

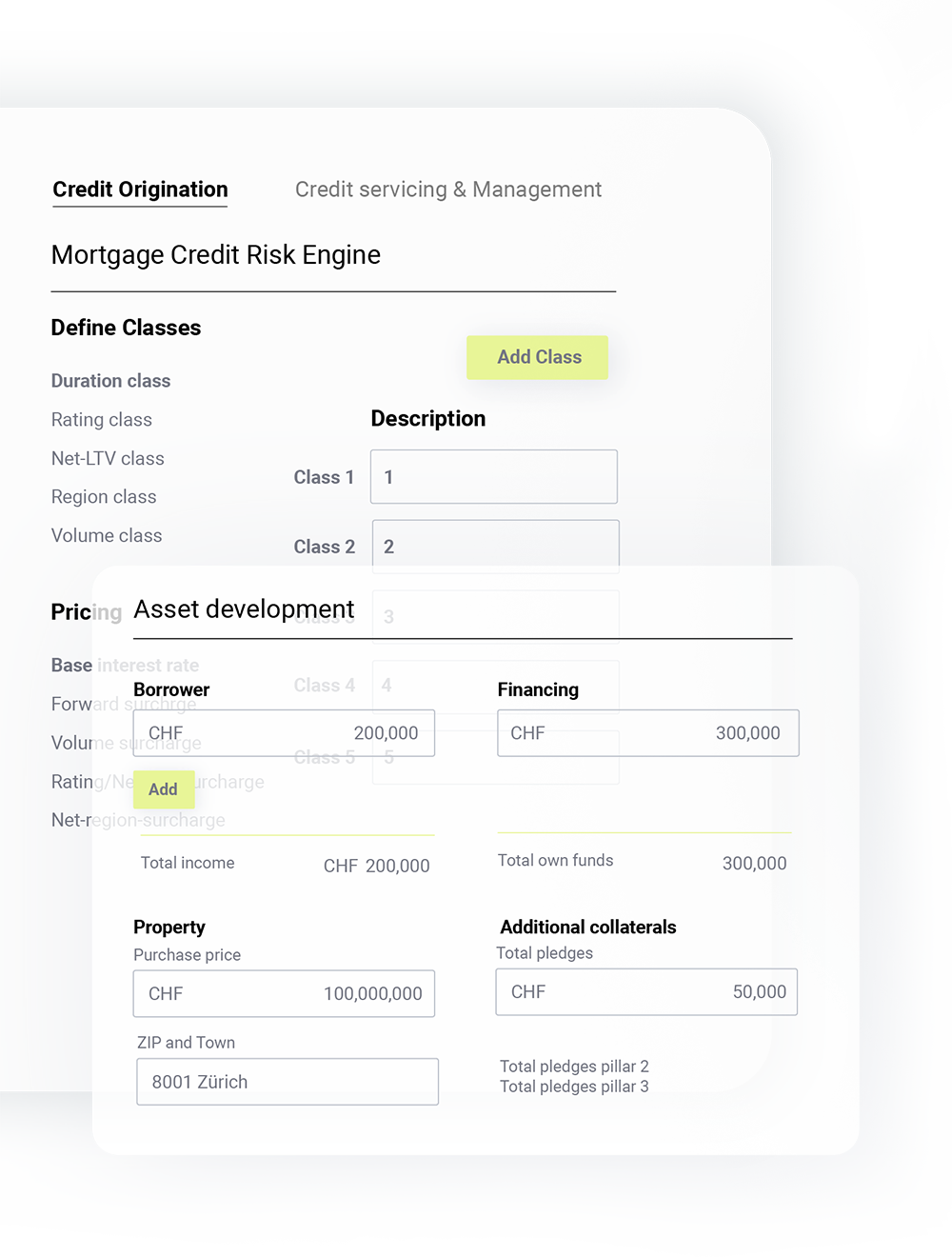

Credit Marketplace

Our Credit marketplace that links multiple lenders with distribution partners. It handles secured and unsecured loans and manages the full customer journey from origination to arrangement.

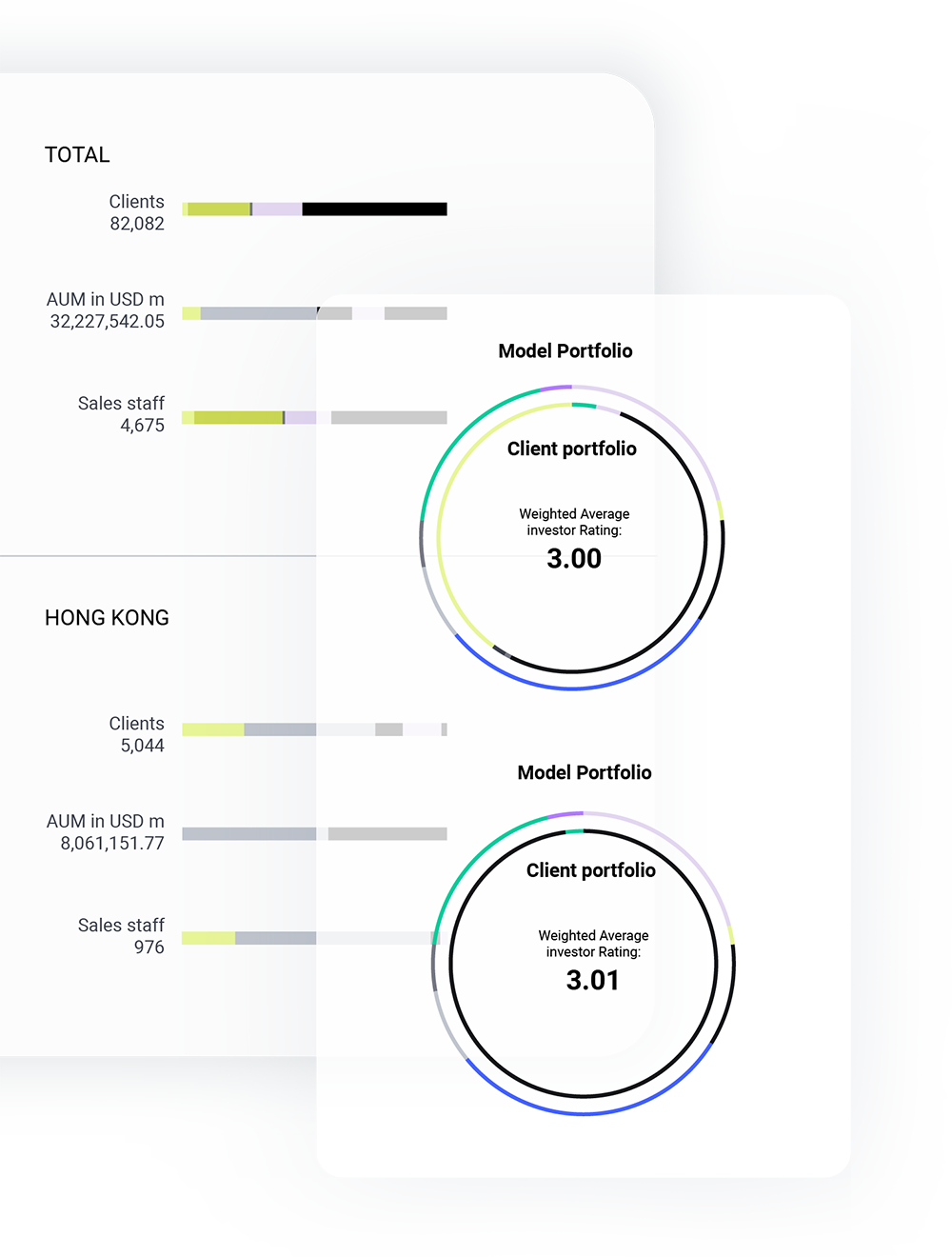

Risk Compass

Risk Analytics deconstructs portfolios across booking centers into underlying instruments, bringing much greater transparency for risk, compliance and advisors.

A wealth of possibilities for designing

the right solution

Extensive capabilities

Capabilities in all key areas of finance, at all stages of the value chain, and in all key geographies.

Adaptable options

Arrange them into comprehensive end-to-end value propositions which address real-life customer needs.

Versatile approaches

Goal-oriented pension planning, tax-efficient savings, blended insurance protection, employee wellness and more.

Everything you need to maximise customer engagement:

- Hybrid wealth management

- Wealth account aggregation, portfolio analytics and client reporting

- Multi-asset execution and custody

- Multi-asset class risk analytics and portfolio construction

Everything you need to offer a seamless investing experience:

- Advised or self-serviced investing

- Portfolio construction, simulation, optimization

- Multi-asset execution and custody and risk analytics

- Stress testing

- Investment process automation

Everything you need to offer sustainable finance:

- ESG data, indexes, evaluation metrics

- SDG-focused investment themes

- SFDR Reporting

- Real-time news analytics

- Actionable insights, scores and predictive signals

Everything you need to maximise customer engagement:

- Conversational & collaboration interfaces

- Live chat & secure messenger

- Video & voice solutions

- Co-browsing

Everything you need to offer secured and unsecured loans:

- Mortgage calculator

- Origination and arrangement

- Fully digitized processes

- Ecosystem of lenders

Everything you need to offer Non-life, Life, and Health insurance:

- Insurance product design

- Individualized insurance products

- Risk-profiling

- Client self-service

- Ecosystems of insurers

Everything you need for secure end-to-end service delivery:

- Fraud monitoring

- Seamless 2FA with fallbacks

- Compliant transaction confirmations

- Secure helpdesk authentication

- Passwordless authentication

- Biometric MFA

- Transaction signing & identity verification

- Digital identity and digital signatures

Everything you need for compliant operations:

- Integration to KYC providers

- Risk Profiling

- Investment suitability

- MIFID and FIDLEG Reporting

- Advisory protocol

- Loss report

- SFDR report

Everything you need to offer digital assets:

- Digital asset custody

- Investing in digital asset opportunities

- Digital asset aggregation and risk analysis

- Digital assets and fiat off-ramps and on-ramps