Featured success stories

PostFinance, one of the largest banking institutions in Switzerland, worked with additiv to enter the digital wealth management market.

Hybrid wealth management

Support of self-service as well as advisor-led investment services.

Comprehensive product offering

Execution-only, advisory and discretionary mandates.

ATRAM, the largest independent asset and wealth manager in the Philippines, partnered with additiv to consolidate all client segments onto a single digital platform.

Advisory-led digital wealth offering

Customizable advisory tools for individual, corporate and institutional clients.

Award-winning

Winner of IBSi Global FinTech Innovation Awards 2023 for Best Project Implementation.

Switzerland’s no.1 retailer works with additiv to provide comprehensive banking and pension solutions seamlessly to their customers in its Coop super app.

One app, full control. Simple and digital

Coop’s household account is specially designed for your day-to-day finances and can be opened in just a few steps.

Sourced from regulated banking institutions

additiv’s API-first cloud platform integrates and orchestrates Coop’s various financial services partners such as Hypothekarbank Lenzburg, Glarner Kantonalbank and others.

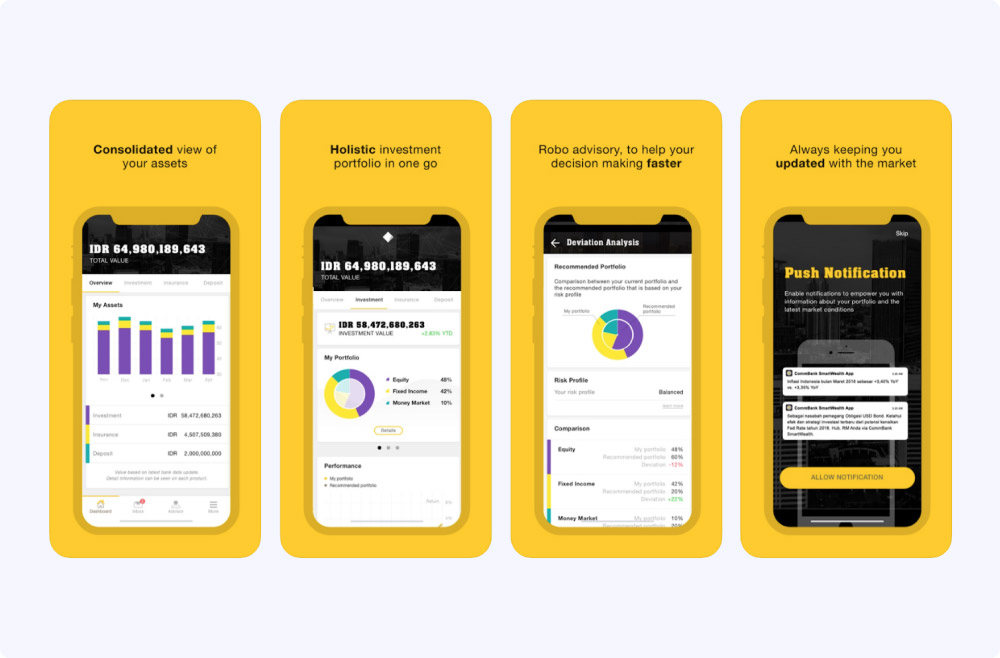

Commonwealth Bank Indonesia was the first bank in the country to launch a mobile banking application with investment features, CommBank Smart Wealth powered by additiv.

360° view of investments

Comprehensive interface enabling customers to directly monitor their total assets.

Self-service with on demand assistance

Manage investment transactions independently, freeing relationship managers and advisors to cater to the ones truly in need.

Zurich Insurance, one of the world’s largest insurance groups, launched investment and retirement offerings to its clients with additiv’s end-to-end wealth-as-a-service platform.

Pension planning services

In-person and remote pension planning for pillar II and 3a.

Operational efficiency

Fully digitalized and automated end-to-end process and workflows.

SwissFEX worked with additiv to launch a mortgage origination platform, with a fully digitized process for brokers.

Comprehensive marketplace

More than 50 financing partners including all relevant mortgage banks are integrated as lenders.

Simplified, fully digital origination

Streamlined the origination journey, reducing the processing effort for the advisors to focus on value add advisory.

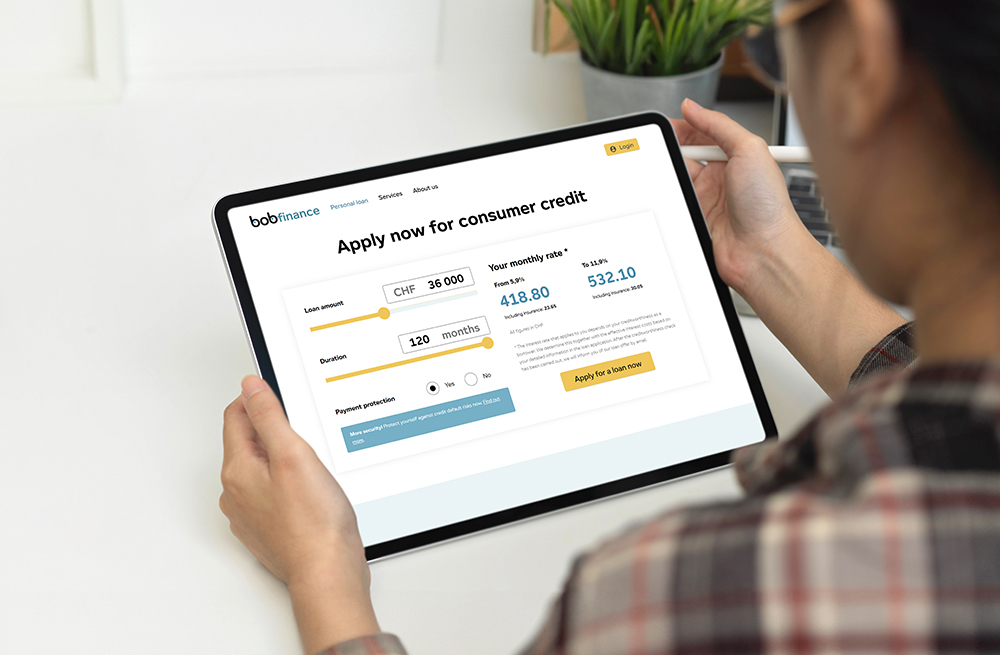

Developing a new financial services company for the retailer Valora targeting consumer finance market online and integrated at the POS.

End-to-end digital lending

From distribution, origination, refinancing till servicing on one digital platform.

Comprehensive business consulting

Business development from business case up to refinancing.

additiv has worked with a global insurance leader to build a plug & play platform that enables banks to offer complementary insurance solutions embedded into banking products.

Complementary insurance to mortgages

Operated through banks who offer the best fitting insurance solutions as complementary offering to mortgages.

Quality and operations overseen by banks

Regulated banking operations such as client profiling, proposals, servicing and billing handled by the additiv platform.