How additiv helped

Commonwealth Bank Indonesia was the first bank to launch a mobile banking application with investment features and increased their Premier Banking customers by 25%.

"*" indicates required fields

The business impact

Since launching the CommBank SmartWealth mobile app, the bank has seen many benefits, including:

Improvement in Net Promoter Score (NPS), measuring the disparity between promoters and detractors.

of all Premier Banking customers have downloaded the SmartWealth app (until June 2020).

Increase in the number of Premier Banking customers, with the SmartWealth app as a key driver.

“Our customers really enjoy how we display their holdings’ status in the CommBank SmartWealth. The intuitive interface makes it easy for them to directly see their total assets and monitor their unrealized gain or loss.”

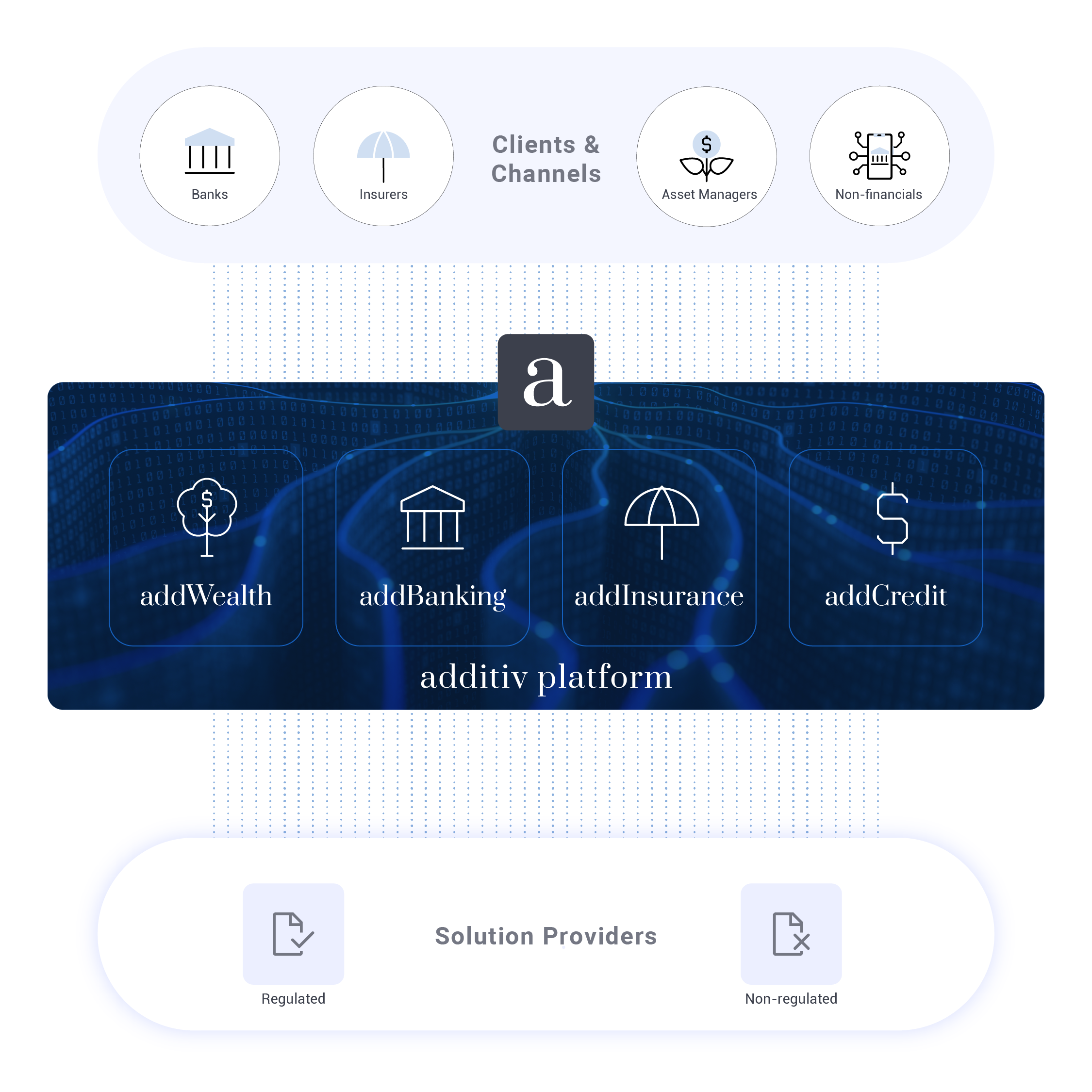

A single, unified platform for digital finance

The additiv platform manages the sourcing, orchestration, and operation of comprehensive regulated financial solutions to deliver end-to-end value propositions in wealth management, banking, credit and insurance services, embedded into everyday digital channels and super apps.