Insurance that scales.

Launch, embed, and scale insurance by automating the full journey, from quote & bind to claims, for faster delivery, lower costs, and greater efficiency.

A single platform. addInsurance.

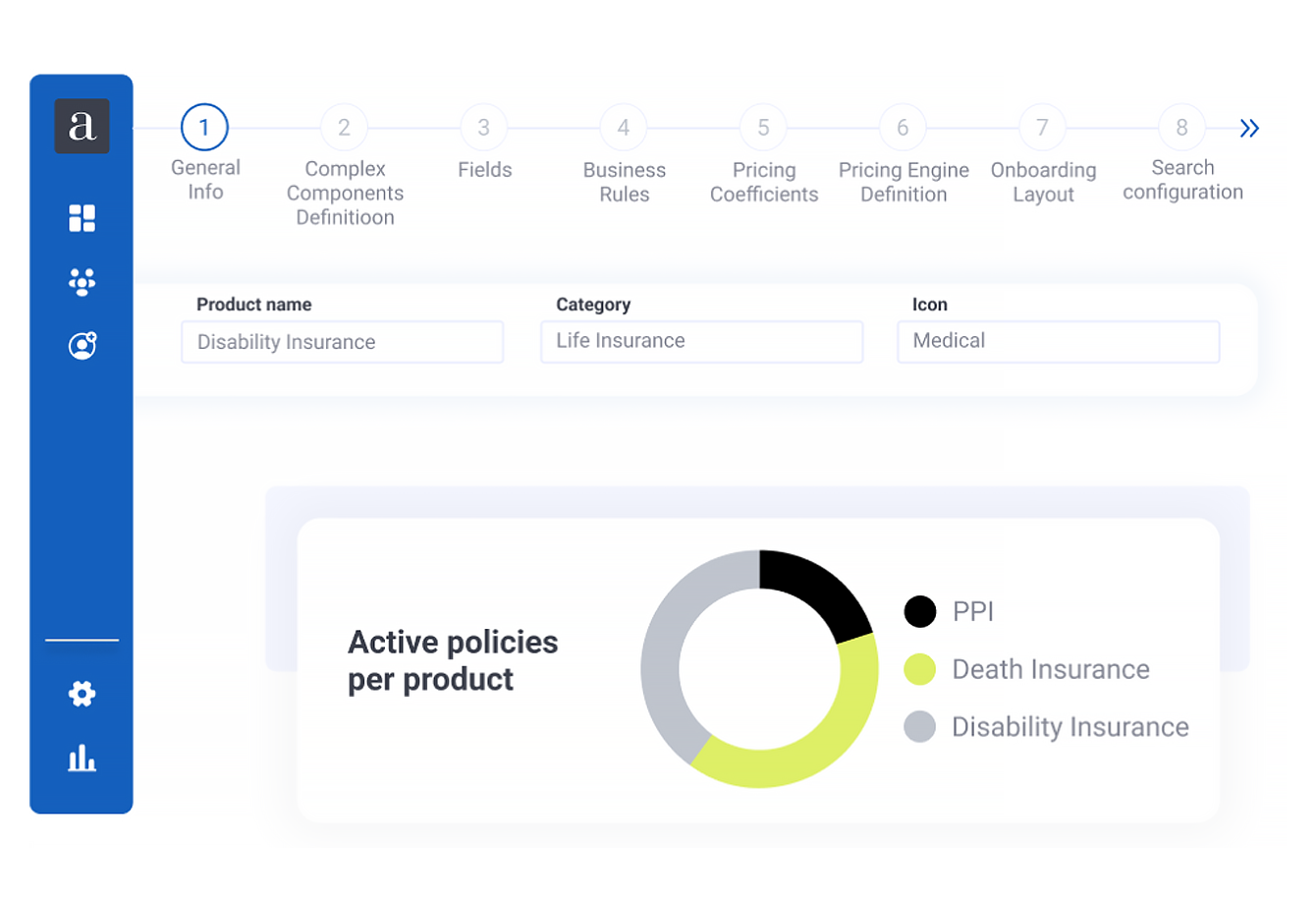

additiv’s platform simplifies and scales insurance delivery, across life, non-life, digital and embedded journeys. Launch new propositions faster, automate processes, and expand distribution, without complexity.

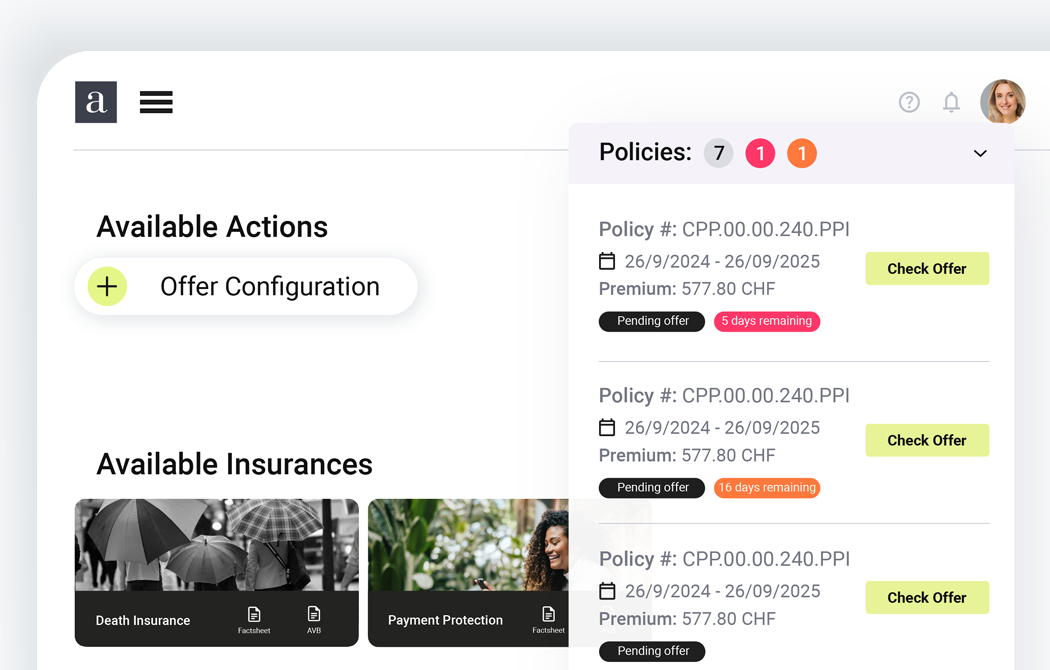

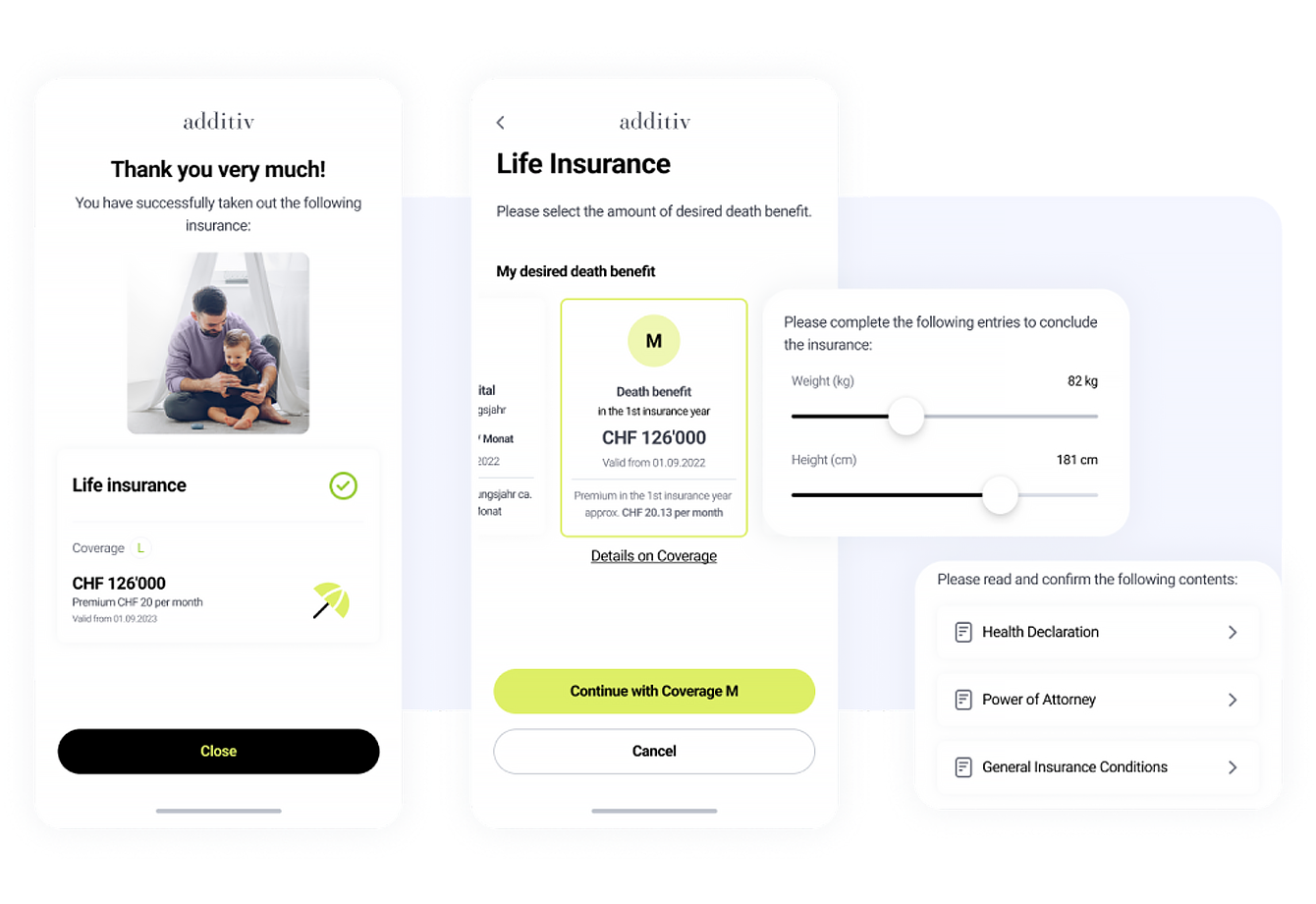

Tailor and distribute insurance products across digital, embedded, and advisor-led channels.

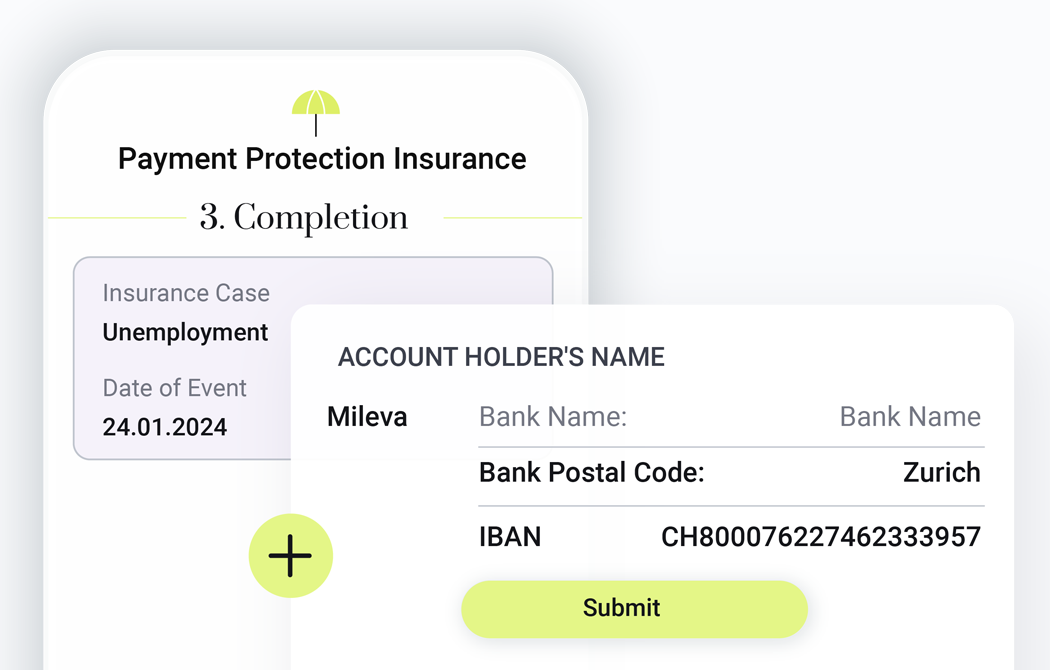

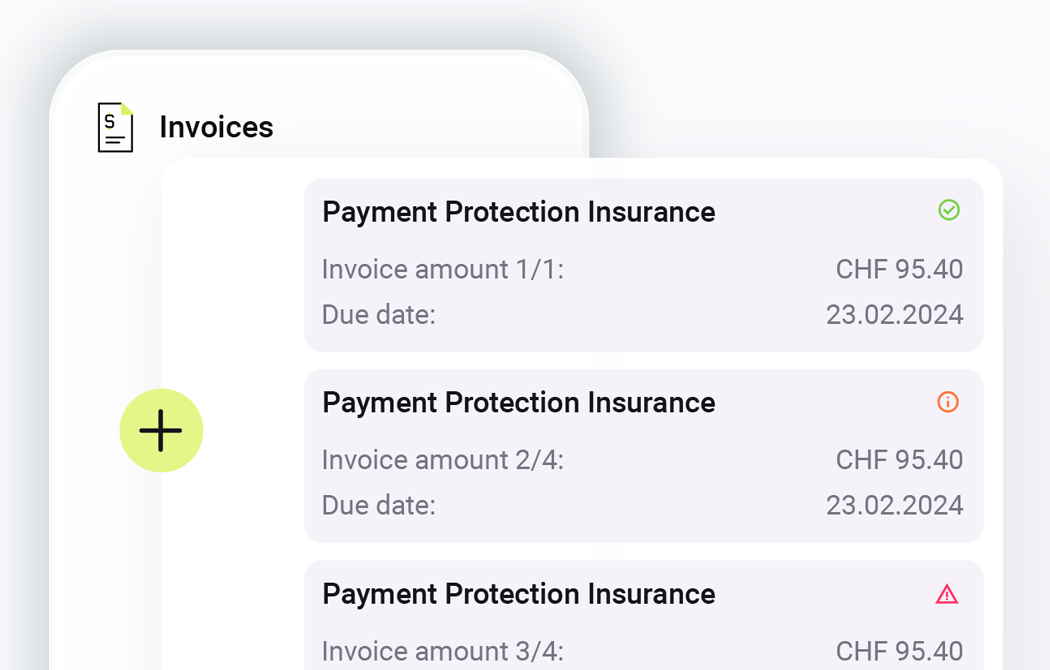

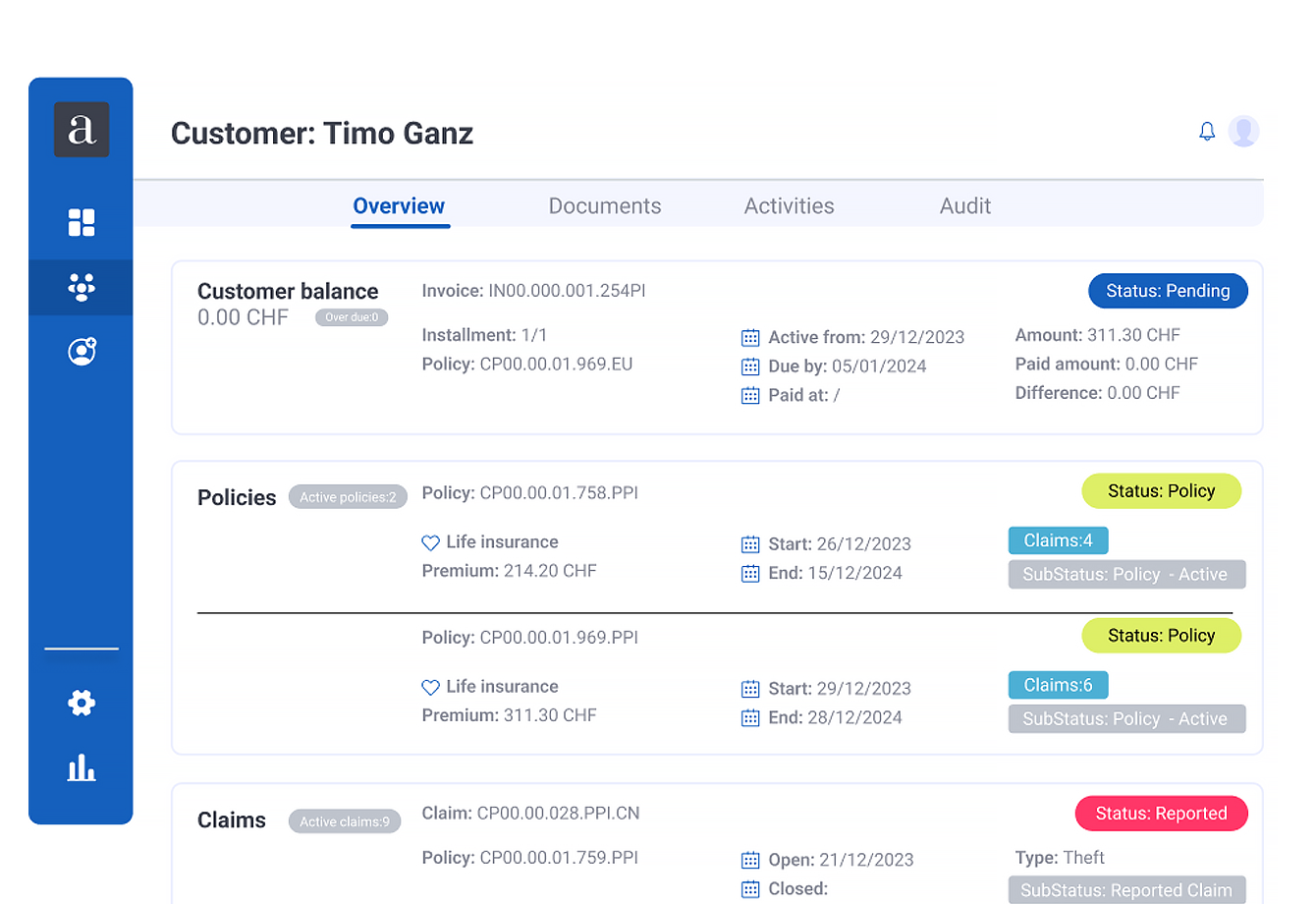

Digitize quote & bind, underwriting, servicing, and claims with intelligent workflows and straight through processing (STP).

Offer contextual coverage where and when it matters, within banking apps, payroll systems, and lifestyle platforms.

Deliver hyper-relevant protection using behavioral insights, life events, and real-time triggers.

Easily connect to internal and third-party providers via open architecture, no license required.

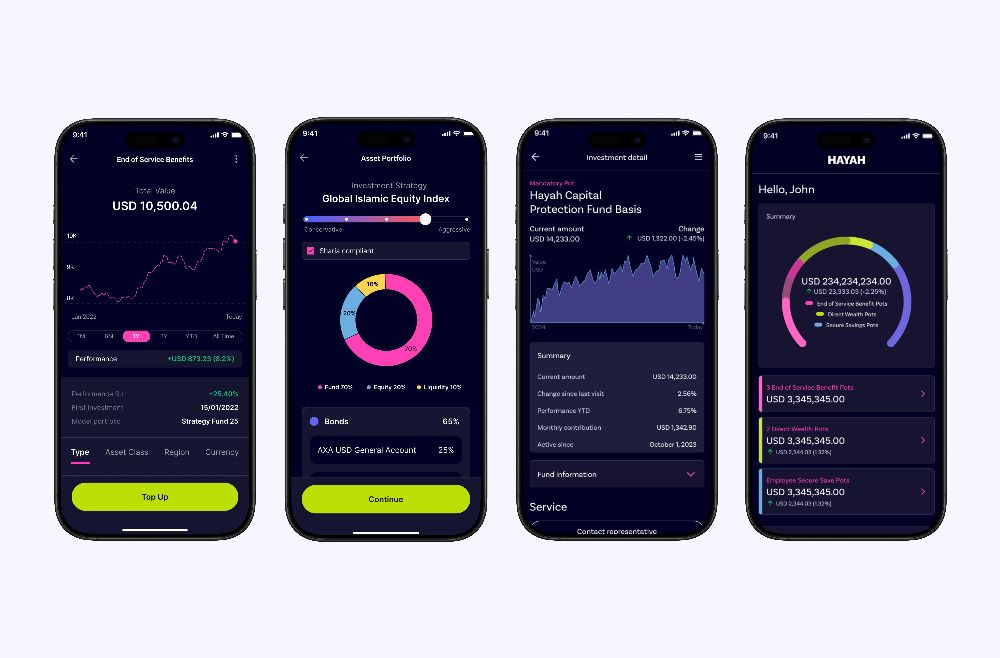

Blend protection and investment with hybrid insurance-wealth products to deepen client value and unlock new revenue streams.

Embed protection. Reduce friction. Scale fast.

From embedded products to modernized legacy services, addInsurance empowers insurers to operate more efficiently, adapt to market needs, and scale intelligently, all from a single platform.

addInnovation

Bring new models to life: from microinsurance to life-wealth hybrids. Serve targeted segments with modular, easy-to-sell bundles via embedded and hybrid distribution.

addAutomation

Streamline every step: from quote to claims. AI-enhanced workflows reduce manual tasks, speed up resolutions, and drive cost savings, without disrupting legacy systems.

addOpenSourcing

Expand your offering with plug-and-play products from trusted providers. Integrate seamlessly and scale quickly while keeping full control of the customer experience.

Impact across the value chain

addInsurance delivers value for every stakeholder, from insurers and distributors to end customers. With a single, modular platform, you can streamline operations, unlock new revenue streams, and deliver more relevant, affordable protection.

Digitalized insurance offering and new distribution channels

Expand distribution

Embed offerings into third-party platforms, digital ecosystems, or affinity channels, reaching new markets at lower acquisition cost.

Innovate faster

Design and launch new products quickly, without overhauling your core systems, keeping you ahead in a changing market.

Streamlined origination journey and minimal processing effort

Tailored product sourcing

Access a curated marketplace of pre-integrated providers, or source your own, so you can deliver relevant protection for any segment.

Faster go-to-market

Deploy embedded insurance propositions faster with pre-built APIs, minimizing integration friction across banking apps, employer portals, and digital ecosystems.

Secure and protect your life

Control and convenience

Empower customers with intuitive self-service tools and seamless digital claims, reducing wait times and giving them real-time control, with advisory support when needed.

Peace of mind

Deliver seamless, personalized experiences that build trust, meet expectations, and strengthen long-term customer relationships, driving retention and brand loyalty in a competitive market.

Our client partnerships

additiv has worked with AXA insurance to build a plug & play platform that enables banks to offer complementary insurance solutions embedded into banking products.

Mortgage protection

This innovative solution allows banks to directly protect their mortgage customers against key risks.

Plug & play

As a seamless plug-and-play solution, addProtect gives banks direct access to the platform without the need for integration with existing IT systems.

Hayah, one of the leading UAE Digital Insurance firms, launched a disruptive End-of-Service Benefits and direct wealth proposition on additiv’s platform.

End-of-Service Benefits

Fully digital employer and employee experience with risk-based Islamic & Conventional solutions and Capital Guaranteed option.

Direct Wealth

Direct to consumer wealth proposition with risk-based portfolios of funds and ETFs.