addCredit by additiv

Offer secured or unsecured loans to consumers in the right context at the right time, with a streamlined origination journey. Aggregate and deliver loan offers from various third-party lenders in real time.

Tap into a rich ecosystem of pre-integrated lenders and credit brokers to enrich your offerings with innovative secured or unsecured credit solutions.

Distribute credit solutions to customers through advised and self-service channels, or embedded into context-relevant user journeys and new distribution channels.

Unparalleled impact

Our Credit-as-a-Service solution brings together regulated lenders, brokers, agents and other third-party services to remove inefficiencies from the credit value chain. This allows institutions to unlock new revenue pools and generate new opportunities with better insights and a broader offering.

Faster and more sustainable credit offerings

Higher conversion and distribution reach

Enhance the quality of credit requests to ensure a higher conversion rate and increased distribution at lower acquisition costs.

Customized risk management

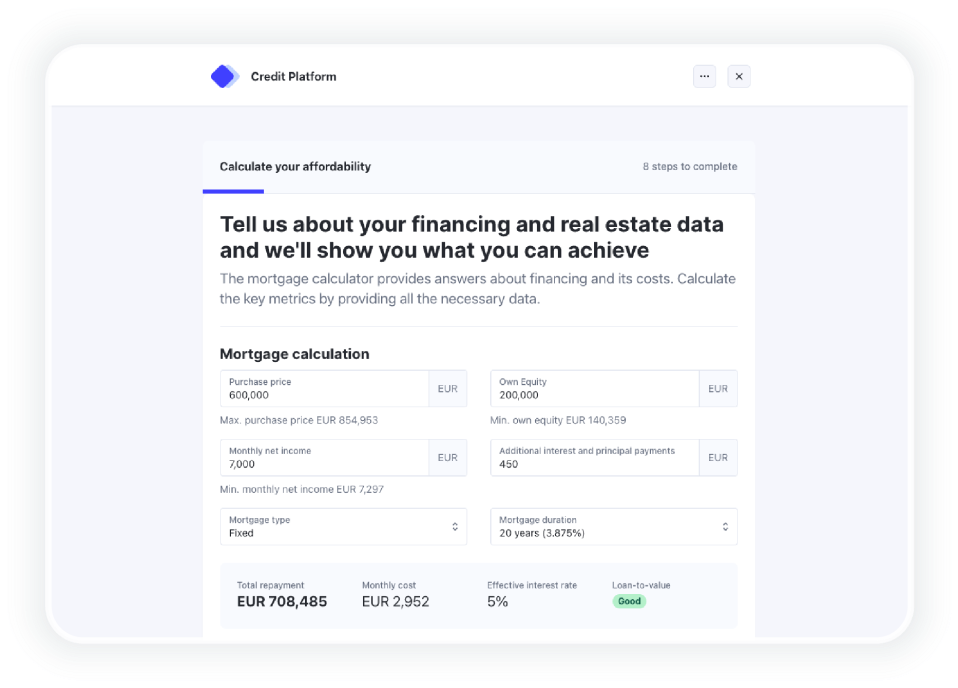

Define your risk management strategy and tailor your credit offerings to match your risk appetite.

Streamlined origination journey and minimal processing effort

Simplified customer journey

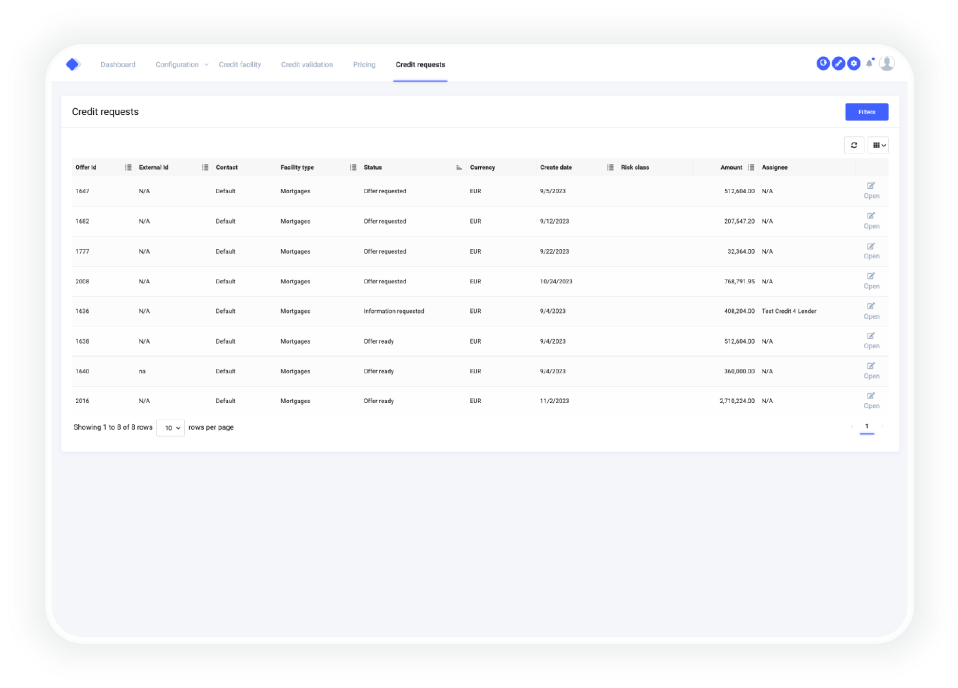

Reduce processing efforts and seamlessly manage the full client journey on a single platform allowing brokers to focus on providing an exceptional service.

Real-time credit comparison

Deliver the most comprehensive market overview to customers by comparing loan offers from various lenders in real-time.

Streamlined, customer-friendly credit processes

Unparalleled market overview

Enable consumers to access the marketplace, compare multiple credit offers and make informed decisions by understanding the best available options.

Accelerated approval processes

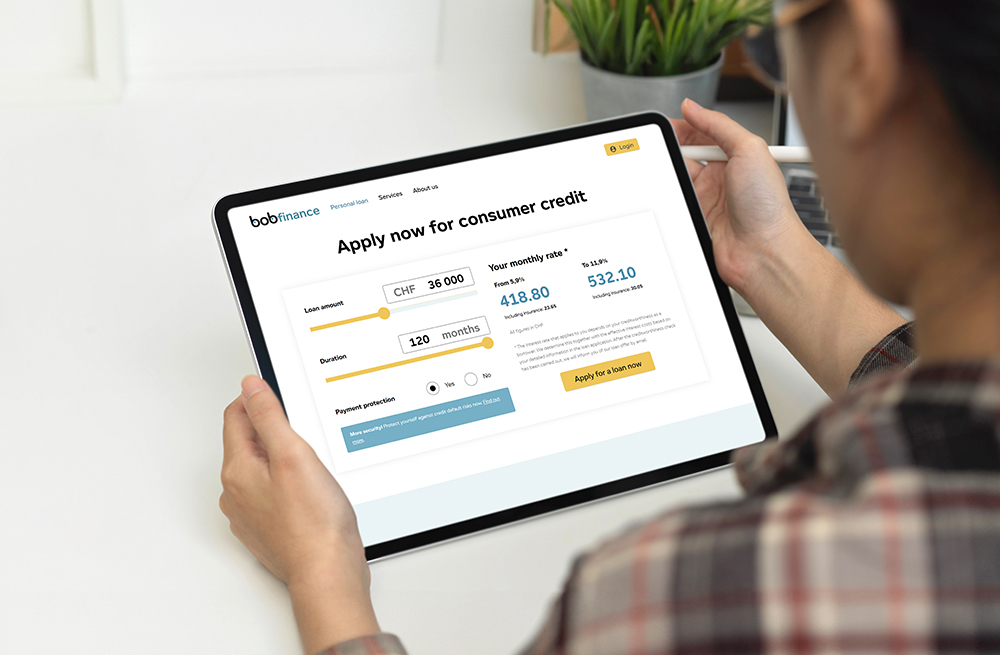

Enhance accessibility to credit services and products through both advised and self-service channels, embedded at the point of need.

Our client partnerships

Developing a new financial services company for the retailer Valora targeting consumer finance market online and integrated at the POS.

End-to-end digital lending

From distribution, origination, refinancing till servicing on one digital platform.

Comprehensive business consulting

Business development from business case up to refinancing.