Modern banking,

Design, launch, and scale banking products from a single platform — without replacing your core systems.

A single platform. addBanking.

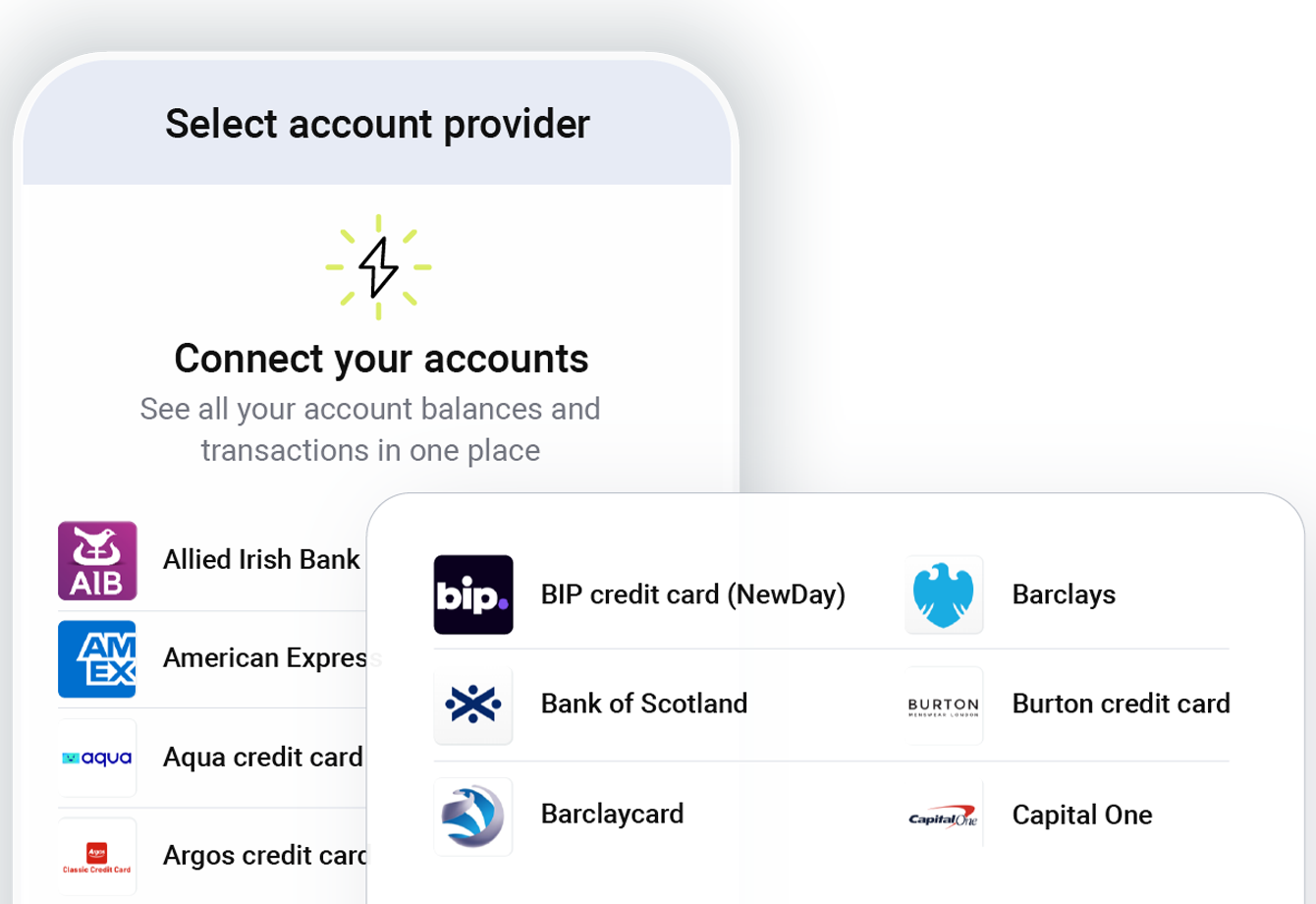

Offer contextual, compliant banking experiences through your own channels, or embedded in third-party journeys. With additiv, you can orchestrate onboarding, accounts, payments, and compliance on one platform with real-time efficiency.

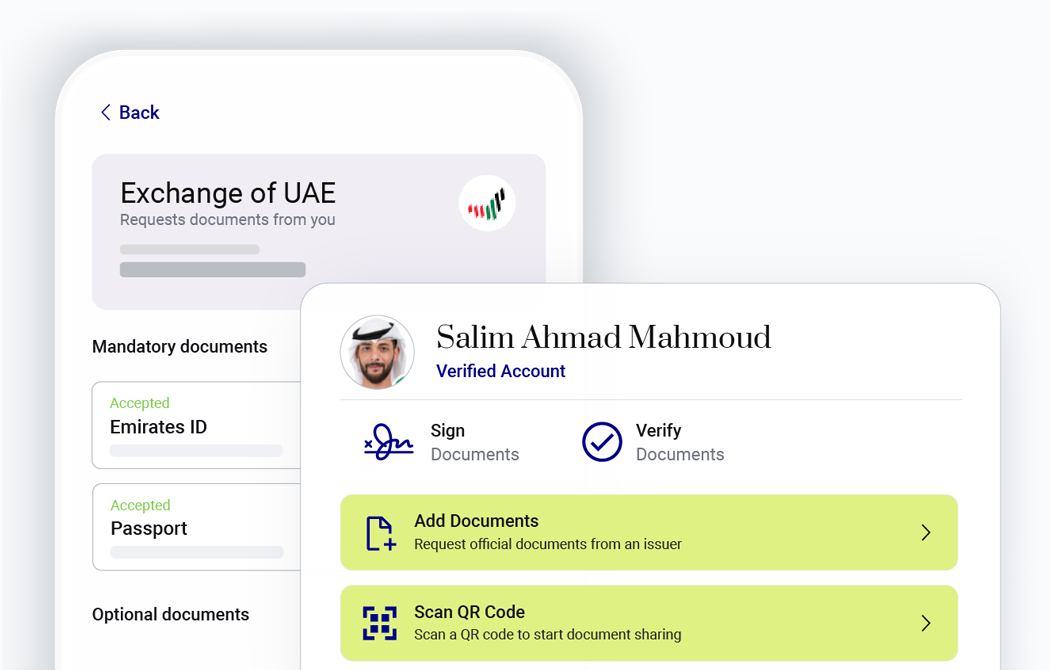

Digitize every process, from onboarding and KYC to payments, account management, and compliance — with embedded business logic and straight-through processing.

Use real-time insights and AI-powered workflows to tailor banking services — while ensuring full regulatory compliance and auditability.

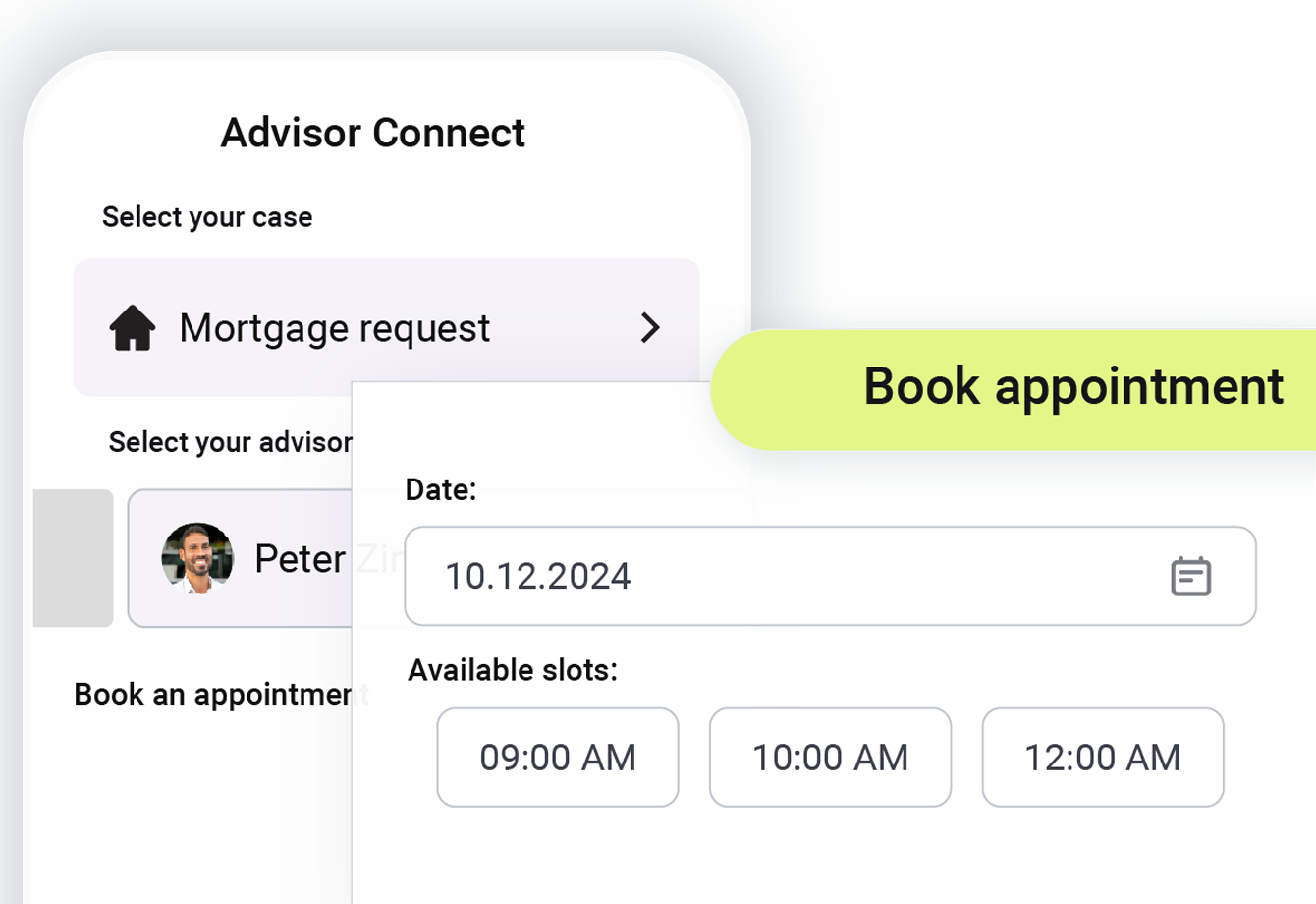

Deliver services via digital, advisor-led, hybrid, or embedded models — without disrupting legacy systems.

Use as a white-label solution, managed service, or embed into partner ecosystems — with full control over customer experience and brand.

Smarter banking. Faster innovation. Broader distribution.

Today’s banking needs to be fast, flexible, and future-ready. With addBanking, you can automate operations, launch contextualized services, and extend your reach through ecosystem partnerships — unlocking new revenue streams while keeping costs down.

addInnovation

Launch new banking products, from savings to embedded finance, without replacing your core systems. Use our API-first platform to deploy faster, integrate smarter, and adapt to change at speed.

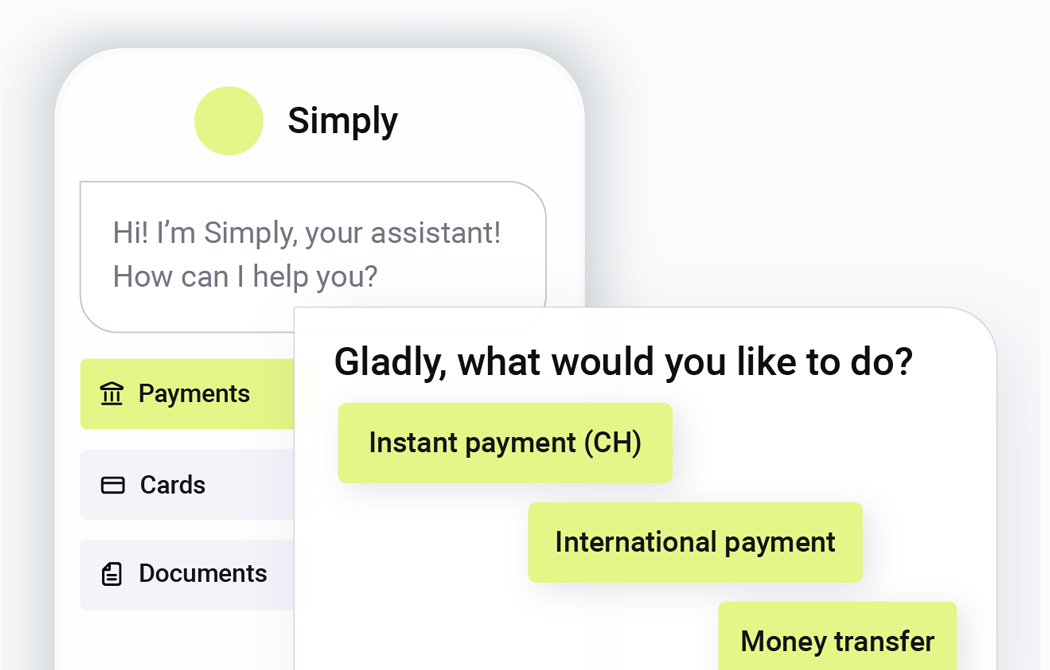

addAutomation

Automate the full banking journey — from digital onboarding and payments to servicing and compliance. Reduce friction and boost efficiency with AI-powered decisioning and event-driven workflows.

addOpenSourcing

Embed and scale with ease. Use our open platform to orchestrate regulated third-party providers or connect to your existing ecosystem, unlocking new distribution and maximizing profitability.

Unmatched value across the banking ecosystem

addBanking delivers measurable outcomes for every player, whether you’re launching a new proposition or modernizing legacy processes. Serve more customers, reduce cost to serve, and scale with flexibility.

Scale your distribution and increase profitability

Operational efficiency

Reduce costs with automation and straight-through processing across the banking lifecycle.

Increased revenue opportunities

Embed your banking proposition into new partner channels and unlock new distribution models.

Increase profitability and better serve your customers

Banking-as-a-Service orchestration

Monetize your customer base or ecosystem by embedding regulated financial services—without taking on a banking license. Launch branded offerings at speed and scale, opening up new distribution and value creation opportunities.

Open integration

Quickly connect to banking capabilities via our API-first platform, no infrastructure overhaul required.

Unlock new monetization models

From interchange fees to lending spreads and partner revenue shares, addBanking helps you turn distribution into a scalable revenue opportunity.

Superior financial well-being

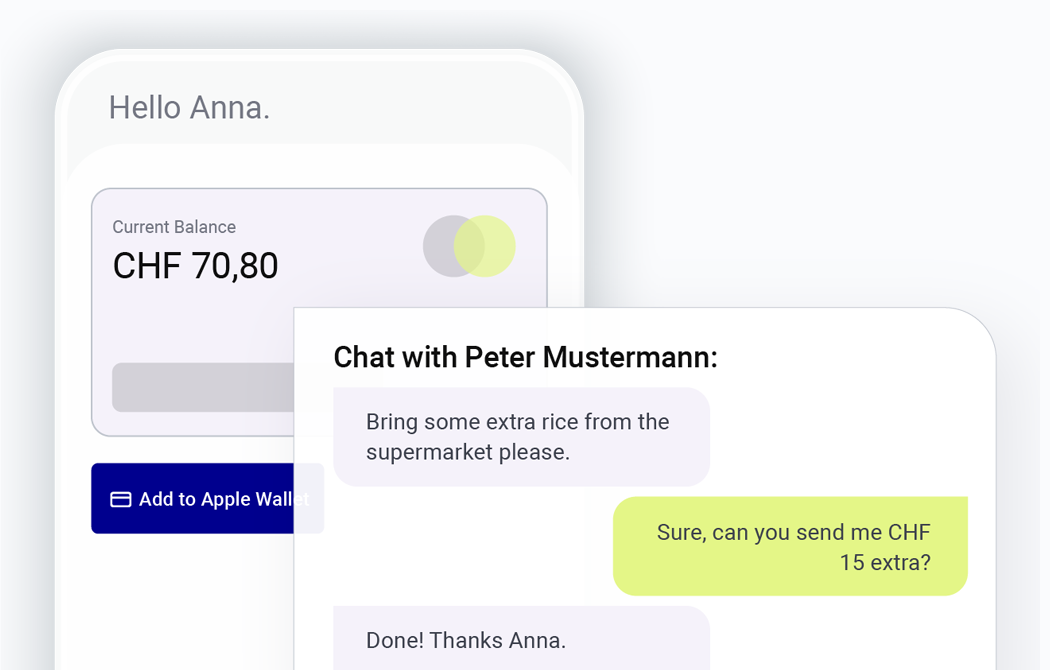

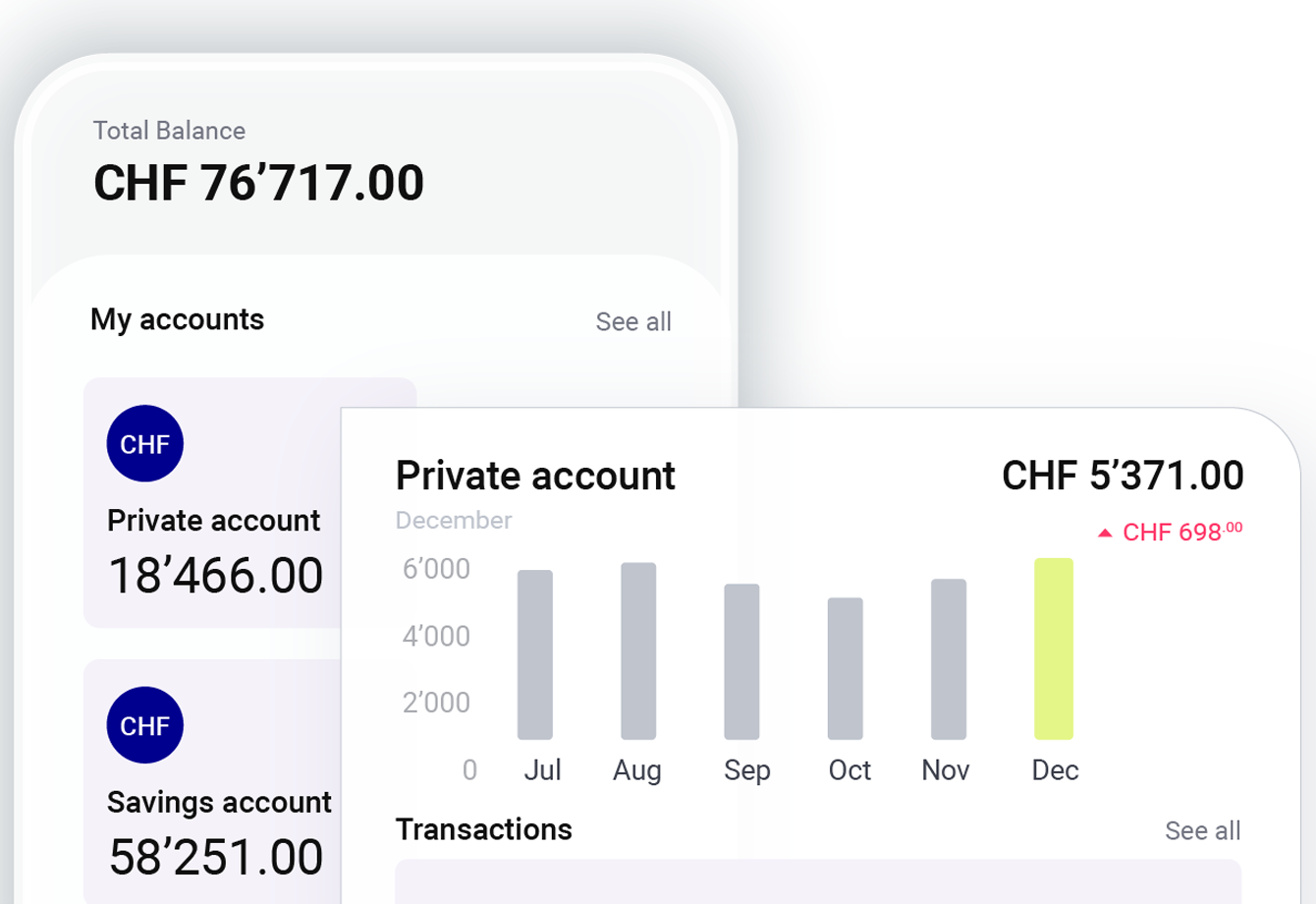

Relevant, real-time services

Access personalized financial tools, like savings, payments, and cards, delivered exactly when and where they’re needed.

Transparency and trust

Enjoy full visibility into your accounts and transactions, with built-in compliance and controls that protect your data and money.

Banking that fits your life

Whether through your favorite brand, app, or bank, get financial services that feel effortless, contextual, and built around your needs.