Our Credit Marketplace is a comprehensive multi-lender and omni-channel distribution platform for secured and unsecured loans, powered by the additiv DFS®.

A single platform, making loans

easy for you and your clients

Support your client journey

Our solution supports the whole client journey from

Digital client onboarding

Instant scoring and valuation of collateral (for example real estate, securities)

Credit offers from multiple lenders based on their risk model

Servicing of the loan

Prospective secondary market

Integrated into core systems

Our Credit Marketplace solution seamlessly integrated into a core banking or loan management system. Deploy class-leading credit offerings – faster and more sustainably than anyone else.

The Credit Marketplace is suitable for

Banks

Insurance Companies

Other financial institutions

The core Credit Marketplace

The Credit Marketplace enables to generate legally binding credit contracts in real-time by providing links to other ecosystem-providers.

Workflow based

Includes a workflow based back-office and CRM system.

Easily integrated

Even with existing credit environments via RESTful APIs.

Market friendly

Independent of any credit market development level.

Modules and high level features

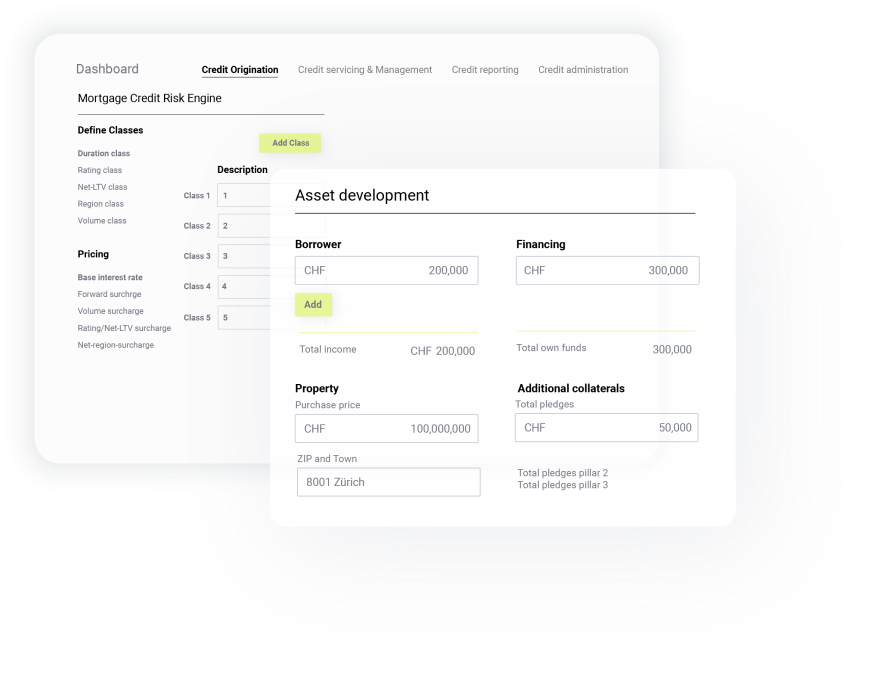

Credit Risk Engine

The Credit Risk Engine allows the lender to set the overall risk framework as well as manage the risk appetite of the desired credit service offering.

Calculator

The Credit Calculator provides an easy and efficient way for eligible borrowers to receive an instant agreement in principle with an indicative credit offer.

Origination

The Origination module includes, in particular, customer onboarding, data and document capture, real-time verifications (e.g. credit scoring agencies, valuation), credit decision and contract creation with e-signature.

Speak with an expert

Book a session with digital wealth, embedded finance

or technology experts.