Behavioral Finance Individual Investor Risk Profiles, Education, and Optimal Personalized Investment Strategy

Yainvest is a Swiss-based digital subsidiary established by BhFS gmbh. Created in 2007, BhFS Behavioural Finance Solutions is a spin-off company of St. Gallen and Zurich universities. BhFS is renowned for its research and development in Applied Behavioural Finance Technology Solutions, with its methods have become the standard in Swiss Wealth Management.

Solutions for Personalized Investor Strategies

Our solutions help measure the behavioral biases of individual investors and suggest an optimal investment strategy that is a good fit for their physiology and financial circumstances which investors understand.

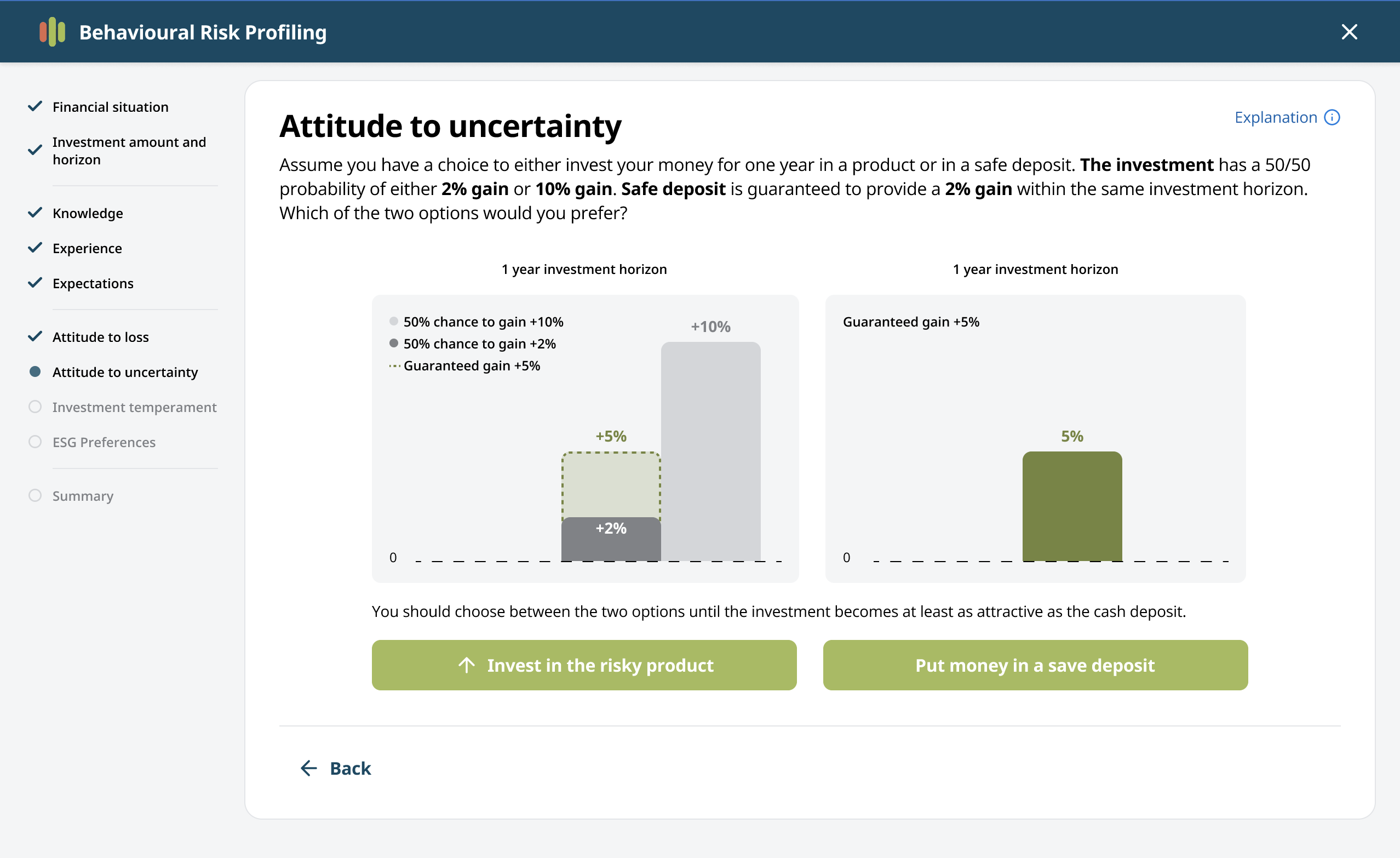

Initiate client relations by accurately measuring financial knowledge and emotional levels, enabling you to understand your investor better. Our methods define the traits and calculate individual value functions based on Prospect Theory, which measures risk tolerance and an attitude to volatility and fluctuating pay-offs. Measure investor financial situations and risk attitude in line with MiFID II, FCA (including Consumer Duty), and FIDLEG regulations.

Define the optimal investment strategy for the investor, created from your strategic asset allocation with any asset class, including (1) cash vs. risky investments allocation, (2) alternatives, including crypto allocation, (3) liquid vs. illiquid allocation, including private equity and venture capital. Our model is founded on the idea that risk attitudes can be fully characterized in terms of risk premia, e.g., clients with higher risk aversion require higher risk premia. It helps construct an investment strategy with the highest utility (value) from an investor perspective.

Strategy Simulation assists in increasing risk awareness, which plays a central role, as investors are not assumed to be fully rational and can have biases. Often, investors perform poorly because they don’t remain committed to the recommended investment strategy. This fact is referred to as the behavioral gap. It is estimated that this is seen in between 2% and 6% of cases that underperform, compared to those who stay invested in an agreed investment strategy.

Business impact

Up to 3-6% gain per year balanced vs. unbalanced portfolio and mitigating “behavioral gaps”

Understand the client better with below-the-surface information on personality traits.

Increase suitable client assets for investments based on more accurate risk tolerance.

Increase loyalty and product use based on more relevant offerings.

Reduce client churn by avoiding pitfalls in the relationship.

Increase investment success by a more substantial commitment to investment strategies.