This article first appeared on TheWealthMosaic on March 10th, 2022.

Year in review

Q: What would you highlight as have been the main technology themes/focus areas in the wealth management sector in 2021?

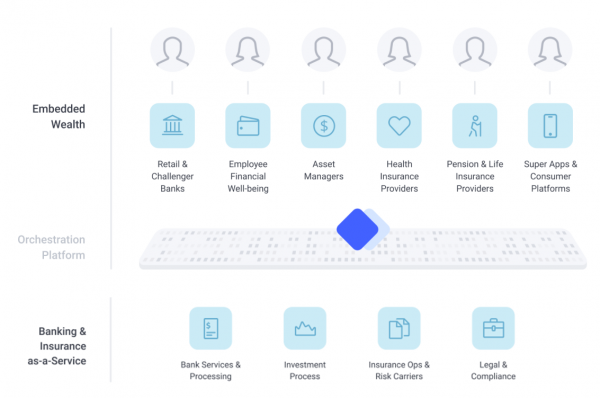

Christine: 2021 was definitely the year that the concept of Banking-as-a-Service to support embedded finance became ubiquitous. The opportunity for wealth management services to leverage this (known as embedded wealth) started to be recognised. Well not only new ways to invest but also new model to offer insurance services – insurtech picked up tremendously. Both driving embedded finance from a pure transactional angle with payment and lending to focus to a more relational angle with wealth and insurance services.

Source: additiv

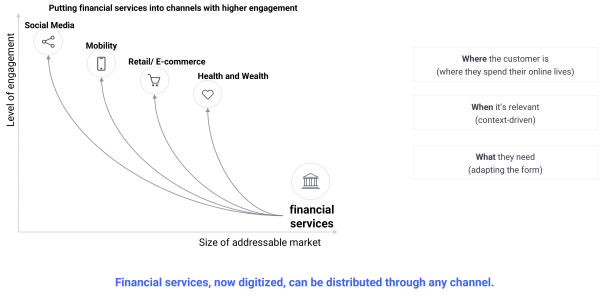

We’re having conversations with firms across a broad range of industries from e-commerce platforms through to employee wellness providers and insurers who see the opportunity to open up a much bigger addressable market by offering wealth management services natively within their existing customer journeys.

Existing financial services providers also see the opportunity as our partners demonstrate. The Nordic platform announced last summer, was the first of a stream of embedded wealth deals that we’ll be confirming in the new year. For financial service providers, who could develop the service themselves, using a BaaS provider is about specialization and getting to market fast.

Q: Why were those themes/focus areas relevant in 2021 and what progress did wealth managers make in their responses?

Christine: Embedded finance has become possible, and an imperative, thanks to the confluence of various market trends:

- Open banking legislation that has encouraged data sharing among an ecosystem of players.

- New technology, such as APIs, that make it easier to interact across platforms.

- Non-financial competitors, such as Amazon, who are offering their own financial services,

forcing financial institutions to choose between either partnering or going into head-to-head

competition with them.

- Customers who are becoming used to financial services at the point of contact such as for payment or lending. This makes it more difficult to up-sell and cross-sell, and increasing attrition for existing banks.

In short, the distribution of financial services is reaching an inflexion point.

Year in view

Q: What would you highlight as the main technology themes for the wealth management sector in 2022?

Christine: We expect three areas to play a key role this year.

Firstly, we believe that embedded wealth will continue to grow. Many brands are realising the long-term benefit of deeper customer relationships, increased loyalty, breadth of product range and a better customer experiences. Brands such as Google, Apple and Uber have been embedding banking services, through BaaS and technology platforms. In fact, the Baas APIs segment is expected to grow 17% CAGR by 2031 by embedding their services into context relevant consumer journeys. And these financial providers are now realising the benefits of embedded wealth management related services in particular, to leverage a $100 billion revenue opportunity jointly with embedded finance orchestration systems.

Secondly, we believe that sustainable and impact investing will increase. This is reinforced within Morgan Stanley’s Sustainability Report which highlighted that sustainable investing funds have already outperformed traditional funds and that global ESG assets will exceed $53tn by 2025. This comes as no surprise as ESG investment need is being facilitated by the COP26 pledge, easy, low-cost self-service investment platforms, embedded wealth and a growing interest by Millennials who are [1]increasingly likely to make investment decisions for ethical reasons.

To support this audience, there are already apps such as Clim8 or Tickr which offers ethical investing options. And through embedded wealth, super apps could leverage the vast amounts of data they already have on their users and target different investment products to support their customers’ aspirations to support ESG. And ESG services (through screening and similar other approaches) can be offered to individuals according to their preferences.

And our last expected focus will be that blockchain technology and DeFi will go increasingly mainstream. We are in the very early days of transitioning to Web 3.0. which focuses on decentralize digital services, secure user privacy and open up data for intelligent applications based on machine learning. Blockchain, with its combined emphasis on security and transparency is what enables cryptocurrencies and is the same technology that enables Web 3.0 apps .

We believe that as users gaining access to blockchain-based assets like non-fungible tokens (NFTs) which are set to also become more popular in 2022, big banks and hyperscalers will be able to blend digital assets with traditional assets in ways palatable to mainstream investors. Goldman Sachs and Morgan Stanley have made moves to facilitate client investment in digital assets – we expect more of this in 2022.

Market status

Q: How should wealth managers tackle these themes? What targets should be they be setting?

Christine: Wealth clients are looking for better intuitive experiences and access to bespoke investment solutions according to their individual needs, at a reasonable price. Rising inflation and rich valued asset classes will bring the topic of asset preservation to the fore.

During the COVID confinement period, one of the largest retail banks in Switzerland, PostFinance, launched an end-to-end digital platform that does just this. It caters to the needs of customers wishing to diversify away from very low-yielding savings products. The platform offers a seamless and engaging experience to both advisory and discretionary customers and, unsurprisingly it is seeing a very strong take-up.

PostFinance’s success in part can be attributed to them recognising the importance of how clients wish to interact with their bank varies, and evolves throughout their relationship along with the market environment. There will be periods when bank clients wish for independence, and at other times they’ll seek guidance on the risks involved. They might even want the bank to handle everything. A hybrid approach enables this.

A hybrid model allows clients to be offered the service that best suits their individual needs, and chose how they want to be serviced. Depending on these needs, the advice or support available is human or self-service, supported by intelligent analytics and offers real value:

- It enables clients to be serviced more efficiently (only support when there is a real need);

- It allows advisors to walk through proposals, optimisations and simulations in real-time; and

- It ensures relationship managers remain productive and focused on clients when it matters most, which in turn improves scalability for banks.

Rather than impeding the client relationship, it actually encourages collaboration; supporting in-person and remote advisor and client conversations through a multitude of channels, going way beyond the “next best trade concept”.

However, there is a common misconception about one aspect of a hybrid service: the self-service approach. It is often confused with robo-advisor online wealth management platforms, which offer automated portfolio management, but these are poles apart. A self-service model allows clients to gain insights and complete actions that historically would have been undertaken by an advisor.

Focus and solutions

Q: What is your role and what does your business offer to support wealth management firms in these areas?

Christine: We built and launched our Embedded Wealth platforms starting mid 2021 for Europe. Like DFS, these utilise our extensive ecosystem of partners to support the growing need for wealth management solutions to be embedded as part of context relevant user journeys.

We offer end-to-end wealth services that any brand can easily include, either tightly integrated into an existing client-journey, or as standalone services. additiv provides the orchestration platform and works with regulated finance partners to fulfil the complete customer journey.

Our Banking-as-a-Service (BaaS) model also utilises DFS. It links regulated wealth management services with the brands that wish to embed them into their offering. In practice, this means providing APIs for interaction, the orchestration along the wealth management value chain and the intelligence to integrate services in context-relevant user-journeys.

Our conversations with FIs and consumer platforms or large employers indicate that no other vendor is supporting embedded wealth fully. In fact, a Geneva-based consultancy called aperture recently published a methodology assessing wealth management technology vendors. Their report (Digital Age Wealth Management) rated additiv as a top ‘Transformer’, stating “In terms of business model enablement, we see additiv as best-in-class. The solution can be deployed with out-of-the-box user agents or headless, using existing or third-party customer interaction channels. This makes the solution ideally suited for wealth management-as-a-service models”.

Q: How will your firm further develop its offering to support the evolving needs of your wealth management clients and prospects?

Christine: In 2021, we partnered with a number of BaaS providers to offer a range of services to support platforms embedding wealth. These include Saxo Bank for access to broker and custodian services, Kidbrooke for financial analytics APIs and Bricknode for Brokerage-as-a-Service. In 2022, we are ramping up our range of partners to support Banking-as-a-Service.

Having quietly launched the first platform end-to-end wealth offerings for non financial brands in 2021 in the Nordics, 2022 will see a material pick up with end-to-end WM services across Europe, our launch in the Middle East early 2022 and later in APAC followed by pension and impact services across Europe.