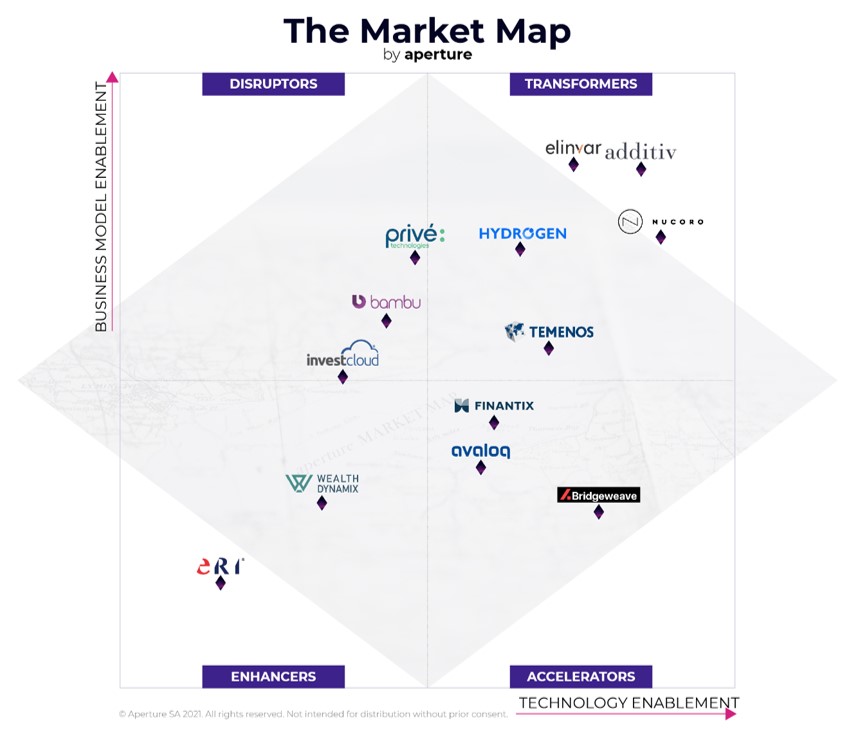

Zürich, 23 February 2021: additiv, a leading global SaaS provider to the wealth management industry, today confirmed that they have been identified as a ‘Transformer’ within Swiss strategy consultancy aperture’s in-depth report: ‘Digital Age Wealth Management’. The report looks at customer, technology and business model trends transforming the industry. It includes a vendor evaluation using aperture’s The Market Map software assessment methodology, which highlights those WealthTech solutions that are best suited to help wealth managers meet digital age demands, placing additiv at the top of its ‘Transformer’ quadrant.

According to the report, as a ‘Transformer’, additiv is

“well-placed to support with both business model and technology innovation whether for a new entrant, a large established wealth manager in its existing business, or through a digital spin-off, as well as for financial or nonfinancial providers looking to embed wealth services into their existing offering.”

The report states:

“In terms of technology, the additiv solution scores well on a number of fronts. There is clear separation between interaction channels and orchestration platform, with the latter handling interactions seamlessly across channels, whether third-party or proprietary to the wealth manager.”

In addition, the report highlights that

“In terms of business model enablement, we see additiv as best-in-class. The solution can be deployed with out-of-the-box solutions or headless, using existing or third-party customer interaction channels. This makes the solution ideally suited for wealth management-as-a-service models.”

Michael Stemmle, founder and CEO of additiv, said:

“We are delighted that additiv has been recognized within aperture’s report and evaluation criteria which uniquely looks at WealthTech vendors’ ability to enable technology and business model innovation. Our strong position within the report can be attributed to our dedication to investing in research and development as well as the fact that all our products are built upon our orchestration platform: Digital Finance Suite (DFS®) system of intelligence.”

Michael adds:

“DFS® is a robust and trusted platform which offers ultimate flexibility to evolve with the changing wealth market and, for those banks looking to ‘build their own bank’ quickly, it’s pre-defined, established foundation enables banks to easily build the functionality and client journeys themselves on top with additiv’s Wealth Solution Builder.”

Within aperture’s The Market Map, additiv solutions were situated in the ‘Transformer’ quadrant alongside Nucoro (based in London), Hydrogen (New York), Elinvar (Berlin) and Temenos (Switzerland), and reviewed amongst a wide range of well-known WealthTech providers across the globe.