In today’s rapidly evolving financial landscape, wealth management is undergoing a profound transformation. The traditional model of high-touch, face-to-face interactions is giving way to a hybrid approach that leverages digital tools to enhance client experiences while maintaining the personal touch that high-net-worth individuals expect. This shift is not merely a technological upgrade; it represents a fundamental reimagining of client centricity in the digital age.

The Changing Face of Wealth Management

Historically, wealth management has been characterized by standardized products and services delivered through intensive personal interactions. However, as client expectations evolve and technology advances, the industry faces a critical inflection point. Today’s wealth management clients which are accustomed to seamless digital experiences in other aspects of their lives, demand similar convenience and personalization in managing their finances.

This article explores how the concept of client centricity is being reshaped in the digital age, with a particular focus on the roles of personalized services, enhanced customer experience, and data-driven insights. By examining these key areas, the article demonstrates how financial institutions can leverage digital tools to build stronger, more meaningful relationships with their clients, ultimately fostering greater satisfaction and loyalty.

Personalization: The Cornerstone of Modern Wealth Management

At the heart of this digital transformation is the ability to offer highly personalized services. Advanced data analytics, artificial intelligence, and machine learning are enabling wealth managers to tailor their offerings to individual client needs with unprecedented precision.

For instance, the ATRAM Group, the largest independent asset and wealth manager in the Philippines, partnered with additiv, a leading provider of digital wealth management solutions, to create Wealth360, a digital wealth management platform. This innovative solution provides customizable advisory tools that deliver tailored investment guidance, demonstrating how technology can enhance rather than replace the human touch in wealth management.

The power of personalization extends beyond investment strategies. Digital platforms are now capable of offering personalized financial education, risk assessments, and goal-based planning tools. These features not only improve client outcomes but also foster a deeper understanding of financial concepts, giving clients the tools and the agency to make more informed decisions. And clients that feel in control are clients that develop lasting loyalty.

Enhancing Client Experience Through Digital Channels

The digitalization of wealth management has dramatically transformed client interactions. Mobile apps, online portals, and digital communication tools now provide clients with 24/7 access to their financial information and services. This always-on availability meets the expectations of today’s clients who are accustomed to managing other aspects of their lives through digital channels.

However, the value of digital tools in wealth management goes beyond mere convenience. They enable a level of transparency and real-time reporting that was previously impossible. Clients can now track their portfolio performance, receive instant notifications about market changes, and access detailed analyses of their investments at any time. This transparency builds trust and allows for more meaningful conversations between clients and their advisors.

The ATRAM case study illustrates this point effectively. Their Wealth360 platform provides clients with access to real-time market commentary and in-depth reports, enabling more informed decision-making. This combination of digital accessibility and expert insights exemplifies the hybrid model that is becoming the gold standard in wealth management.

Data-Driven Insights: The Engine of Client-Centric Wealth Management

The true power of digital transformation in wealth management lies in the ability to harness data for deeper client insights. By leveraging big data and advanced analytics, wealth managers can gain a comprehensive understanding of their clients’ behaviors, preferences, and financial goals.

These insights enable wealth managers to anticipate client needs, identify potential risks, and proactively offer relevant advice and solutions. For example, predictive analytics can flag potential life events that might impact a client’s financial strategy, allowing advisors to reach out with timely guidance.

Moreover, data-driven insights can significantly enhance operational efficiency. By automating routine tasks and providing advisors with comprehensive client profiles, digital tools free up time for more valuable, strategic interactions with clients. This shift from transactional to consultative relationships is key to delivering truly client-centric wealth management services.

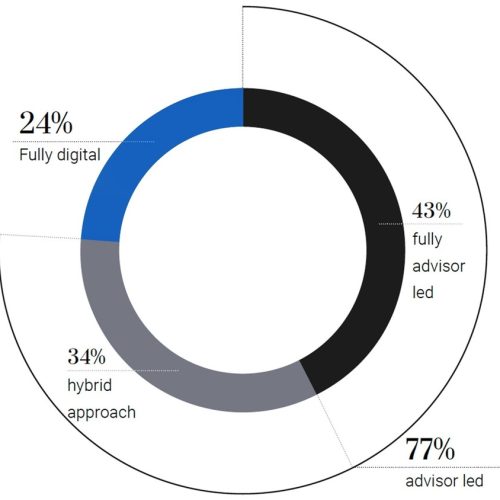

Chart 1: Consumer preferences for receiving investment advice (Consumer study 2024, additiv)

While there’s a growing acceptance of digital channels, a significant portion of consumers still value human interaction in their wealth management relationships. This underscores the importance of a hybrid approach that combines digital efficiency with human expertise, as displayed in chart 1.

The Rise of Embedded Finance: Expanding the Reach of Wealth Management

As the boundaries between financial services and other industries blur, embedded finance is emerging as a powerful trend that could further revolutionize wealth management. The additiv consumer study reveals a growing trust in non-financial service providers to deliver regulated financial services. On average, 46% of consumers trust super-apps, e-commerce sites, or utility providers to offer financial services.

This trend opens up new possibilities for wealth management services to be seamlessly integrated into broader customer experiences. For instance, a retailer could offer investment products as part of its loyalty program, or a healthcare provider could embed retirement planning services into its patient care platform.

The implications for client centricity are profound. By meeting clients where they are and integrating financial services into their daily lives, wealth managers can deliver more relevant, timely, and accessible services. This approach not only enhances client satisfaction and loyalty but also has the potential to dramatically expand the reach of wealth management services to previously underserved segments.

Embracing the Digital Future of Wealth Management

The digital transformation of wealth management is not about replacing human advisors with algorithms. Rather, it’s about creating a hybrid model that combines the best of both worlds: the empathy and judgment of human experts with the efficiency and insights of digital tools.

As we look to the future, the most successful wealth management firms will be those that embrace this client-centric, technology-enabled approach. They will leverage digital platforms to deliver personalized services, enhance client experiences, and generate data-driven insights. At the same time, they will retain the human touch that is essential for building trust and navigating complex financial decisions. By putting clients and advisors at the center of their digital transformation efforts, wealth managers can create enduring relationships, drive better financial outcomes, and ultimately redefine what it means to provide exceptional wealth management services in the 21st century.