Join 400+ companies using the additiv platform to efficiently launch and manage financial services across channels and markets.

Join 400+ companies using the additiv platform to efficiently launch and manage financial services across channels and markets.

A faster way to scale—without disruption. The additiv platform works with your existing IT, unlocking innovation and automation without the cost and risk of system overhauls.

Unify data to automate operations, reduce costs, and enhance self-service. AI powers smarter decisions and personalized experiences—seamlessly across every channel.

With its open sourcing model, additiv lets you source financial services seamlessly—internally or through a network of regulated providers. Expand your reach, unlock new revenue, and scale faster.

Rich business logic allows you to design, launch and manage services across multiple financial verticals. Limitless optionality for businesses with the distribution power to exploit it.

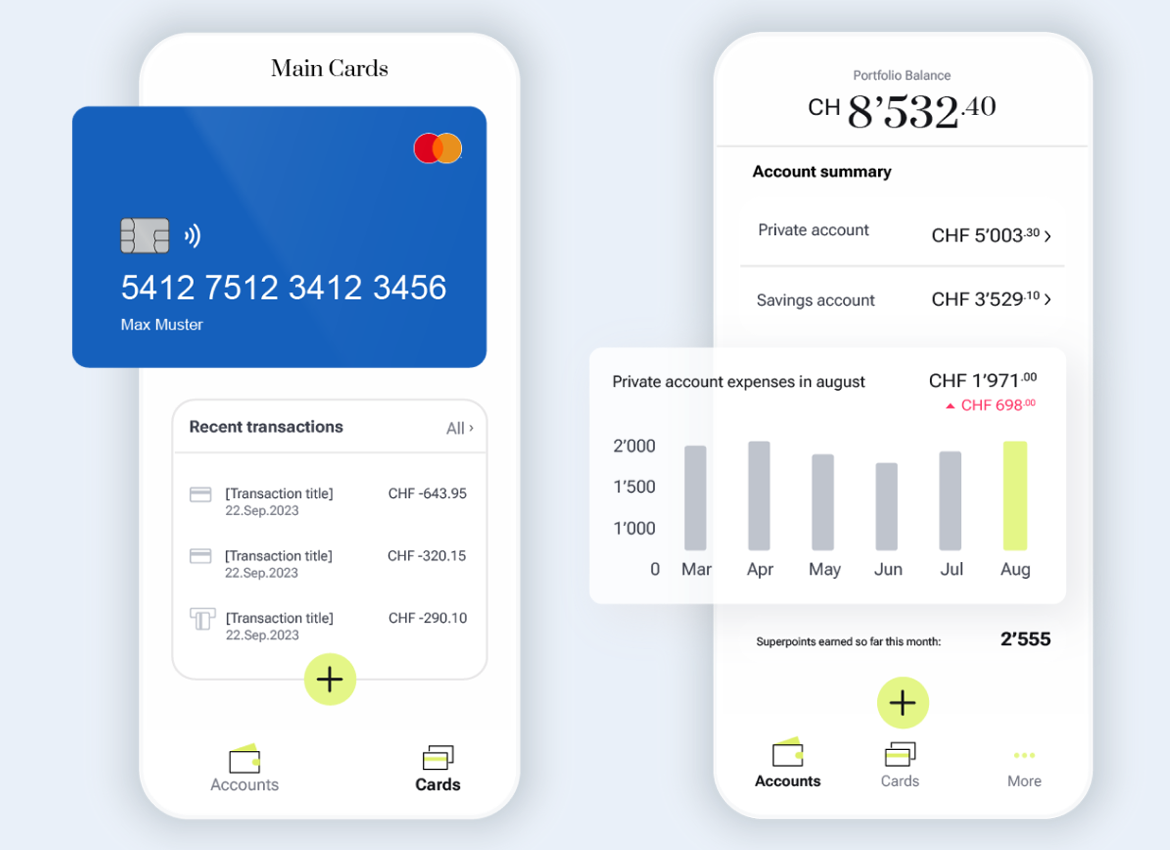

Innovate and provide delightful banking services to your customer base, spanning current accounts, debit and credit cards, deposits and payment services, all seamlessly orchestrated from regulated Banking-as-a-Service (BaaS) providers and embedded into your existing systems and processes.

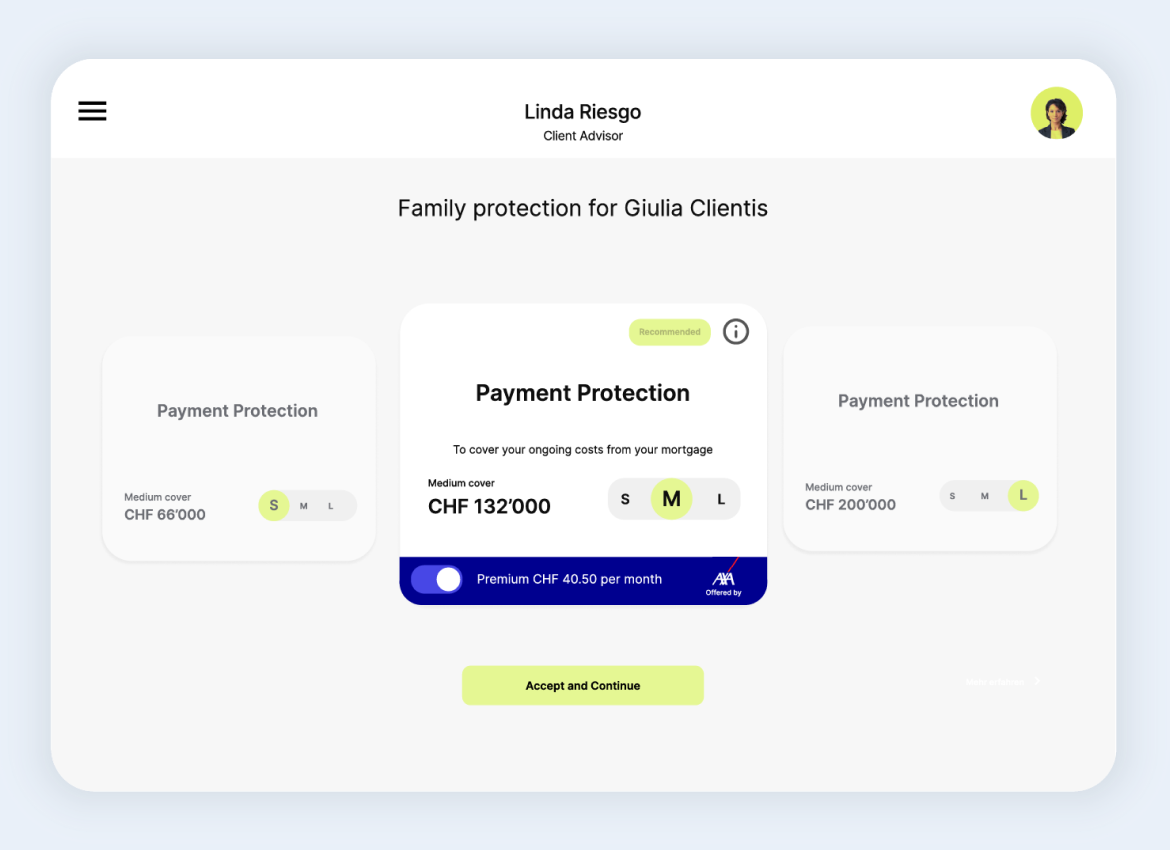

Enhance your offerings and propositions with embedded life and non-life insurance products sourced and orchestrated from the right insurance partners. Tailor your insurance offerings to seamlessly align with your current portfolio and satisfy your customer’s needs.

Employees serving

clients

Offices across Europe,

APAC and Middle East

Institutions relying on

our platform

Jurisdictions where

clients are served