This article first appeared on fintech talents on April 19th, 2022.

The logic of embedded finance is obvious, what’s needed is to bring it to life.

Embedded finance is transformative

“Software is eating the world, and #embeddedfinance is its chocolate sauce on top” – Shaul David, Head of Growth at Railsbank (Twitter)

Embedded finance is transformative. And people are increasingly waking up to its importance. Whether your measurement is the number of non-financial brands that are starting to offer financial services, the investments going into the space, or the size of the market opportunity, it is clear that this is a massive, structural growth driver.

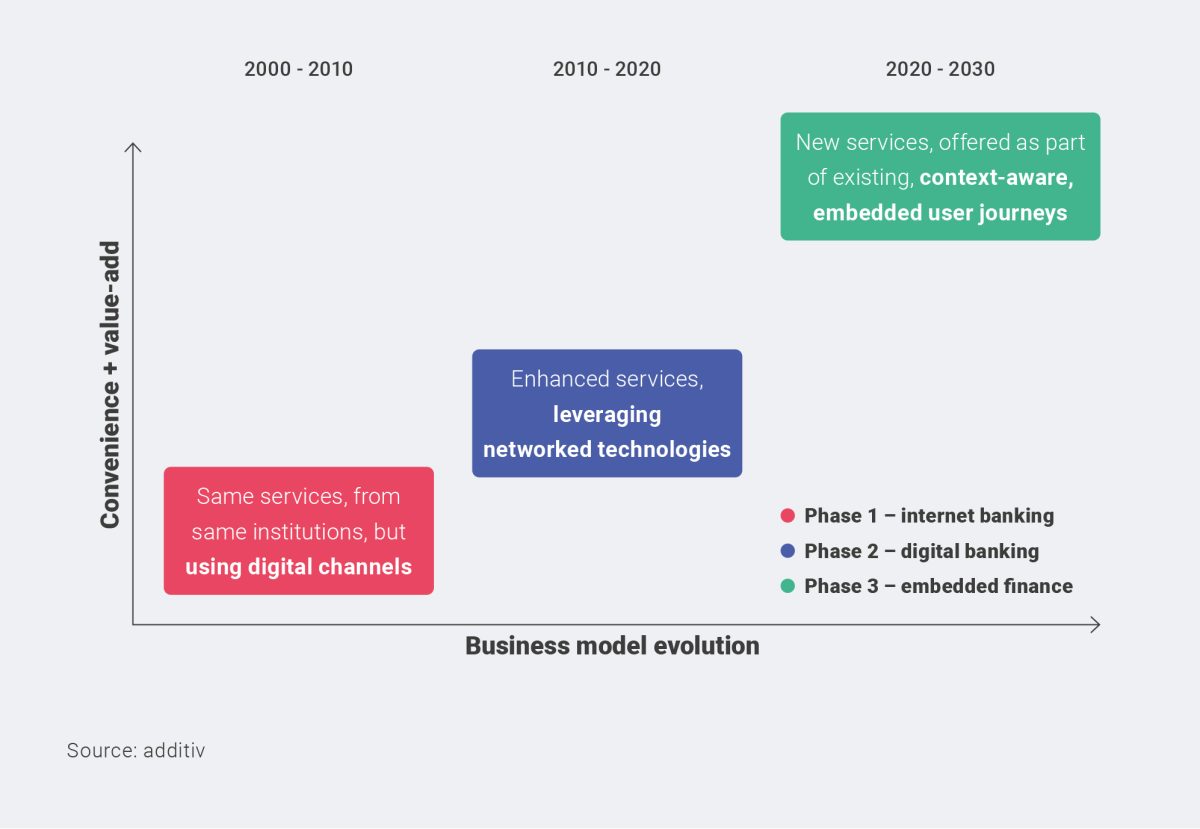

Embedded finance is the third wave of fintech innovation. The story of financial digitalization has come in three phases. The first was about making banking more accessible – available 24/7 over the internet – but without changing the underlying services. The second wave was about using the properties of the internet technologies to make the services better, like P2P payments. The third wave is about making financial services available over any distribution channel.

Embedded finance is the third phase of fintech disruption

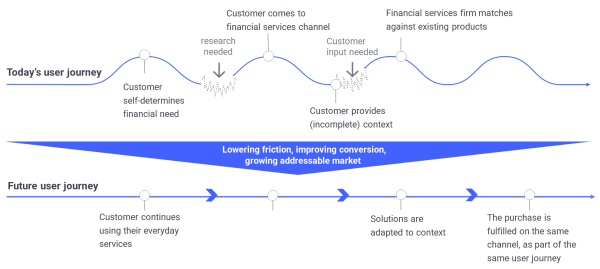

Embedded finance is transformative because it adds context to financial transactions at the point of need. Of course, if a financial service is offered over an existing channel – like being able to pay for an e-commerce transaction with a single click – that improves convenience. But it goes much further. Because your context is understood, the right service can be presented to you at the right time, boosting conversion and take-up rates. As an example, it makes a lot of sense to suggest travel insurance at the time of booking a flight. But, embedded finance, in adding layers between the product and the distribution, can also transform the product form – getting much closer to customers’ jobs to be done.

Selling products becomes addressing customer needs

Meeting the customer’s job to be done

“People don’t want to buy a quarter-inch drill. They want a quarter-inch hole.” Clayton Christensen, Competing Against Luck: The Story of Innovation and Customer Choice

Clayton Christensen’s theory of jobs to be done is a simple and powerful framework for thinking about innovation. His view was that for companies to innovate successfully, they had to abstract away from product features and functions to focus on the experiences they enabled. More specifically, he argued companies needed to look at “the progress that the customer is trying to make in a given circumstance – what the customer hopes to accomplish, the job to be done.”

If we take the job to be done lens to traditional financial services, it is clear that they have been created with features and experiences in mind. Customers don’t think in terms of mortgages; they think in terms of buying their own home. Customers don’t think in terms of overdrafts; they think in terms of still being able to meet their expenses when they’re running low on cash. And so on.

In contrast, embedded finance is putting the customer experience first. When an embedder brand looks at inserting financial services into a customer journey, they’re not doing so to sell a financial product; they’re doing so to meet a customer need. When you buy a pair of jeans on the H&M website and you have the option to pay in installments, that is meeting the customer’s need or wish to get a new piece of clothing now. The customer is not offered a loan or a credit card, they’re offered to buy now and pay later.

An example of embedded finance, we can expect financial services to become not just more contextual and convenient, but also more relevant and experiential.

Winning over your stakeholders

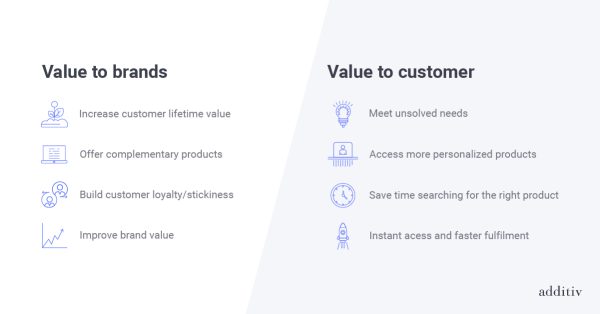

It’s easy to make the economic case for embedded finance. We speak with embedder brands every day. They come to us because they are usually already certain that embedded finance can boost their unit economics. They have large and loyal customer bases. They have engagement and a reason to interact with their customers on a frequent basis. So it is only logical that they can start to offer financial services, to grow customer lifetime value and reduce attrition.

Embedded finance: a win-win

Source: additiv

But knowing that embedded finance can boost profits doesn’t automatically take it to the top of the corporate agenda, nor does it tell you where you start, nor what provider to work with, how your customers will benefit, etc.

To get from sound idea to successful execution, we find that using a jobs to be done framework really helps:

- It breaks downs the economic benefits into streams of activity that can more easily and credibly modelled.

- It helps understand into which processes and customer journeys the services should be added and in what form

- It enables the organization to start to articulate the value-add internally and to its customers

- It brings focus to what underlying services are required and what capabilities will be needed, including thinking about technologies and partners

- It enables the project to be translated into a discrete set of tasks that deliver value quickly and allow that value to compound as more customer needs are met.

Embedded investment jobs to be done

What I have covered in this article holds true for every area of embedded finance, whether that be embedded lending, embedded payments, embedded insurance, embedded banking – or embedded wealth management.

It’s important to know what kinds of use cases provide the best opportunity to embed wealth management. In many of previous articles and white papers including our recent Embedded Wealth Report, we have looked at the kinds of business channels where we see most potential and where most of our conversations are happening today. Depicted on the graphic below, these are namely retail and challenger banks (neobanks), employee wellness apps, IFAs and financial advisors, health insurers, pension and life insurers, and super apps and consumer platforms. We estimate the potential addressable market for these companies is over $100billion in additional revenues.

Six key use cases for embedded wealth

Source: additiv

However, while each of these business segments and channels have touchpoints and customer journeys into which they can seamlessly embed wealth management products, it is first critical for them to understand the jobs to be done. Otherwise, as already noted, they run the risk of despite understanding the context offering them the wrong experience – for example, a customer wants a higher return on their savings but is still served up the same traditional product as before. Or worst of all, misunderstanding the context and serving up both a product rather than an experience and the wrong product to boot.

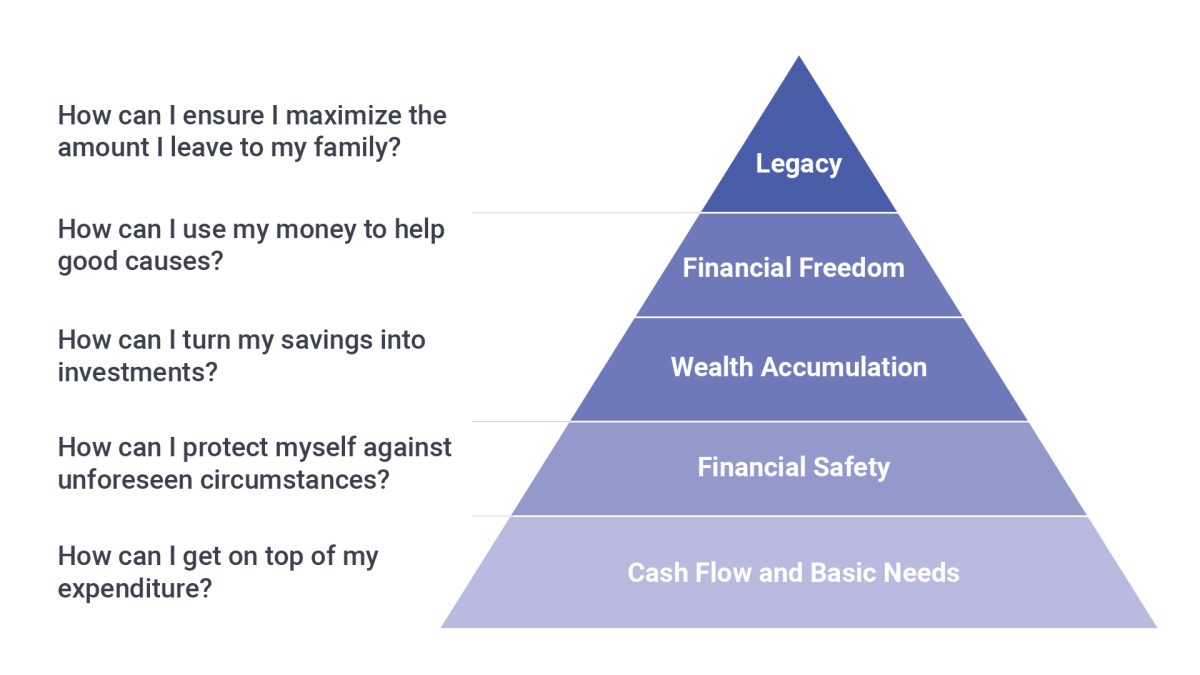

In our experience, and based on extensive customer research, the best way to frame this analysis is in terms of a customer’s wealth journey or, to put another way, where a customer sits on the investment management hierarchy of needs.

This informs both what jobs to be done to address, but also in what order.

Some brands, such as challenger banks and consumer platforms, are best placed to address people’s jobs to be done as they start their wealth journey. As a result, they are best to concentrate first on jobs to be done centered around customers’ most basic needs – helping them to understand and control their expenditure. However, their challenge is to retain these customers as they become wealthier, and so they need to plan for how they will grow their wealth proposition over time, putting in place the capabilities and partnerships to orchestrate more complicated jobs to be done.

Conversely, other providers, such as IFAs and asset managers, are in a position to orchestrate more complicated jobs to be done, but they may find it increasingly hard to acquire these customers in the first place unless they also engage earlier in the wealth management lifecycle.

Understanding ‘jobs to be done’ against a hierarchy of needs

Source: additiv

Over the last year or so, we’ve been discussing the needs of platforms in this context. It’s an important conversation and one that we’d be happy to have with you, what ever segment your business operates in,

To receive our complementary upcoming market study on customers’ wealth management jobs to be done, please follow additiv or sign up to our newsletter.