This article first appeared on thewealthmosaic.com on April 7th, 2021

Thomas Schornstein, Head of Middle East and Member of the Executive Board of leading wealth management SaaS provider, additiv, reviews the Middle Eastern market and reveals fundamental considerations to meet client changing needs within the region.

Across the globe, the wealth management industry is undergoing dramatic changes, and the Middle East is no exception. One major factor is digitalization and, since COVID-19, this technology transformation is essential.

Since March last year, we have seen banks triple their revenue through online channels. But having online capabilities isn’t enough. Financial institutions must understand not only what being truly digital means (and the value that it offers) but also the changing dynamics and demographics of their customer. In doing so, they can develop solutions to fully leverage this new norm and avoid losing what’s most important: the customer relationship.

The changing face of the customer

Although enabled by new technologies, the need for digitalization comes as a result of many different elements including demographic changes.

One significant change within the Middle East (ME) that is a higher growth in its younger population than other regions. This population growth is set to continue and, as a result, the region has an unusually high penetration of smartphone users. According to Deloitte, mobile phone penetration is already at 97%, and thus there is a strong requirement for mobile first banking services. These user expectations extend to well established wealth advisory services that are available within an online, end-to-end system.

In addition, we are seeing the demand for wealth advisory services expand beyond high-net-worth individuals. A new ‘middle class’ is being created by increasing education levels within the region, along with a greater number of women entering the workforce, and a growing expatriate community. These audiences are looking for extended wealth management services for accumulation, and digital allows banks to service them efficiently like never before.

The changing expectations of the customer

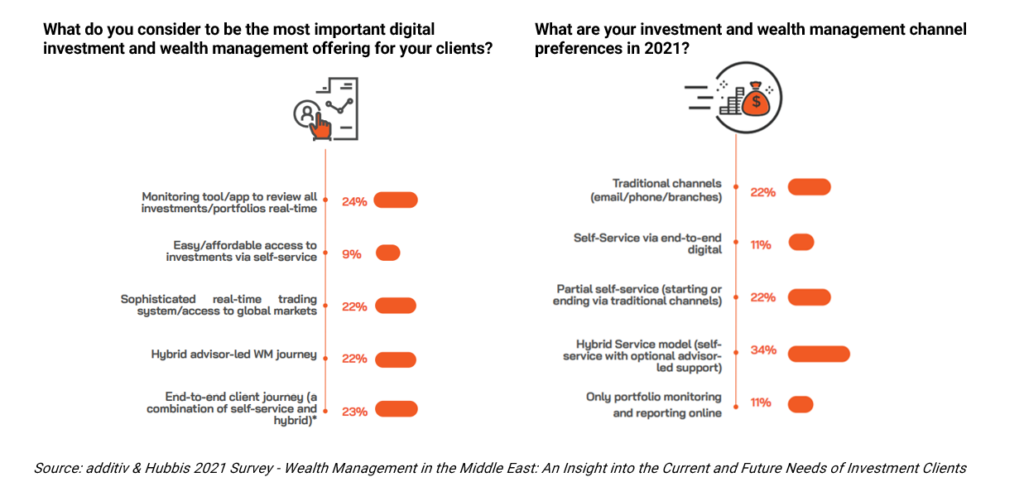

We recently reached out to wealth managers within the Middle East to understand what their clients really wanted in terms of channel and product offerings. The answers to our questions were very telling:

What’s clear from our survey to wealth managers in the region is that optionality is important. There was an equal balance between four key focuses; two of which focus on a purely hybrid model (55%), however, sophisticated real-time trading system/access to global markets (22%) and monitoring tool/app to review all investments/portfolios real-time can also be offered through a hybrid approach.

The changing requirements of WealthTech

To capture these new markets and maintain competitive with existing customer bases, the right IT infrastructure is imperative. Presenting customers with better user interfaces isn’t sufficient. Wealth clients are looking for better experiences and access to bespoke investment solutions according to their individual needs, at a reasonable price.

During the COVID confinement period, one of the largest retail banks in Switzerland, PostFinance, launched an end-to-end digital platform that does just this. It caters to the needs of customers wishing to diversify away from low-yielding savings products. The platform offers a seamless and engaging experience to both advisory and discretionary customers and, unsurprisingly it is seeing massive take-up.

PostFinance’s success in part can be attributed to them recognizing the importance of how clients wish to interact with their bank varies, and evolves throughout their relationship along with the market environment. There will be periods when bank clients wish for independence, and at other times they’ll seek guidance on the risks involved. They might even want the bank to handle everything. A hybrid approach enables this.

A hybrid model allows clients to be offered the service that best suits their individual needs, and chose how they want to be serviced. Depending on these needs, the advice or support available is human or self-service, supported by intelligent analytics and offers real value:

- It enables clients to be serviced more efficiently (only support when there is a real need);

- It allows advisors to walk through proposals, optimizations and simulations in real-time; and

- It ensures relationship managers remain productive and focused on clients when it matters most, which in turn improves scalability for banks.

Rather than impeding the client relationship, it actually encourages collaboration; supporting in-person and remote advisor and client conversations through a multitude of channels, going way beyond the “next best trade concept”.

However, there is a common misconception about one aspect of a hybrid service: the self-service approach. It is often confused with robo-advisor online wealth management platforms, which offer automated portfolio management, but these are poles apart. A self-service model allows clients to gain insights and complete actions that historically would have been undertaken by an advisor as an administrative function.

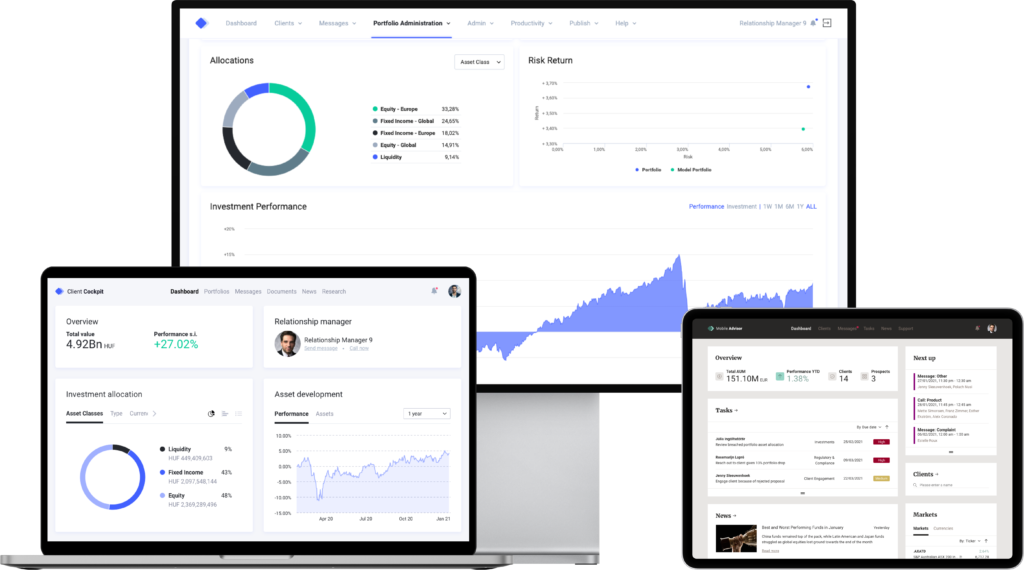

At additiv, our Hybrid Wealth Manager product enables banks to offer a truly digital solution. It is a set of digital applications for managing investments and client relationships: Workbench, Mobile Advisor and an advanced self-service model: Client Cockpit. Unlike a robo approach, our Client Cockpit only automates the menial elements previous undertaken by the bank and really puts clients with their advisor in the driver’s seat.