Build and scale digital wealth journeys across every segment, without replacing your core systems.

A single platform. addWealth.

additiv’s Digital Financial Services Platform orchestrates everything needed to deliver end to end wealth management services. With modular capabilities and cloud-native deployment, you can launch efficiently and evolve your offering at speed.

Deliver intuitive experiences across digital, hybrid, and advisor-led channels to meet clients across all channels.

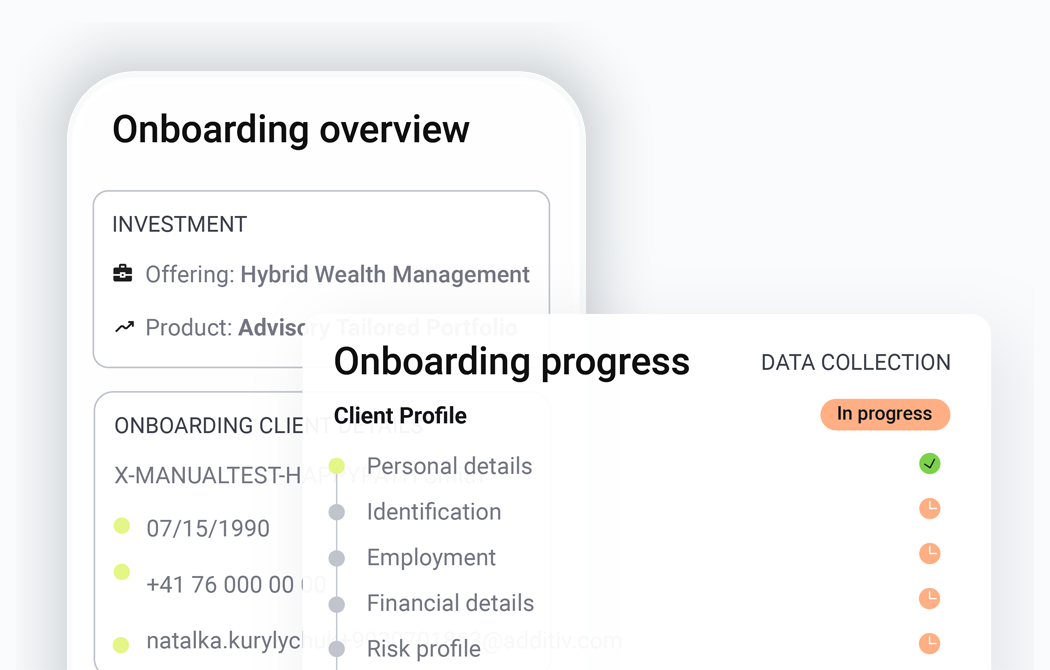

Simplify onboarding, automate suitability checks, and enable goal-based financial planning with seamless workflows.

Ensure global regulatory alignment, including MiFID II, while supporting portfolio construction, automated rebalancing, and comprehensive reporting.

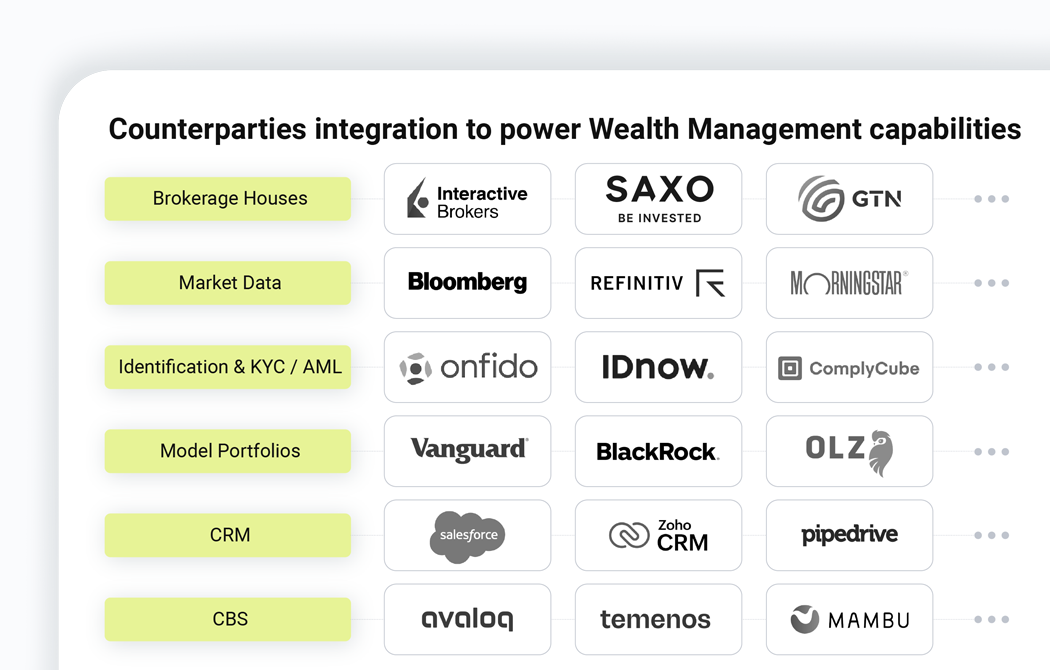

Leverage an orchestration layer that integrates effortlessly with both internal infrastructure and third-party services for full-service delivery.

Scale smarter. Serve faster. Personalize better.

Unlock the full potential of your wealth offering. With additiv, you can launch, scale, and tailor digital investment services from a single platform, more efficiently, more intelligently, and with greater reach. Whether you’re serving retail clients or high-net-worth individuals, we help you stay ahead with the tools to innovate, automate, and grow, without complexity.

addInnovation

Bring new wealth propositions to life fast. From ESG portfolios to goal-based planning and embedded offerings, tailor experiences to your clients’ needs. Expand access and reach with self-service journeys, digital onboarding, and guided tools that lower costs and bridge the advice gap.

addAutomation

Automate onboarding, risk profiling, portfolio management, and compliance with embedded workflows and AI-driven insights. Remove costs, reduce manual work, and boost advisor productivity. Built-in controls ensure regulatory alignment, so you stay compliant, efficient, and agile.

addOpenSourcing

Grow your wealth offering with pre-integrated, regulated third-party providers. Use our orchestration layer to combine internal and external products, distribute across channels, and scale at speed, while retaining full control of the client experience.

Unparalleled impact across

the value chain

additiv empowers you to launch, scale, and personalize wealth services from a single platform — driving efficiency, collaboration, and faster time to value for every stakeholder.

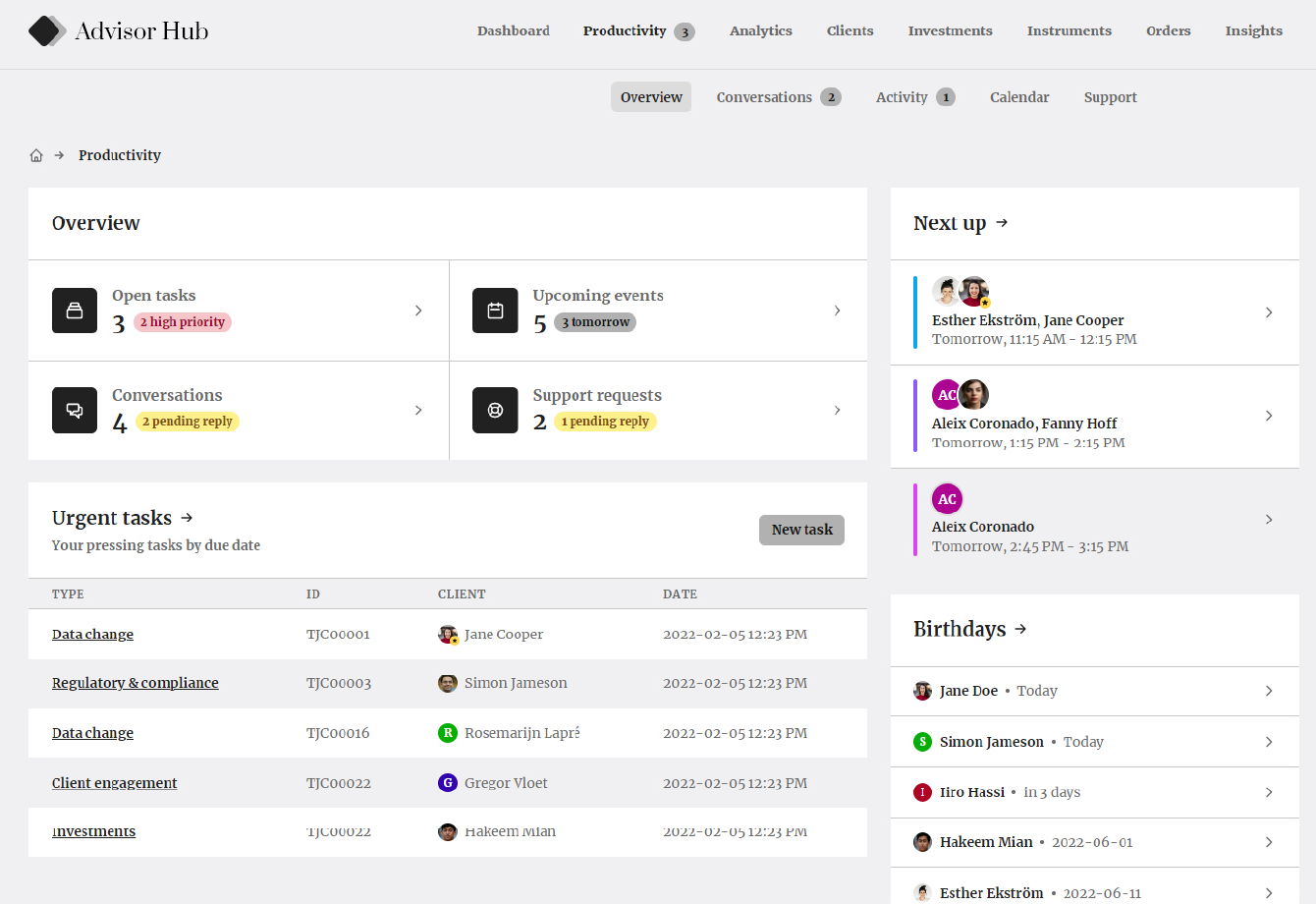

Empower productivity and enhance client relationships

Personalized advice at scale

Deliver hyper-relevant recommendations using AI-powered nudges, real-time insights, and dynamic client data, whether in hybrid, digital, or face-to-face settings. More relevance, less admin.

Elevated client experience

Gain a 360° view of each client’s goals, preferences, and portfolio, enabling consistent, proactive engagement and deeper relationships across every interaction and channel.

Build tailored portfolios at scale

Intelligent portfolio automation

Automate proposal generation, profiling, and rebalancing with built-in roboadvisory tools, driving efficiency and enabling more personalized service, at greater scale.

Real-time monitoring & portfolio control

Track every portfolio against defined constraints with full transparency. Real-time alerts, automated remediation options, and KPI dashboards give you complete control over performance, compliance, and risk at scale.

Deliver smarter, more personalized investment experiences

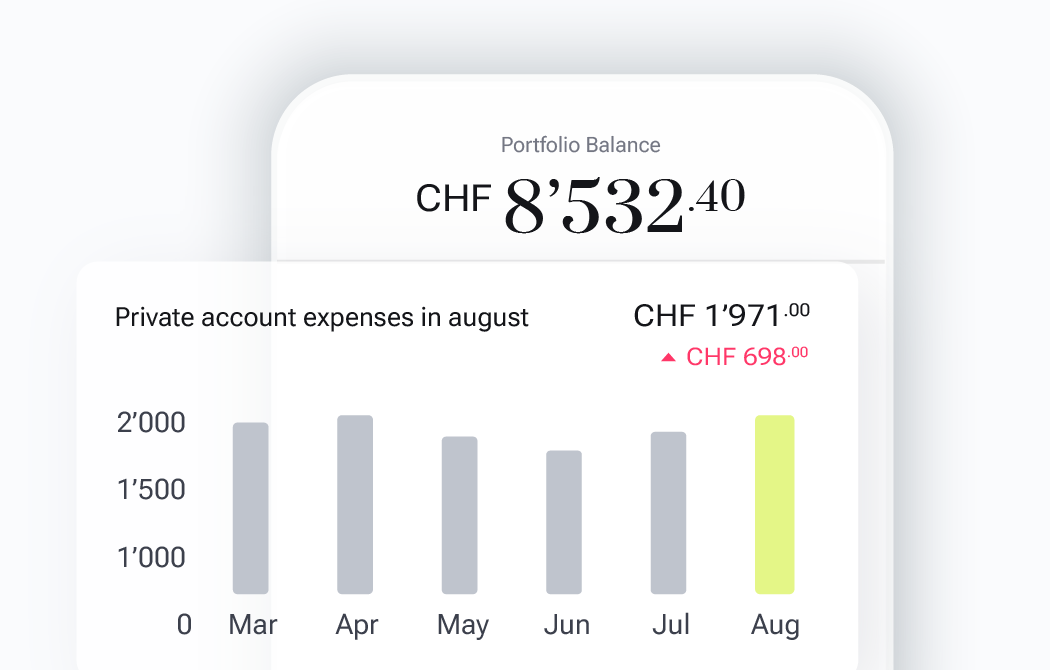

Self-service, redefined

Let clients onboard, manage portfolios, and handle servicing independently, reducing friction while offering advisor handoff when needed.

Seamless advisory support

Enable timely, human engagement through in-person or remote advice, fully synchronized across channels for a consistent, high-touch experience.

Our client partnerships

PostFinance, one of the largest banking institutions in Switzerland, worked with additiv to enter the digital wealth management market.

Hybrid wealth management

Support of self-service as well as advisor-led investment services.

Comprehensive product offering

Execution-only, advisory and discretionary mandates.

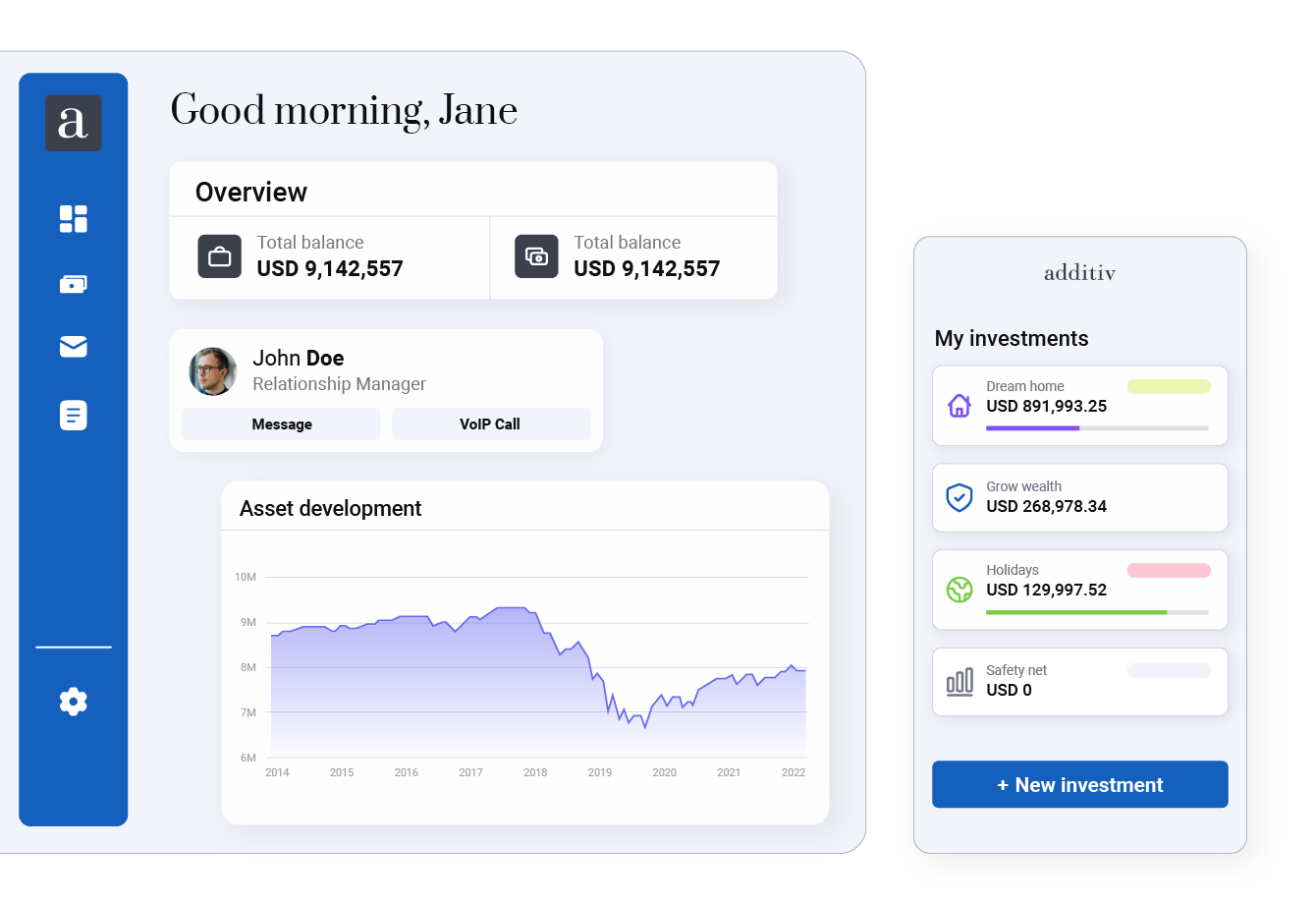

ATRAM, the largest independent asset and wealth manager in the Philippines, partnered with additiv to consolidate all client segments onto a single digital Wealth-as-a-Service (WaaS) platform to scale solutions for client-centricity.

Advisory-led digital wealth offering

Customizable advisory tools for individual, corporate and institutional clients.

Award-winning

Winner of IBSi Global FinTech Innovation Awards 2023 for Best Project Implementation.

Zurich Insurance, one of the world’s largest insurance groups, launched investment and retirement offerings to its clients with additiv’s end-to-end wealth-as-a-service platform.

Pension planning services

In-person and remote pension planning for pillar II and 3a.

Operational efficiency

Fully digitalized and automated end-to-end process and workflows.

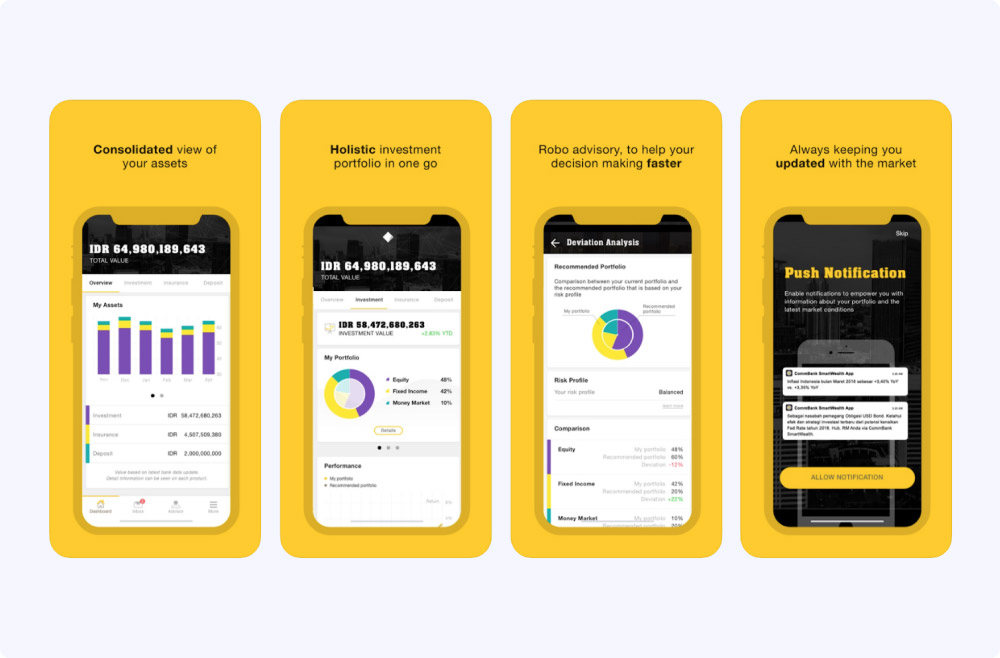

Commonwealth Bank Indonesia was the first bank in the country to launch a mobile banking application with investment features, CommBank Smart Wealth powered by additiv.

360° view of investments

Comprehensive interface enabling customers to directly monitor their total assets.

Self-service with on demand assistance

Manage investment transactions independently, freeing relationship managers and advisors to cater to the ones truly in need.

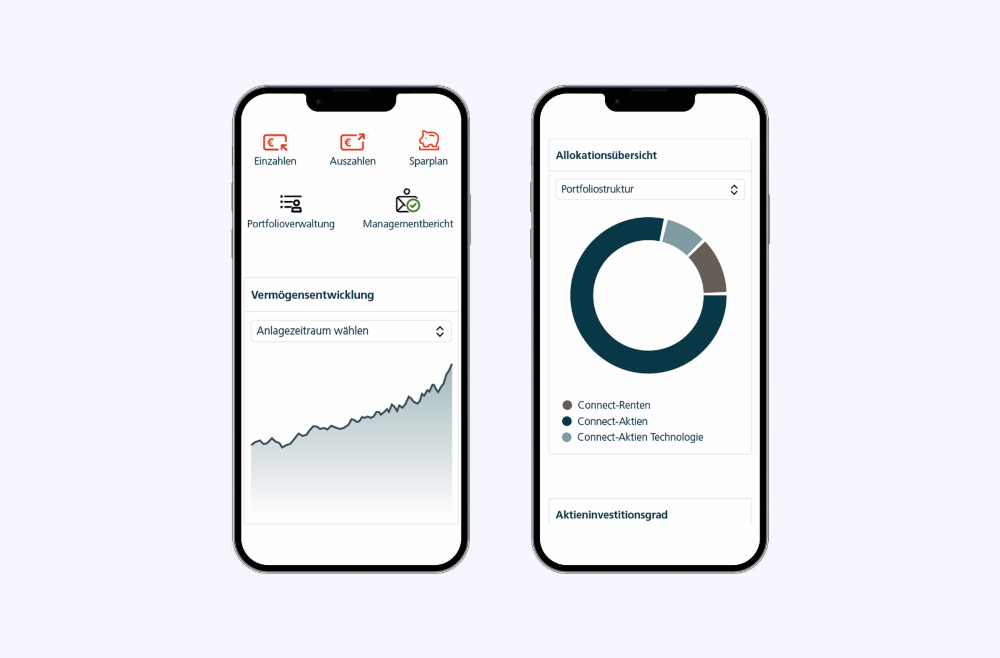

Deka, one of the leading asset managers in Germany serving the largest German retail banking group “Sparkassen”, uses the additiv platform for end-to-end portfolio distribution and omnichannel servicing.

Hybrid wealth management

Investment management and advisory services fully embedded into the saving bank's advisor and client portals.

Efficient processes

Intuitive digital onboarding journey with efficient and compliant advisor assisted onboarding and portfolio modification workflows.

Akbank AG, the German banking entity being part of Turkey’s leading banling group Akbank T.A.Ş., digitized the end-to-end investment and advisory services for advisor and clients on additiv’s platform.

MiFIDII compliant

MiFIDII onboarding and modification workflows for multiple client and investment types including investment advisory and execution only offerings.

Managed digital platform

Leveraging additiv's managed platform services for easy integration into partner systems and lean day-to-day operations.

PensExpert, a leading occupational pension provider in Switzerland, built a self-service pension offering, providing pillar 3a and vested benefits solutions, on additiv’s technology platform.

Pension solution

Self-service pillar 3a and vested benefits offering.

Process orchestration

Leveraging additiv's platform to orchestrate pension and wealth related services with multiple investment allocations.

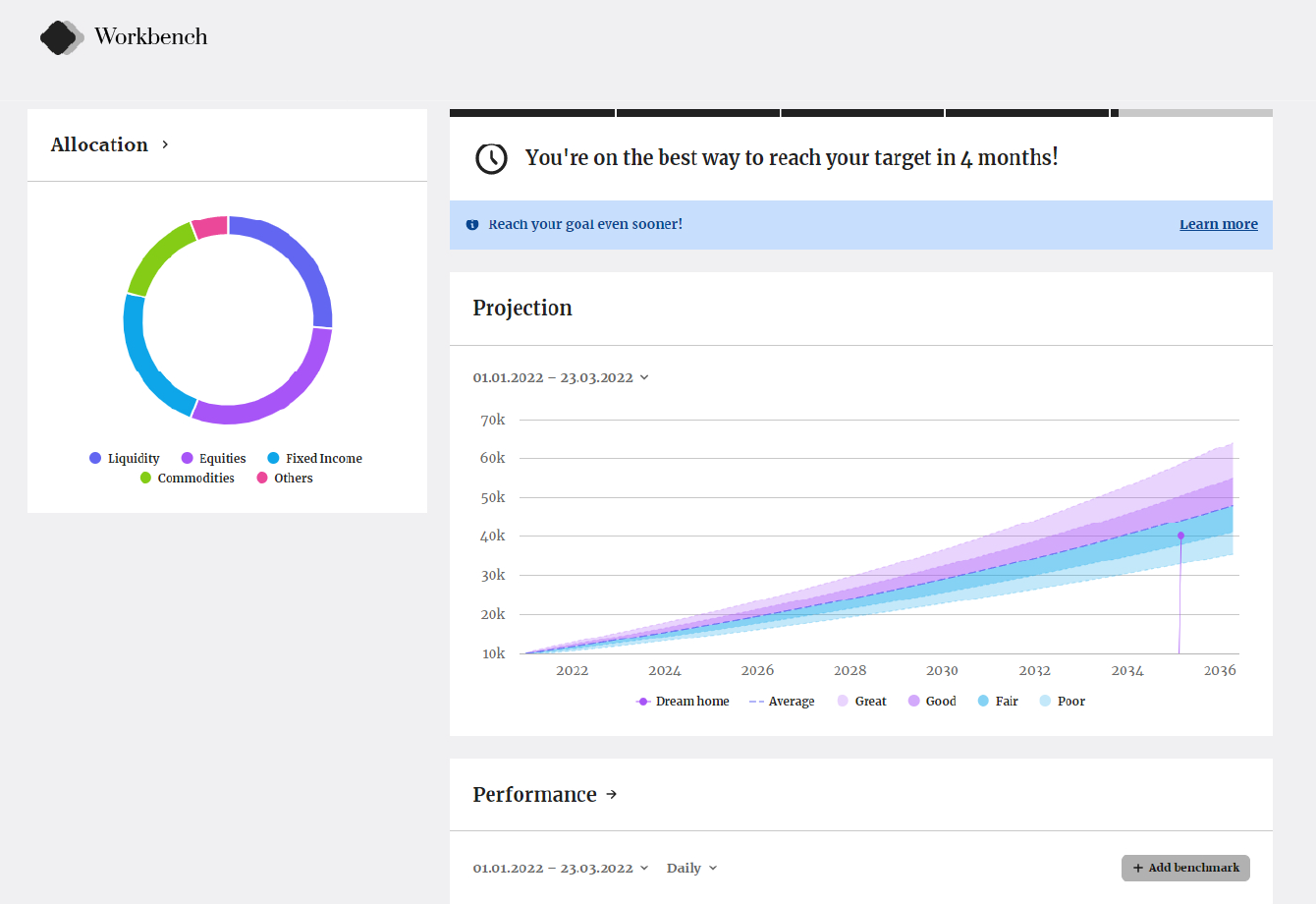

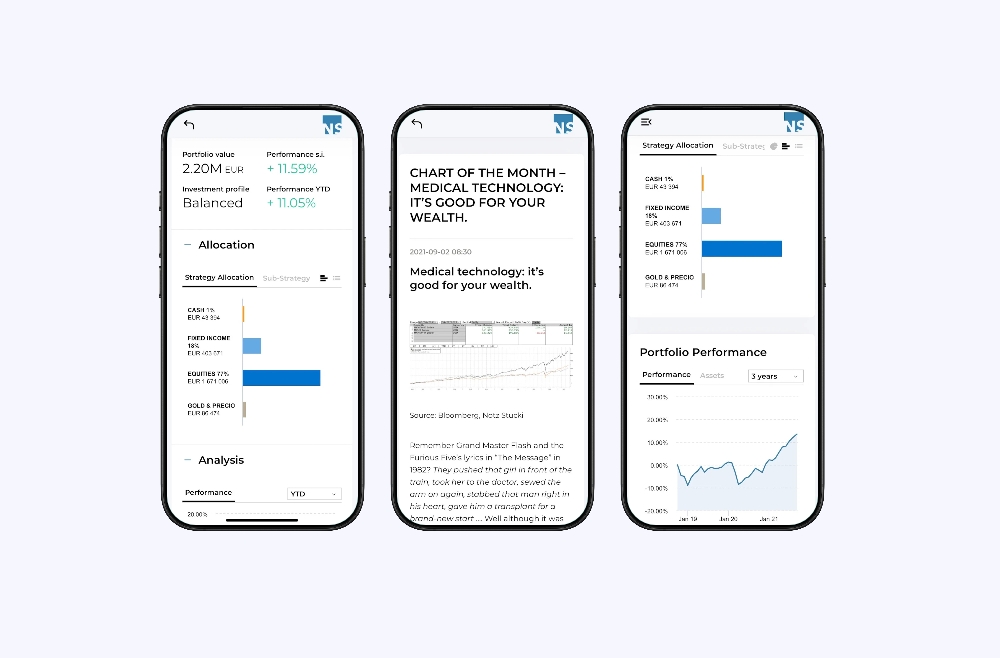

NS Partners, a global investment management firm providing bespoke wealth management solutions to private and institutional clients, partnered with additiv to provide a holistic, intuitive client cockpit.

Omnichannel advisory solution

Single core application to deliver easy access to investments and in-house market research.

Customer cockpit

Comprehensive overview and visualization of portfolios as well as direct market and investment news flow.