The wealth management industry is evolving. And the market within the Middle East is no exception. It is a work in progress that requires a consolidation of objectives and collaboration between private sector incumbents, new entrants, governments and regulatory bodies within the region. Nobody expects the wealth markets to suddenly blossom and mature overnight; the development of a broad-based and fully diverse wealth management market will take time. But the demographics and the demand are in place.

And there are many different players waiting in the wings; alongside stablished banks within the region are international banks expanding into the Middle East and a wide and growing range of independent wealth manager. But to achieve this revolution they must deliver a digital led strategy; offering optimum quality of advice on investments, wealth structuring, and estate planning and boost personalisation and diversify their offerings, all while significantly enhancing their private client engagement. Digital transformation, especially in the age of this pandemic and (hopefully) in its more benign aftermath, will be crucial to achieving many of these goals. But what has been their experience to date and what strategy are they adopting going forward? Hubbis, in association with additiv, conducted a mini-survey to gauge the state of the market and to identify in what areas the region’s wealth industry must advance its digital journey.

Executive summary

As the world continues to grapple with the pandemic and as numbers worsen in the US, Europe and in some other markets, we reached out to our Hubbis readership from within the region to understand their wealth management strategies, current digital transformation status and outlook for the imminent future.

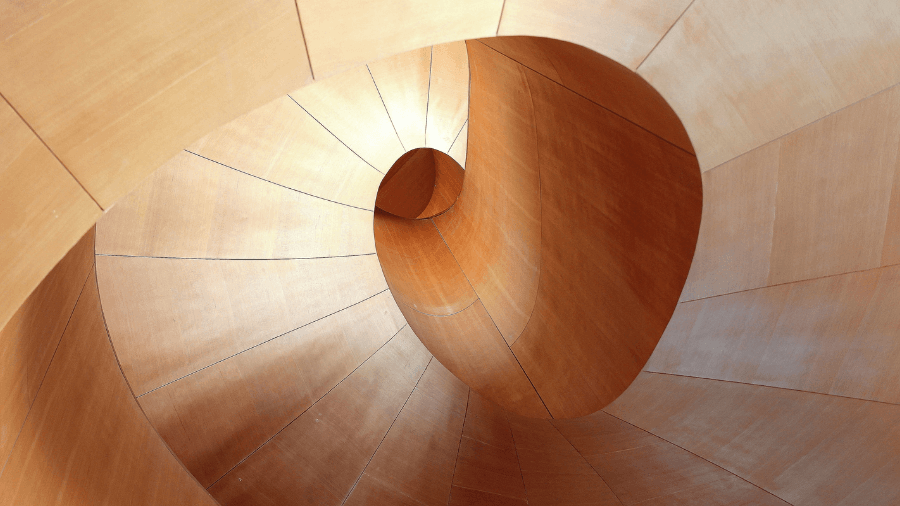

- 91% of respondents highlighted that more than 20% of their wealthier client portfolios will be focused on international assets.

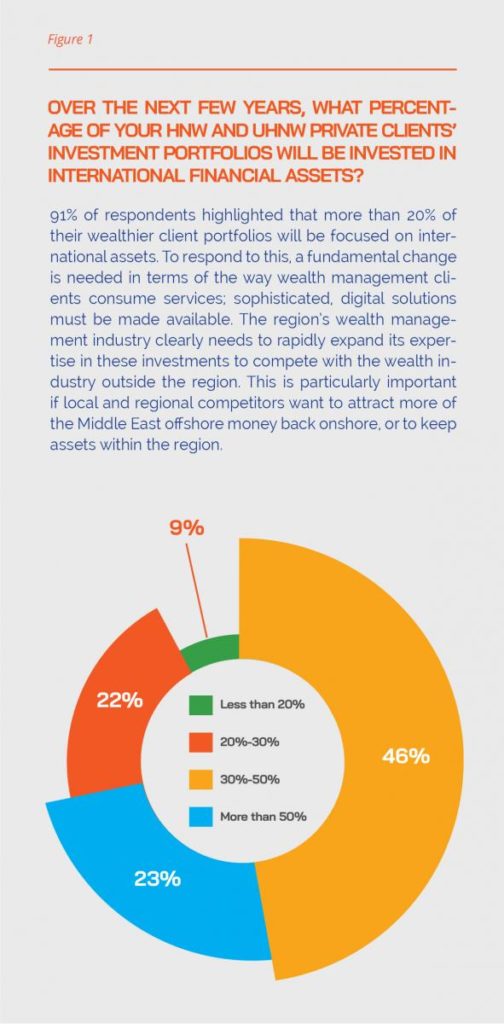

- 54% of wealth managers say collective investment schemes (e.g. funds and ETFs) are likely to play an increasing important role in their clients’ portfolio.

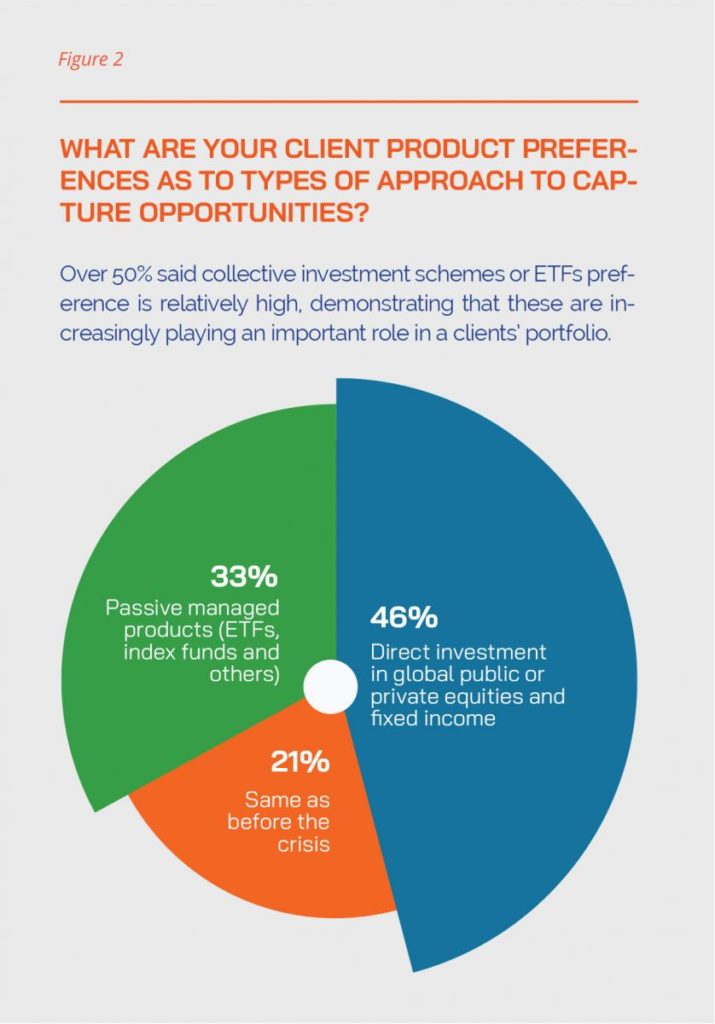

- Most (88%) of our respondent’s clients are expected to seek advice or delegate investment decisions to a bank/asset manager.

- The majority (78%) of wealth manager’s clients are ready and want to use digital channels but still appreciate support from an advisor if required.

- Optionality appears to be a major focus for wealth management clients with a variety of different product functions being desired. Although these can all be serviced through a hybrid approach, 55% of respondents highlighted a particular need for a hybrid model.

Investment portfolios: an imbalance

Our first question (Figure 1) looked to understand a preference for local verses international markets for our respondents’ clients.

Passive investment on the rise; active has a part to play

Within our survey (Figure 2), there was some indication that as the local industry improves its skills and services and becomes more global in outlook, there should be increased appetite for discretionary portfolio management (DPM) and advisory.

The volatility of the markets in the past year, and more, is seen as sound reason for clients to pass their portfolio management to experts and improve their risk management via diversification. This process has only started recently but should grow strongly in line with the banks offering such services, although realistically, there are cultural, control and trust issues to overcome along the way.

Our survey respondents indicated that the main approach amongst private clients will remain direct investment in global equities and fixed income, while 54% of respondents indicated that to capture opportunities, the clients will buy into actively-management strategies, or passive strategies, especially via the world of ETFs (Figure 2).

Investment advice: a major priority

Our next question, (Figure 3), unveiled that clients are expected to increasingly delegate investment decisions to their financial advisor (and this is likely to be through a hybrid managed approach).

It might be wishful thinking to some extent at this stage, but our survey’s respondents indicated that many of their clients (73%) will take up advisory offerings; taking advice from their wealth management providers based on elucidating their expectations and letting these providers build a risk profile assessment. There is no doubt that in order to meet these expectations, the region’s wealth industry must significantly expand its expertise.

The question that followed look at understanding the next level of advisory that wealth management clients might look to.

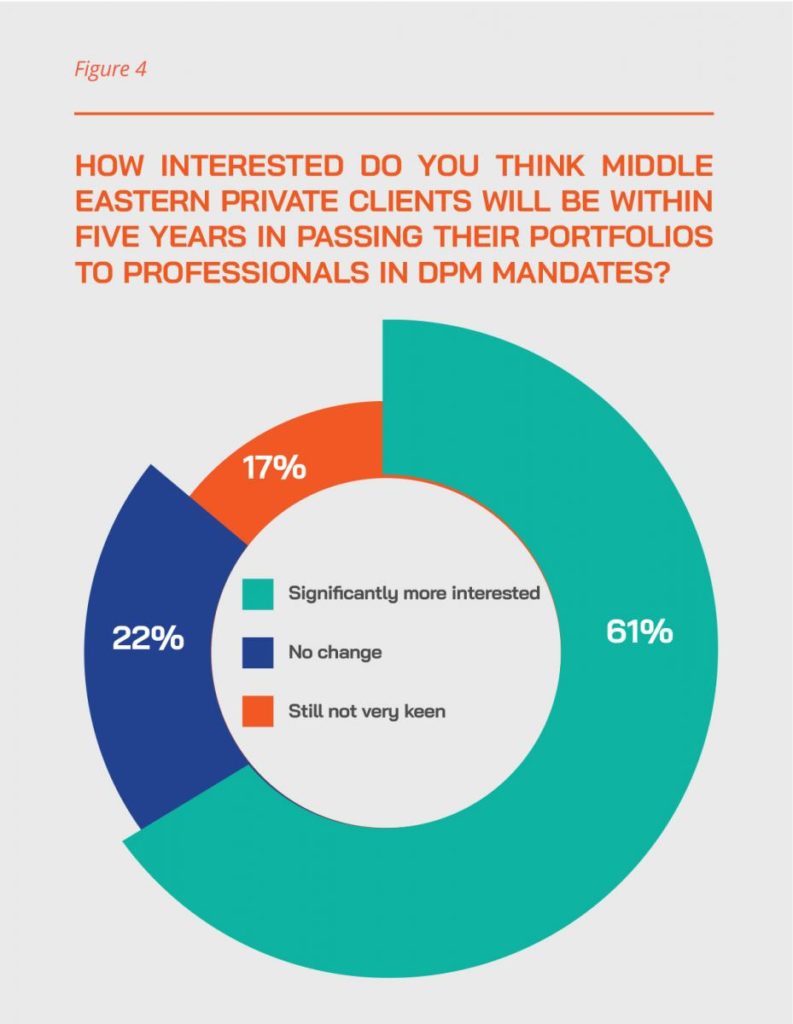

From the responses within Figure 4, there is also clearly an expectation that delegation is likely with DPM mandates increase in the region in the long term. However, the reality from comments made by some of the experts we spoke to highlighted that these are few and far between at the moment. Nevertheless, there is genuine cause for optimism, as 61% of replies indicated that there would be a growing interest in private clients taking up DPM within the next five years further supporting an appetite for a hybrid model.

The family office: an increasing presence

The region is anticipated to attract more families to establish family offices in the Middle East This is facilitated by the evolution of the WM industry and regulations in the region. It is also driven by the need for multi-bank and holistic portfolio aggregation and management at one single point. Add to this the need to have a bird’s eye view on a continuous basis and supported by a highly experienced seasoned advisory team of the family office and you can see the appeal.

Accordingly, respondents anticipate significant growth of SFOs and MFOs, with the latter acting more as competition to the banks, whilst also using them for custody, execution and other services. One expert commented in their reply that the region is attracting more clients looking for a safe haven for their portfolios as both the wealth industry and political stability and thinking improve in the Middle East, especially benefitting Dubai and Bahrain.

Succession planning: professionalizing and formalizing

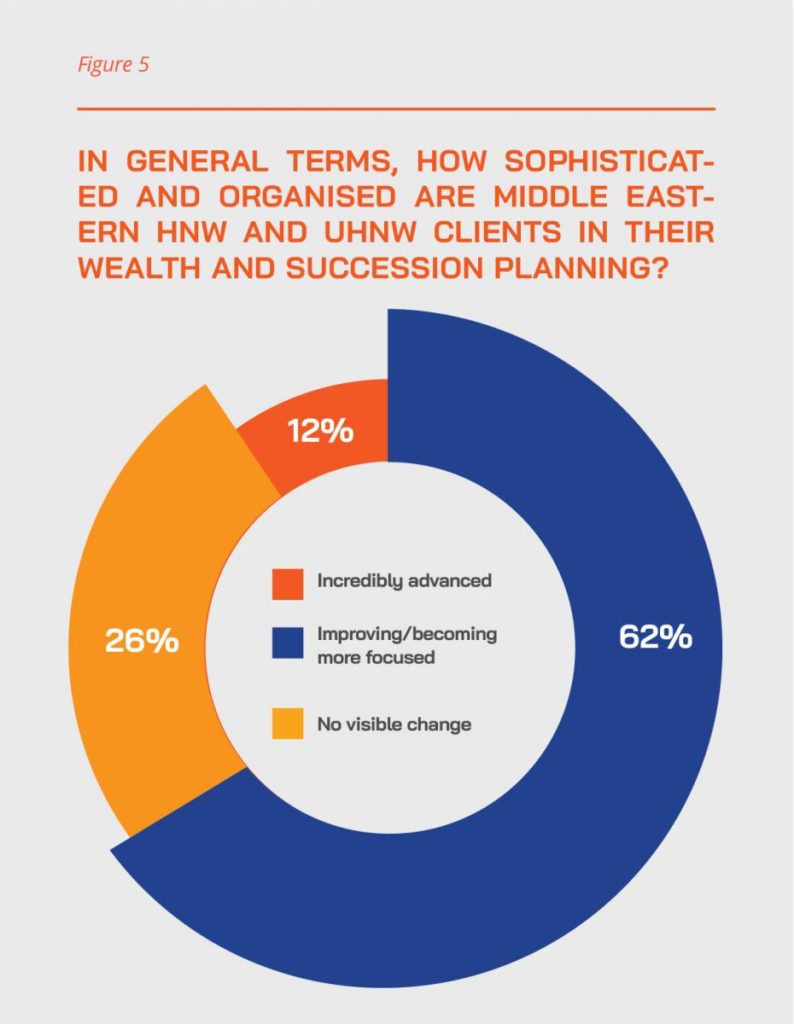

Another key area of emphasis was the rollout of more appropriate structures for more families who are increasingly keen to explore succession planning. There appears to be considerably increased demand for such advice and structures, especially after the new Family Law implementation in the UAE. In addition, the rising availability of relevant and sophisticated structures locally to address those needs will undoubtedly have an impact. We explored succession planning further with our next question (Figure 5).

In the world of wealth and succession planning, for which there is rising demand and interest in the region, there is a huge opportunity. Only 12% of replies indicated that the private clients and families in the region are highly sophisticated in these areas, while 62% said that there is improving interest already, with 26% indicating that their clients had not yet engaged properly with these concepts.

Skills and education: a need for improvement

There is little doubt that professionalism in the industry must rise and that better information and education is disseminated to the end clients to achieve any or many of the strategic goals mentioned. This will result in a more virtuous circle of expertise on offer and client expectations being both more sophisticated and more realistic, and then more likely to be met.

All this, in turn, will also help the market evolve from a more short-term, ad hoc approach to wealth planning and investments towards a more needs or goals-based markets with a longer-term perspective.

Indeed, in conversations with our survey respondents, they highlighted how regulators have been driving better skills and professionalism, often requiring continuous professional development schemes, so the advisors can assess what the client needs are, driven by a more formalised and professional assessment of their risk profiles and goals. Overall, the replies indicated that headway is being made, but of course, also that much more progress is required.

The digital journey: focusing on the client with a hybrid model

Another vital area of development has been the ongoing rollout of omni-channel approaches and digitalization overall. There were comments to the effect that those who were ahead in their digital journeys before the onset of the pandemic in 2020 had fared better. Their digital advancement meant that they were more capable of working remotely, more able to connect efficiently to their clients, and were better at executing, processing and reporting seamlessly via digital channels.

Many of the region’s banks have historically focused on fairly basic elements of banking products and services and able to make good margins in what has been a relatively higher rate environment in the region. It is clear from our survey comments that many traditional banks are already making some progress in expanding into the world of wealth management and digitizing their offerings, but it is also clear that there is a long road ahead in this endeavour.

The need for diversification: playing the end-to-end game

Banks are increasingly realizing that developing an end-to-end digital investment and wealth management journey, and the necessary investment required is crucial. Within our survey discussions, replies indicated the region’s banks need to diverge from such an intense reliance on pure balance sheet business, increasing their other revenues and achieving over time a fundamental transition of their business models. This is creating strong demand for end-to-end digital investment and wealth management journeys amongst the leading banks, some of which are more engaged and advanced, and others of which are gradually dipping their toes in these complex waters.

Many Middle Eastern banks also see the need to upgrade capabilities from execution-only as they have offered in the past, to value-added advisory. In the future, the majority of clients will need advice on portfolio creation and want dedicated professionals. Our survey also indicated that discretionary support that can gradually compete with the offerings of international private banks armed with well-known brands, may also be needed.

Certainly, the hybrid model is considered the most relevant, as there is a widespread sentiment that today’s wealthier clients and even the mass affluent customers of tomorrow will continue to want interaction with the RM community, even if remotely via digital channels.

Digitalization: the rise of the well-to-do middle classes

There is rapid growth anticipated in wealth in the mass affluent segment. As this transpires, there will be an even more pressing need to digitize the wealth management and investment management platforms, end-to-end, in order to roll out the necessary democratization of the region’s wealth management offering in the years ahead.

The greater digital facilitation of mass affluent investing should take place alongside the globalization of these portfolios, with greater access to and expertise on offshore assets and wide appreciation of the ETF market and of increasingly dominant trends such as ESG. All this must be accompanied by better data management, better assembly and delivery of information and research and far greater relevance.

An issue with remote communication is that many messaging and other apps are banned/prohibited in the region, but respondents indicated that there is a willingness amongst the regulators to help develop remote communication protocols in a secure and compliant way.

Digitalization: client-centricity

All these developments should be set against the backdrop of the development of a more client-centric, financial planning and professionalized environment in the region, emulating the types of approach in the US or Europe, or even in the more advanced markets in Asia. Whoever is building the platform has to keep the client at the heart of everything that they do.

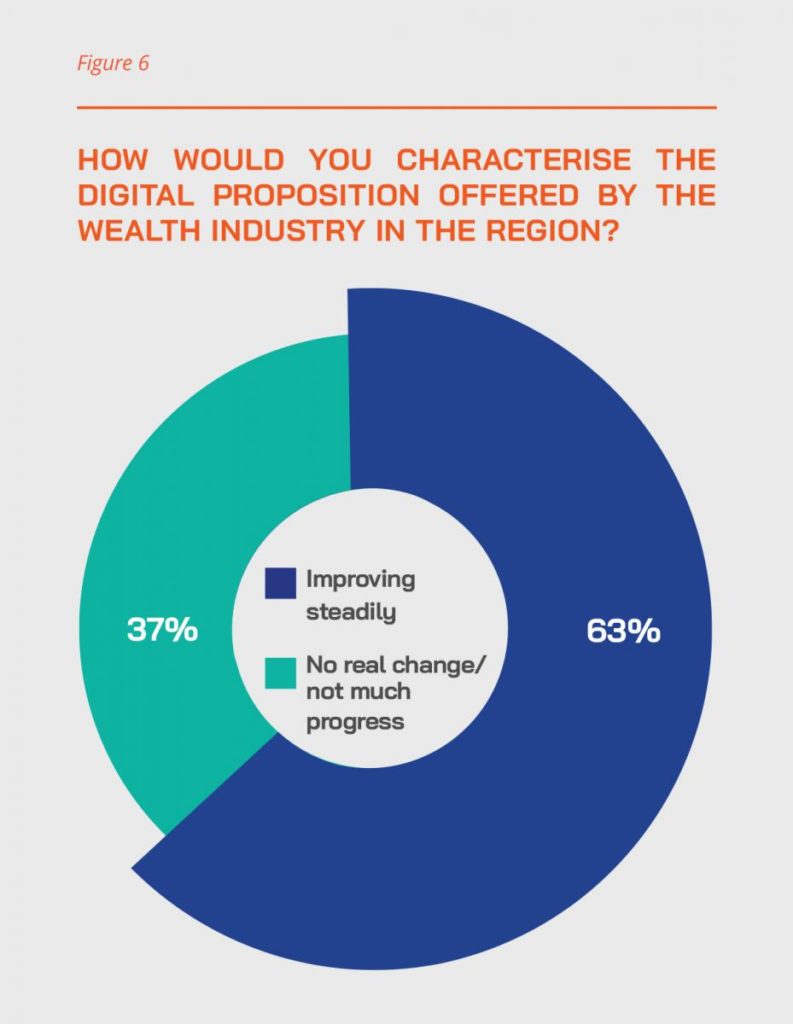

Having unfurled their flags across Europe, many leading international digital wealth solutions firms are expanding rapidly in Asia and the Middle East, as local wealth management offerings develop at a speed and diversity not seen before. The modernization and democratization of private wealth offerings in the region offer such FinTech companies an immense opportunity as local banks and other firms advance their digital journeys, expand their self-service offerings, develop their hybrid offerings and progress their advisory expertise and delivery. Our next question (Figure 6) explores the perception of the current view wealth management in terms of the progress.

Our respondents indicated that they believe that there is progress being made, with 63% of replies indicating that the digital solutions on offer in the region’s wealth industry are improving steadily. However, 37% also stated that there is as yet insufficient traction, with anecdotal comments from some experts that lip service might be paid to digitisation but that some banks and other players are dragging their feet in decision making, either because they are unsure of which directions to take or which FinTechs and other solutions providers to work with, or because they simply have not fully worked out where they want to compete in the year ahead on the region’s wealth industry. But as one expert commented, therein lies both the opportunity and the challenge.

The Middle East remains a traditional culture and environment, yet there is very evidently a positive embrace by providers and clients alike of the growing range of channels available for the customers’ wealth management needs. If there is one highlight from the feedback here, it is that the hybrid model appears to be the most significant protocol, and again comments from the respondent indicate that this will rise in importance as the rollout of wealth management to well-to-do mass affluent investors accelerates in the years ahead, and as more HNW-segment clients either remain in the region for products and services or repatriate funds from offshore as the region’s industry develops.

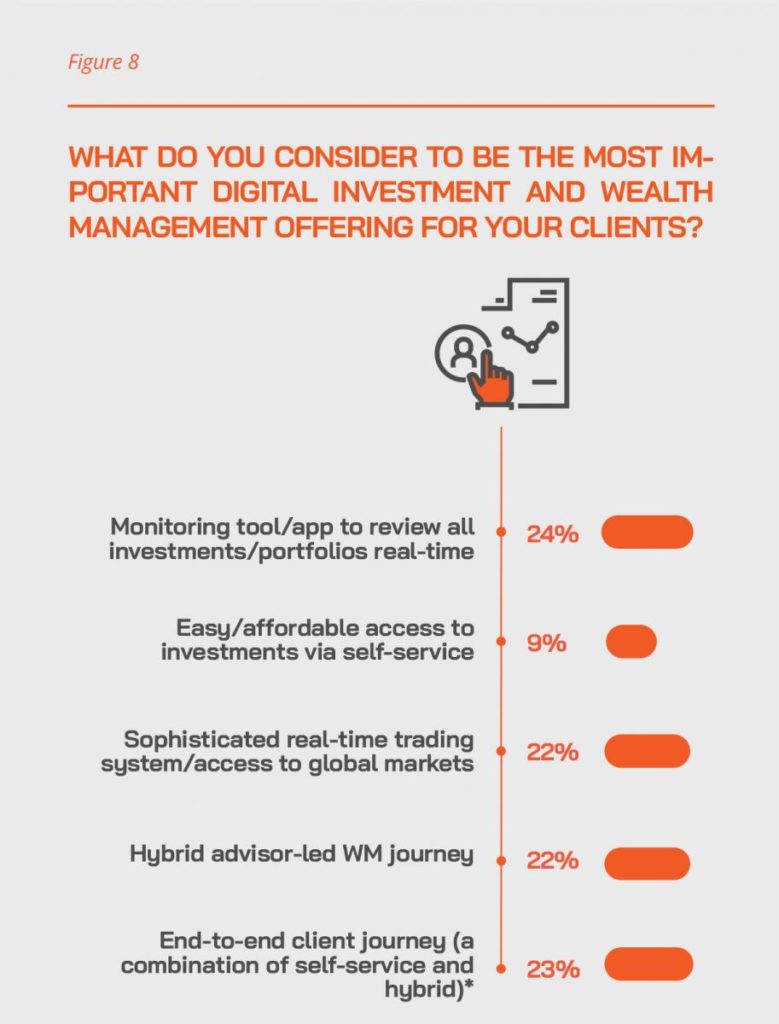

The next two questions (Figures 7 and 8) explored the appetite for optionality, looking to understand wealth managers appetite for this within the digital journey.

The digital revolution for the region’s wealth industry must take place from front to back, but for the clients themselves and their user experience, the Middle East wealth industry needs to address the needs of their customers and emulate the advances taking place in, for example, the wealth markets of Singapore and Hong Kong, which are themselves rapidly advancing towards the best European models and sometimes even beyond.

Optionality is clearly important, as in general Figure 8 shows an equal balance between four key focuses; two of which focus on a purely hybrid model (55%), however, sophisticated real-time trading system/access to global markets (22%) and monitoring tool/app to review all investments/portfolios real-time can also be offered through a hybrid approach. Interestingly, a self-service, purely robo approach appears to have less of an appeal (9%).

Customer engagement: end-to-end

Our discussion with respondents indicates that much of the progress taking place centres on maximising customer engagement. Everything from banks onboarding clients, through KYC/AML, risk profiling, goal setting, and the whole implementation execution of a set of financial investment opportunities, and later the whole monitoring and reporting for the account holder.

When asked in a post-Covid-19 world, what key avenues they intend to enhance their client engagement/client experience in 2021 and beyond, respondents sent a very clear message; they must respond to pressure from incumbents and aspiring future competitors. These are connecting more through digital media, especially as more and more clients are comfortable to meet and communicate on those platforms, particularly the younger generations.

Customer engagement: building the UX

Our conversations highlighted that digital is also felt to be key to enabling FIs to offer greater proactivity, to significantly enhance the end-user experience, produce a more tailored set of products and advice as well as enhanced responsiveness and transparency. Mobile and seamless 24/7 availability of answers and solutions are also essential.

With the pandemic, digital transformation has most clearly moved from a luxury to a vital necessity. There is, in short, an unprecedented transformation taking place in operating, servicing and sourcing models, as the need for wealth managers to quickly match up to the demands of clients grows. In particular, customers around the globe, and increasingly in the Middle East, demand seamless end-to-end digital wealth management on account of demographic, behavioural and technology changes.

These changes include the rise of middle-income households, wealth transfer from baby boomers to millennials, higher mobile penetration, and a shift in online activities from execution-only to advisory services. Add to this the effects of the Covid-19 pandemic, which has universally accelerated digital adoption across all digital channels, whether self-service or advisor-led. This in turn, generates high levels of engagement that build loyalty and translate into lower cost to serve and higher revenue per customer.

Conclusion

There is, in short, a very evident and growing structural change taking place in the region’s wealth management market. This is providing a once-in-a-generation opportunity to local financial services companies. The market is rapidly moving to digital distribution at the same time as a growing number of people with savings seek to invest those savings in diversified portfolios. For the institutions that act quickly to meet this untapped demand, this is a massive opportunity.

And this is all taking place from a relatively low base – the banks have a considerable amount of catching up to do to achieve the higher standards of investment and wealth management that are prominent in the major European and more developed Asian markets, especially for sophisticated clients in the world’s major financial centres.

In the past, so much wealth, once created or inherited, has been shifted offshore. But some or indeed much of this is being or can be repatriated, providing the local onshore wealth management offering is higher grade and appealing to these private clients.

The region’s leaders recognise the potential, as the countries are bringing their regulatory environment up to date and helping oil the wheels of these changes. A banking business driven mostly hitherto by balance sheet activity, is therefore gradually evolving a higher degree of service and commission income, especially vital in a world where interest rates and therefore lending spreads are so tiny.

The demographics are also immensely appealing, as more and more people span the type of investment range of USD10,000 to USD5 million of investible funds. Indeed, there are simply more and more younger people in the region creating new private wealth, or inheriting the wealth of parents and grandparents.

The need for investments and wealth planning is therefore rising fast as this disposable wealth proliferates, and as these people – especially the wealthiest and the rising wealthy – focus increasingly on obtaining and executing a far more professional and organised approach to retirement and for wealth and estate planning.

In terms of engagement, there are many different forms of communication required, from secure email to chatting to browsing, sharing screens, all of which allow seamless and very easy and high-quality communication with an advisor. Clients in the region are building their financial knowledge, but many need good levels of support, for their planning and decisions, and ensuring high grade, seamless communication to actually stimulate sales and supporting the clients is an essential part of the equation.

It is vital also to enhance the ability to communicate with dedicated relationship managers, in the hybrid journey protocol, thereby facilitating the transition from a self-service journey to a hybrid journey, or the other way around, enabling the relationship managers to reach out to the client.

We have focused here largely on the USX, in other words, what the wealth management industry must achieve in its overall professional development and in its digital journey to retain and win the broadest range of clients in the region. But of course, there are numerous areas of any operation that remain unseen to the clients, but where the banks and other providers can achieve great efficiencies, cost savings and other advantages that will set them on the right course ahead.

It is now up to the Middle East wealth management industry to embrace the need for such journeys and to prepare themselves for what appears likely to be a highly robust and also increasingly competitive market in the years ahead.