A blueprint for omni-channel services — blending human and digital advice to enhance client interaction, operational efficiency and profit

Executive summary

- Wealth managers have no choice but to adapt and modernize if they want to survive — and thrive — over the coming decade when the industry is expected to undergo far-reaching changes to business models and delivery channels.

- “More of the same” is likely to prove insufficient and inadequate for wealth management success in the face of evolving client preferences and growing competition from incumbents and disruptors alike. Instead, a more radical approach is needed to build on existing capabilities.

- With slower economic growth and the looming global downturn adding to the challenging business environment, forward-looking organizations will be those firms that follow a clear set of ready-to-implement action items.

- At the same time, there is an increasing urgency to enhance operational efficiency amid the pressures of changing client expectations and demands from shareholders for top-line growth, yet rising compliance costs and a shortage of affordable talent create their own drag.

- In light of the various challenges confronting the industry as a whole, and individual firms and practitioners directly, we propose an actionable blueprint for hybrid wealth management.

- This is based on a new operating and sourcing model that requires minimal change in legacy systems, but can simultaneously meet client expectations, boost top-line growth through value-for money services, and increase operational efficiency.

- Ultimately, this will drive the provision of omni-channel services which, in turn, will take client experience to a new level via a blend of human and digital collaboration.

1. A call-to-action for wealth managers

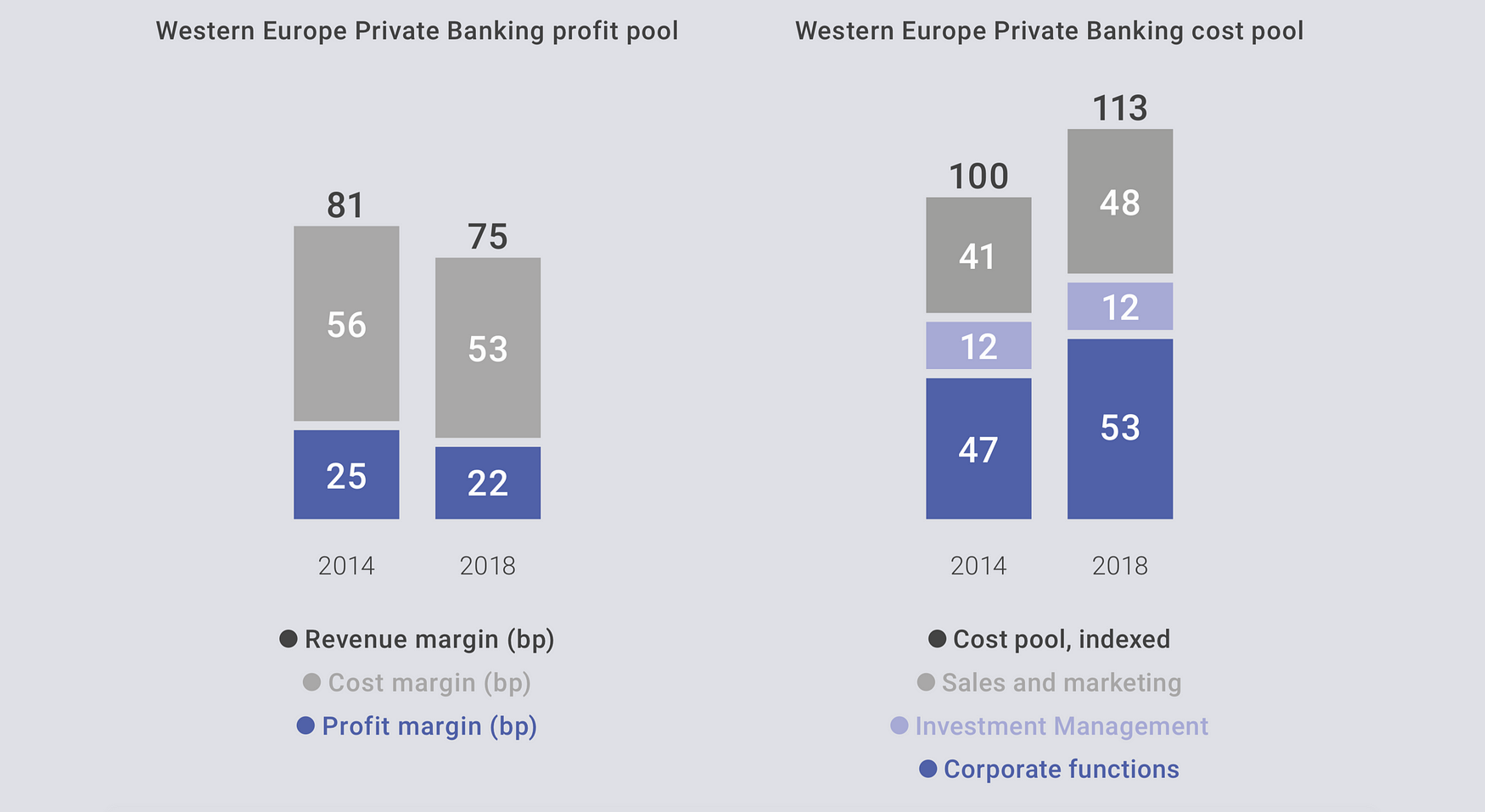

Shrinking revenue and declining margins, yet higher operating and business costs, have become synonymous with private banking. This trend has come to define conversations about profitability in private banking globally over the past five years, especially in Western Europe.

To make matters worse, overall costs have increased in parallel — across functions such as sales and marketing, compliance and operational risk, and the middle and back offices.

Many wealth management firms face a “perfect storm” scenario.

This “perfect storm” for most wealth management firms has led to a tightening of any non-essential spending. In a recent study, McKinsey & Inc revealed that the share of IT spending on innovative areas differs significantly between incumbent banks and fintechs. While banks allocate just 35% of IT budgets to innovation, this figure rises to 70% for Fintechs which benefit from not having the same legacy IT issues.

The current late stage of the economic cycle is compounded by continued uncertainty and volatility, plus concerns that slowing global growth will trigger recessionary times. None of this bodes well for efforts to try to reverse the sluggish (net new) asset growth that has for several years struggled to keep pace with growth in nominal GDP.

Reshaping mind-sets

With these types of big-picture challenges characterizing the wealth management industry across different geographies, business leaders are questioning whether the traditional “improvement” programs will yield any sustainable remedy to the current situation.

Several solutions are frequently discussed as potential ways to address shortcomings within wealth management. Yet these seem inadequate given the way the world is changing. For example:

- Potential solution: Improve the client experience to grow revenue, by reaching a larger customer base and/or increasing share of wallet.

- Shortcoming: While client focus is central to any value proposition, this may not be enough to achieve the desired impact on the bottom-line. Efforts that focus solely on improving the experience risk creating unsatisfactory and non-sustainable results. For instance, higher levels of client satisfaction need to be channeled towards sales, which require support from the entire organization. At the same time, growing the customer base is easier said than done — it relies on the people, processes and systems to tap into new segments and offer new, targeted products and services.

- Potential solution: Increase productivity by using modular “utilities”.

- Shortcoming: This approach is borrowed from other industries, such as the automotive sector. Although this type of approach has led to some efficiency improvements when applied to financial services over the past two decades, the wealth management sector must adapt its underlying operating and sourcing models to realize gains, not just persevere with what exists already. With so many legacy IT processes and systems, the results to date of adopting modularization have generally led to limited benefits at disproportionately high costs.

- Potential solution: Enhance risk management systems with powerful analytics.

- Shortcoming: Many financial services institutions have invested heavily in this area, especially in more recent years, with the intention of monitoring (or even controlling) business activities. Yet results have been mixed. Today’s web of digital networks and vast amounts of data add further complication — on one hand, the cost of acquiring, storing and processing information has fallen significantly; on the other, firms face a strategic challenge in consolidating and analysing all this data to make insights meaningful and actionable, and in a way that proves a clear economic benefit from data analytics in the form, for example, of greater customer loyalty and demand for additional products and services. Then there is the implementation and outcome of these actions, requiring yet more monitoring.

These are a few examples that highlight why making short-term, patchwork-style “fixes” to core problems are a route to failure for modern wealth management. It is time to look beyond cosmetic cover-ups that are essentially “more of the same”. Instead, fundamental changes are critical to encompass new operating and sourcing models within financial services.

Against this backdrop, the case for the hybrid wealth manager is compelling: omni-channel delivery of products and services within a flexible ecosystem incorporating a mix of providers and partners.

Less revenue, thinner margins and higher costs: an ever-louder wake-up call for wealth managers.

How profit pools have evolved (2014 to 2018) despite growing AuM. Source: McKinsey Private Banking Survey 2019, additiv analysis

2. Your clients: meet their expectations — or lose them

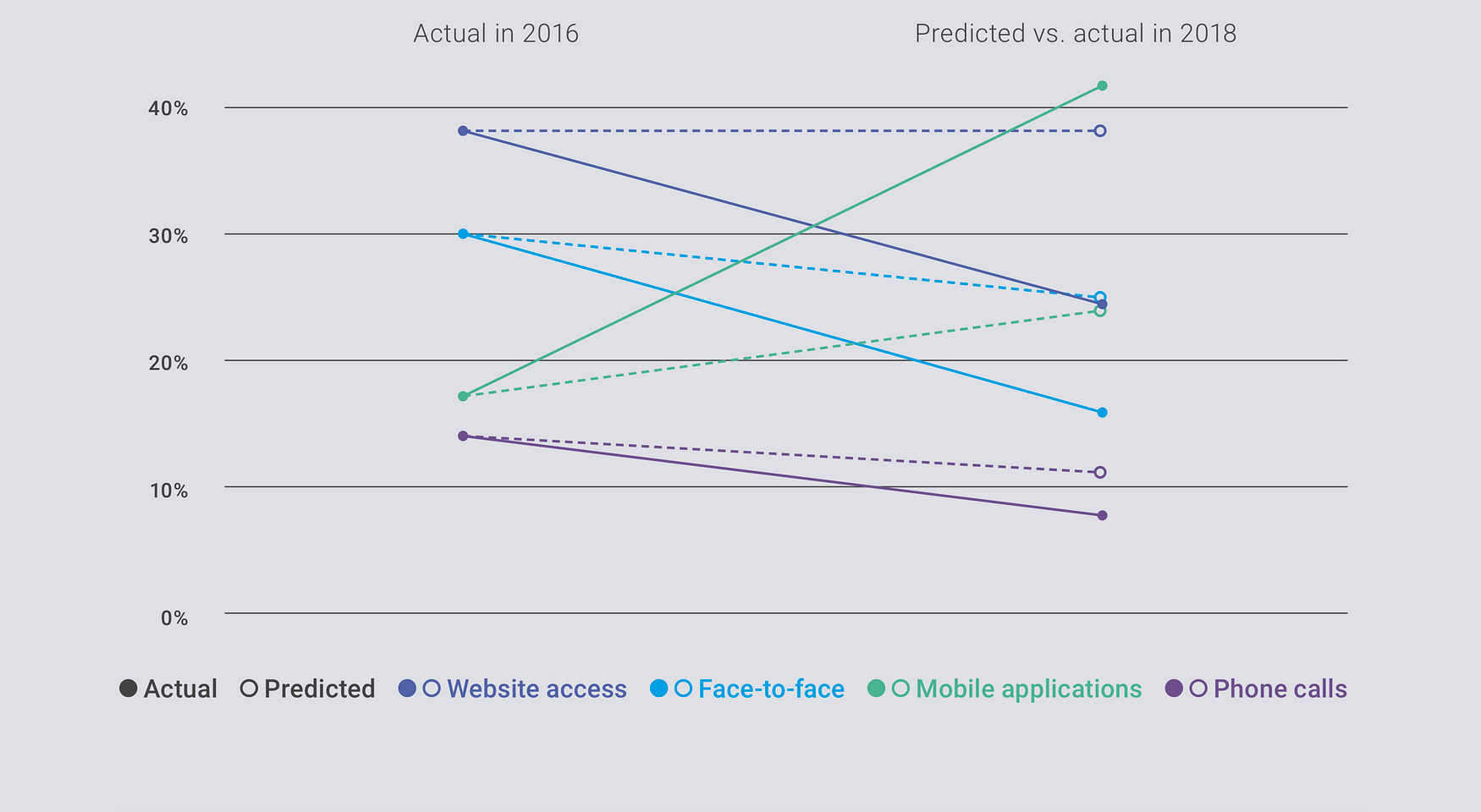

Digital innovation is transforming wealth management quicker than anyone expected. Recent studies show that market players are underestimating the speed of digitally led change. While regulatory pressures for new approaches have eased somewhat, client expectations and preferences are evolving faster than ever before.

As a result, wealth management organizations need to shift their attention away from internal challenges (such as regulation and compliance) towards external forces, led by clients.

Clients increasingly demand omni-channel experiences.

EY’s latest Global Wealth Management Research report, for example, provides two notable findings in relation to this broad trend:

- Rising demand for mobile access — in line with the continuing increase in the use of digital channels, the choice of channel is changing. Clients are moving away from website access to mobile applications, and this is happening on a scale and at a pace that firms didn’t predict.

- Blended advice based on client needs — while human interaction (face-to-face and phone contact) has reduced, it remains an important channel for many clients. In particular, this is the case when it comes to more complex topics such as longer- term wealth structuring and planning, or more tailored investment strategies. “Simpler” activities such as straightforward transactions or basic information requests are the main areas where digital, self-directed channels have taken the lead.

Although these are general observations, we have found from our experience and interactions with many wealth managers and business partners that they are true across various countries on different continents.

Keeping up with what clients want

As client expectations of their wealth managers evolve, there are three key areas in which we see consensus:

- Clients increasingly demand an omni-channel user experience.

- Clients are seeking an extended offering to address their broader needs.

- Clients are looking for “anywhere, anytime” services

Shifts in channel usage are happening faster than most wealth managers expected.

Source: 2019 EY Global Wealth Management Research Report, additiv analysis

- An omni-channel user experience — both in terms of advisory interaction and client services, clients prefer a blended offering rather than either a digital-only business model or an exclusively face-to-face offering. In developed markets, in particular, customer journeys need to involve a seamless handover in a consistent way across all channels: client-only, joint, and advisor-only. A recent BCG report, titled “Retail Banking Distribution 2025: Up Close and Personal”, reinforces this re- quirement for a wealth manager’s processes to support multiple channel journeys. The study pinpointed the capability to implement the intelligent routing of customer requests between digital and assisted (human) channels as a key lever in meeting client expectations.

- An extended offering for wide-ranging needs — clients increasingly want, and expect, to address different but related needs via a one-stop offering. As a result, they are looking to interact within an ecosystem that combines services for wealth accumulation, financial and pension planning, and financing and liquidity needs.

This would be far more likely to satisfy their needs while enabling the wealth man- ager that has such capabilities to cross-sell plus benefit from efficiency gains. - Anywhere, anytime — exponential growth in the use of mobile and other electronic devices has made clients accustomed to instant access to the latest information. As a result, wealth managers need to ensure they can provide relevant data and updates instantly upon request — ranging from market views to portfolio data to customised research and communications.

Armed with a better and deeper understanding of what existing and prospective clients want in terms of information and services, along with format and delivery preferences, wealth management firms must meet their expectations.

To make this manageable and sustainable, the ability to customize the preparation of portfolio and investment updates, for example, should be embedded in internal processes and systems to the extent that it does not require additional manual work by an advisor or any other staff member.

In short, wealth management firms need to meet client expectations of better value-for-money by ensuring solutions are segment-specific, transparent and individually tailored. Accurate and personalized information should be the norm.

3. New services to drive top-line growth

Positive market performance over the past decade has masked some of the shortcomings within wealth management models. Rising stock market valuations during the past 10 years have helped mitigate the impact of pressure on wealth management revenue to some extent, but banks can no longer rely on this.

They need to redefine their client value propositions to protect existing revenue pools, as well as to try to create new ones. In line with this, they need to start charging their clients fees for any parts of their offering where they provide a differentiated or value-added service, rather than giving these away for free.

Wealth managers need to deliver better service at lower cost.

There is an ever pressing need to replace current revenue streams. The emerging client expectations in terms of an omni-channel, wide-ranging, “anywhere, anytime” experience create two important consequences for wealth management firms:

- Transparency and erosion in transaction costs.

- The elimination of information asymmetry and transactional inefficiencies that have in the past justified fees.

Pressure will come from two interrelated forces: clients rightfully requesting added value for the fees they are asked to pay, and banks needing to deliver value-added services to justify these fees.

Five ways to be smarter about change

We believe wealth management firms need to incorporate the following five dimensions into their business model if they want to achieve sustainable top-line growth:

- Embrace an ecosystem of service providers

- Innovate fast

- Explore new client segments

- Improve client interaction via consistent touchpoints

- Develop a systematic approach to cross-selling and up-selling.

Embrace an ecosystem of service providers — use the customer loyalty created by the current value proposition to promote additional offerings that are sourced from third parties. Examples include: integrating new product offerings such as third-party asset managers; additional data analysis for sophisticated risk management; and supplementary market intelligence via research-as-a-service or wealth planning-as-a-service.

Innovate fast — launch products that help clients create more value for their portfolio. Wealth managers need to equip themselves to add new offerings — whether in-house or from third parties — in a plug-and-play manner to the existing operating and service model. By systematically using standardized API frameworks and integration protocols, for example, products and services can be road-tested in a fast and straightforward manner, and then launched quickly across markets and segments at a low marginal cost.

Explore new client segments — when applying a flexible operating and sourcing model, wealth management firms can roll-out new products and services to previously underserved or untapped client segments at lower acquisition and production costs. In turn, this can expand the overall customer base, positioning hybrid wealth management as both an omni-channel and multi-segment proposition.

(Re)defining the value proposition

Each wealth management firm needs to define and develop its value proposition for current and future client segments. A common theme will be the activation of underserved clients and at the same time producing at zero marginal cost.

- Improve client interaction via consistent touchpoints — given the scope of automated analysis of client and portfolio data, coupled with the potential for personalization by digital and self-service channels, it is possible to identify and use relevant touchpoints in more cost-efficient and systematic ways. This can create higher and more meaningful customer satisfaction and, therefore, reduce attrition.

- Develop a systematic approach to cross-selling and up-selling — doing this in a way that is relevant to an individual client will lead to additional perceived value and, by extension, a higher chance to close more deals. For example, automated monitoring, portfolio triggers and alert management enable wealth managers to approach clients with specific topics that are relevant to them. Whenever a client considers such a touchpoint to add value, they will have a greater willingness to engage a wider range of products and services — and to pay for them.

4. Increase operational efficiency — and lower costs

The digitally enhanced wealth management proposition — or hybrid wealth manager — will improve the client experience and generate new business. To offer products and services to clients at an attractive price that can also generate profit, wealth mangers need to overcome the all-pervasive challenge of rising total and factor costs.

We see no other solution than combining two key elements:

- Increasing value for the client

- Reducing cost dramatically.

Advisors remain crucial for delivering value to clients.

To achieve better service at lower prices requires increases in efficiency and productiv- ity via IT — and there is no realistic way to do this other than a Cloud solution. Not only can this help to reduce direct IT costs; it also facilitates a significant reduction in costs when integrating third-party services and providers. Such a partnership-led approach is the way forward in today’s competitive environment. Doing everything in-house has become far too expensive and does not create enough points of difference in terms of products and services.

The solution, therefore, lies in a new operating model with an effective and cost-efficient combination of acquisition, automation and differentiation in service.

Creating value-adding advisors

Although we believe client advisors will remain crucial in acquiring and servicing clients going forward, these advisors need to (re)focus on tasks for which they offer a unique capability. This might include providing “magic moments”, reducing complexity, giving bespoke or high-value advice.

In line with this, wealth management firms need to enable these individuals to spend less time on low-value administrative tasks in favour of operating more efficiently to bring value to clients. Some of the ways to do this include:

- Provide advisors with all relevant client and portfolio data at their fingertips.

- Reduce client meeting preparation time.

- Enable a digitally augmented dialogue between clients and the advisor.

- Install end-to-end processes to minimize post-meeting workloads.

- Help advisors monitor and analyse client portfolios via consolidated views.

- Provide full transparency over advisors’ meetings and other tasks so that line man-agers can more effectively manage resources.

It is becoming ever-clearer that a hybrid wealth manager working within an omni-channel service architecture can solve two problems at once:

- Give clients more choice

- Offer clients more services and a better experience at low, or zero, marginal cost.

Examples of added-value services that hybrid wealth managers can deliver to clients:

- Detailed and transparent portfolio monitoring — anytime, anywhere

- Access to financial markets at affordable (ie. lower) prices

- Holistic views across multiple portfolios, bancassurance and non-bankable assets

- Integration of reward programs and loans as part of a self-service journey

- Customized, needs-based alerts, research and switch offers in an automated way.

Creating a win-win in wealth management

For wealth managers, the potential of automation in the middle and back offices is a win-win for advisors and clients: increased service quality at substantially lower cost. With real-time straight-through processing enabling tasks and requests to be done ‘right now’, clients will value this enhanced service.

Working within existing limits

Inevitably, there are challenges to implementing such change. One of the biggest hurdles is the all-too-common — and relatively clumsy — core banking system.

These systems are often based on outdated technology and were not designed with real-time, omni-channel interactions in mind. They are more akin to ‘systems of records’.

However, they can still work perfectly well in today’s more demanding and digitally oriented world if a new layer is added: a ‘system of intelligence’. This integration layer deals with all client-related tasks and processes by holistically including CRM, portfolio management, advisory processes, document management, analytics and reporting.

The result is the creation and execution on a single operating platform — one that brings together the capabilities of various existing systems while redesigning internal and client-related processes in an automated and integrated manner. If done well, it encompasses data-driven processes with predictive models applied in real time.

5. Adapting to a new model

Nobody denies the need nor the drivers for change but initiating this within existing operating models presents a unique challenge for each firm.

Our experience and conversations with wealth management firms and other industry partners globally has taught us there are two pre-requisites for a successful transformation:

- The technology that supports flexible operating and sourcing models.

- An internal culture that embraces change as an opportunity — especially within the front office.

In line with this, defining and developing a ‘system of intelligence’ as an overlay to a core banking platform should involve the following to be effective:

- It should be a Cloud-based solution, even if restrictions require an on-site solution initially. The Cloud helps to reduce both running and development costs, plus facili- tates more flexible and faster integration of third parties

- There should be a strong focus on a modern API architecture (such as RESTful) to achieve the required flexibility. This is important given the objective to integrate and combine functional modules in today’s systems, as well as in any platform that a future partner may have

- Third parties should be chosen based on these firms having already moved up the learning curve, so they can contribute from their experience and know-how

- All partners need to have a mind-set of collaboration where they embrace the con- cept of working within an ecosystem.

- The system needs to use the right type of technology that focuses on implementing the firm’s processes to get the job done.

It’s a journey, not a project

However, as part of achieving these goals, there are several critical components of success that wealth management firms must embrace to achieve a successful transformation. These include:

- Don’t position a change program as a reorganization or cost-cutting exercise but rather as a journey with a positive experience.

- Be fast in the initial implementation and start to live in this new model as quickly as possible.

- Test and learn; nobody can know it all, so use continuous feedback loops to improve competitiveness, client benefits and efficiencies.