In the words of Barak Obama

“We are the first generation to feel the effect of climate change and the last generation who can do something about it”.

And no-one feels more passionate about this sentiment than Millennials and older GenZs.

Making up an audience of over 3 billion[1], this population is different to traditional high net wealth individuals. It’s a segment that usually prefers brands to be more aligned with their personal values[2]. And expects to access these brands online, 24/7, tending to only respond to messages that resonate with their current needs. As a result, offering tailored environmental, social and governance (ESG) investments represents an opportunity for brands – financials or non-financials alike.

Making the ‘arm-chair investor’ accessible

Digitization is bringing personalized wealth management solutions to this electronically savvy consumer segment. With their interest in ESG, we’ve recently seen these new mass market investors easily and cheaply investing via online trading platforms from the comfort of their own home. Fortune Market Insight valued these online platforms at growing from $8.59 billion (2021) to reach $12.16 billion by 2028 at a CAGR of 5.1% within their recent market research report. And yet, accessing this market has been a challenge; limited to the likes of stand-alone platforms such as Robinhood and eToro plus a few banks who had built their own platform. That was until brands started to utilize financial orchestration platforms.

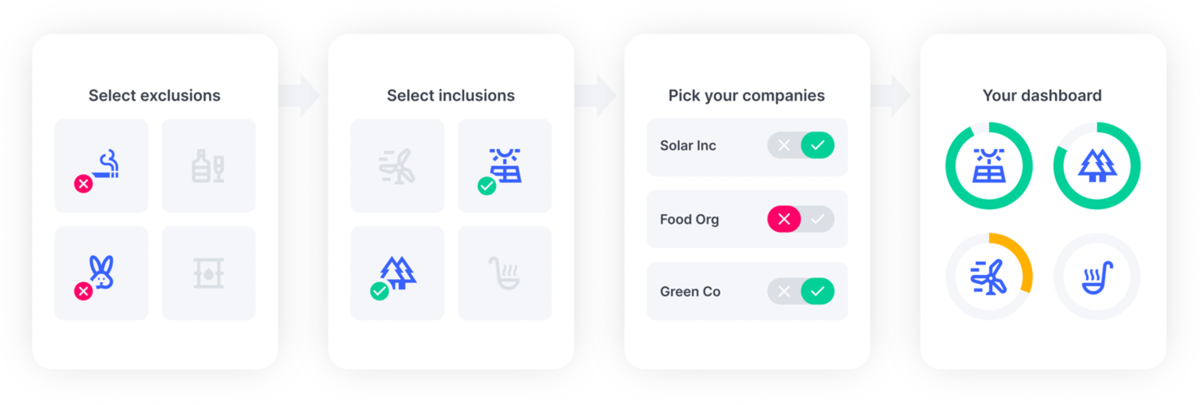

Brands (financial or non-financial) can now serve anyone wanting to invest from anywhere (‘arm-chair investors’) by offering embedded financial services. Often referred to as embedded wealth, and enabled via orchestration platforms, brands facilitate communication between all parties, enabling consumers to access highly personalized investment services at their point of context. In essence the opportunity to invest comes to the consumer rather than the consumer having to search out and go through extensive identification and verification processes.[1]

The ESG Investment opportunity for digital banks

Often referred to as neobanks or challenger banks, these predominantly online banks can enter wealth and launch new products in much shorter cycles and thus remain more agile to respond to market needs quicker. However, they are not without their own challenges; particularly when it comes to customer profitability and retention. As a result, they are continually looking for new, personalized solutions that will appeal to their digitally savvy customer demographic, particularly ESG related solutions.

Embedded wealth is enabling these digital banks to offer just this. Through orchestration platforms, digital banks can now offer their customers regulated investment products, via self-service or advice based investment channels without the need for cumbersome or costly implementation. And once embedded, the value is instantly realized by banks when accompanied by sustainability data and capabilities from ESG related partners connected to the platform.

Personalized, appropriate ESG investing

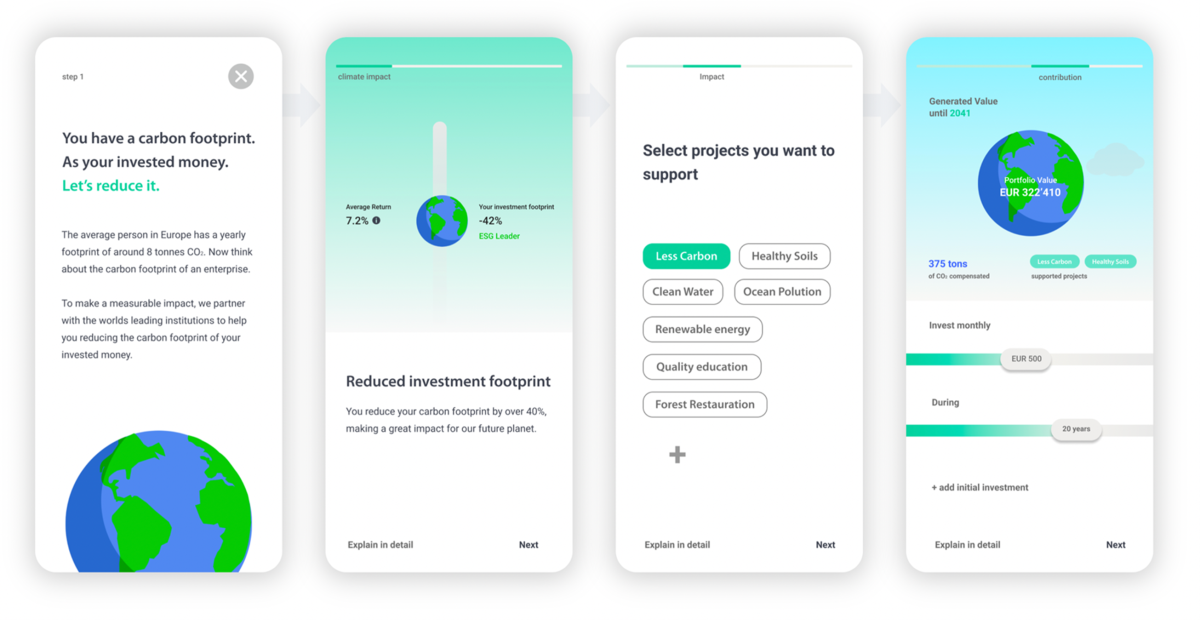

With investment products offered in conjunction with sustainability tools, digital banking customers can select the projects that they want to support according to their personal values as well as understand the benefits that their investment can really have on a dedicated goal. They can also select investments based on carbon reduction and neutralization focus. A word of caution – the outcome is as good as currently available data. Nevertheless, even if some data quality can be questioned, the trend is clear. In essence, it records investors’ values and preferences, provides engagement content on both their financial and sustainability goals, all while screening unfit instruments.

With this approach, banks can ensure that their investment customers can track the financial and material ESG performance of their assets in a intuitive way. For example, at additiv, our partner network allows for donations to projects that serve the investors’ sustainability goals, particularly offsetting the carbon footprint of the investments.

Overcoming ESG regulation hurdles

The last few years has seen a raft of regulation related to investment services, particularly ESG, coming out of the EU, with the potential to dramatically change the landscape of sustainable investing in Europe. For some, this creates a barrier to entry, but this potential hurdle for digital banks and other brands, is overcome by embedding a regulated partner and ESG specialist.

ESG investing for the masses

Offering ESG related services within a brand is essential if they are to flourish and gain consumer relevance. With a demographic more likely to use a brand that supports social causes, in offering ESG related solutions, these brands are supporting social responsibility. Made easy by embedded wealth, enabling the introduction of ‘ethical’ digital consumer products such as green investing.

When partnered with an orchestrated finance platform, ESG partner’s technology can be accessed by financial and non-financial brands who embed investment services to offer greater appeal and increased customer value. Services can be tightly integrated into an existing journey or offered standalone.

Ultimately, with the right digital platforms, brands can now offer investment to the masses to prosper and serve their clients best interest. ESG tools and services must be at the forefront of their investment offering – increasing appeal and ultimately ensure benefit to all – after all, this is likely to be our last chance.

[1] Financesonline research: 113 Key Generation Z Statistics 2021/2022 - Characteristics & Facts You Should Know + MSCI - How Millennials Consume Character Trait or Economic Reaction? [2] THE DELOITTE GLOBAL 2022 GEN Z & MILLENNIAL SURVEY (Sept 2022)