It’s been over 20 years since the founder of Apple, Steve Jobs said “Get closer than ever to your customers. So close that you tell them what they need well before they realize it themselves”, and yet the message is more important than ever before; especially in the world of investment.

The power of digitalization is bringing personalized wealth management solutions to a new segment of investors; the mass market. Often made up of GenZ’s and Millennials, this digitally savvy consumer segment prefers brands to be aligned with their personal values. As a result, offering tailored environmental, social and corporate governance (ESG) investments to support these interests represents a huge opportunity for a range of complimentary financial and non-financial platforms, including retail banks. However, without the right technology to offer the right investment product at the right time, reaching this audience is impossible.

Accessing the ‘arm-chair investor’ opportunity

With their interest in ESG, we’ve recently seen these new mass market investors easily and cheaply investing via online trading platforms from the comfort of their own home. According to a recent market research report by Fortune Market Insight, these online platforms were already valued at being worth $8.59 billion in 2021 and are expected to reach $12.16 billion by 2028 at a CAGR of 5.1%. And yet, the opportunity to access this market has been limited to the likes of stand-alone platforms such as Robinhood and eToro and a few banks who had (often painfully) built their own platform. That is until the recent emergence of Wealth Management-as-a-Service (WmaaS) platforms.

These new platforms can actually be embedded into any financial or non-financial platform. Enabled via APIs facilitating communication between all parties, they enable consumers to access highly personalized investment services at their point of need (referred to as embedded wealth). In essence the opportunity to invest comes to the consumer rather than the consumer having to search out and go through extensive identification and verification processes. And this is particularly appealing to the new digital banks that have emerged over the last few years.

The ESG investment appeal to digital banks

Often referred to as neobanks or challenger banks, these predominantly online banks can launch new products in much shorter cycles and thus remain more agile to respond to market needs quicker. However, they are not without their own challenges; particularly when it comes to customer profitability and retention. As a result, they are continually looking for new, personalized solutions that will appeal to their digitally savvy customer demographic, particularly ESG related solutions.

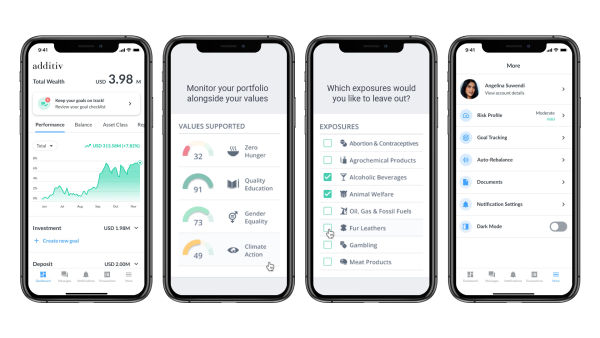

Embedded wealth is enabling these digital banks to offer just this. Through WmaaS platforms, such as additiv’s orchestration platform, digital banks can now offer their customers regulated investment products, via self-service or advice based investment channels without the need for cumbersome or costly implementation. And once embedded, the value is instantly realized by banks when accompanied by sustainability data and capabilities from ClarityAI that analyze and assess the impact of investing on a personal level appealing to their customer demographic.

A catalyst for ESG investment transparency

With investment products offered in conjunction with sustainability tools from Clarity AI, digital banking customers can select the projects that they want to support according to their personal values and understand the benefits that that investment can really have on that project. And they can also select investments based on carbon reduction and neutralization focus. In essence, it records investors’ values and preferences, provides engagement content on both their financial and sustainability goals, all while screening unfit instruments.

Source: additiv Impact Investing with Clarity AI

With this approach, banks can ensure that their investment customers can track the financial and material ESG performance of their assets in a clear way. For example, at additiv, our partner network allows for donations to NGOs or projects that serve the investors’ sustainability goals, particularly offsetting carbon footprint of the investments.

Avoiding ESG regulation challenges

The last few years has seen a raft of regulation related to investment services and particularly ESG coming out of the EU, with the potential to dramatically change the landscape of sustainable investing in Europe. However, the potential hurdle related to offering investment services is overcome by embedding a regulated partner and ESG specialist.

ESG investing for all

There is no doubt that offering ESG services within a digital banks range is a given. Their demographic is more likely to use a brand that supports social efforts they identify with. These banks are harnessing this socially responsible ideology by introducing ‘ethical’ digital consumer products such as green investing. Embedded wealth is enabling this.

When partnered with a WmaaS platform like additiv DFS, Clarity AI’s technology can be accessed by financial and non-financial platforms who embed investment services to offer greater appeal and increased customer value. additiv’s WmaaS platform, DFS, allows brands to easily embed wealth management into their offering. Services can be tightly integrated into an existing journey or offered standalone.

The platform connects brands with additiv’s regulated and fintech ecosystem partners, including Clarity AI, through a Banking-as-a-Service (BaaS) model, to deliver the end-to-end customer journey and fulfillment. And for regulated BaaS providers, offering Clarity AI’s technology increases the appeal of their products, further extending their reach and addressable market.

So, wealth management is no longer for the elite. Now, via digital platforms, such as additiv DFS, digital banks can offer it to the masses, adding ESG tools and services to increase appeal and ultimately ensure benefit to all – isn’t that what ESG is all about?