This is a short version of a broader thought-leadership paper launched 10th of Feb 2020, at the EFMA World Retail Banking Summit 2020, event which is proudly sponsored by additiv. To read the full paper please access it on our website.

Executive summary

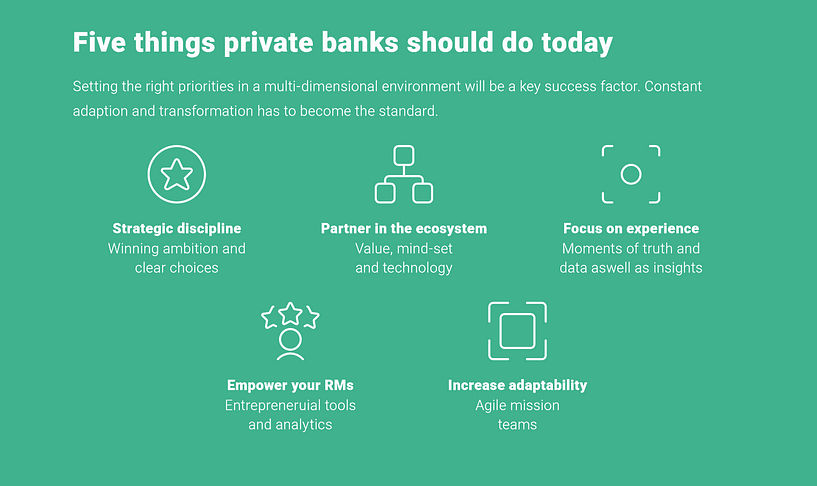

Now is the time for digital action — Although financial institutions have been talking about digitizing wealth management for several years, this has now become a strategic priority if they want to be able to show net revenue growth going forward. While the requirements of clients are relatively straightforward, digital solutions will change the way wealth managers meet these needs. This makes it critical for industry players to be able to prove their value-add via a level of automation they haven’t been able to achieve before.

Respond to evolving client needs — Given that the expectations of the next generation of clients are driven by their experiences with online retail offerings, wealth management providers need to deliver far greater levels of digital proficiency. Availability anytime, anywhere, as well as speed, ease of use, transparency and seamless omni-channel services and fair pricing are key success factors in today’s landscape.

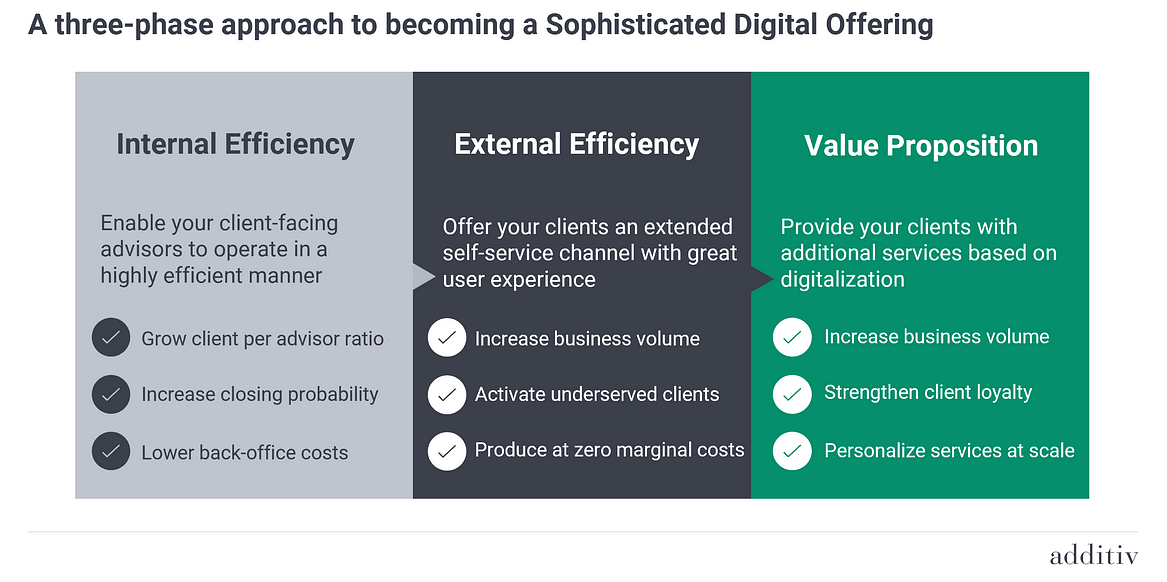

Augment the role of client advisors — Client advisors will continue to play an important role in managing the overall client relationship in this new world of wealth management, combining the human touch with technology as an enabler to offer more customized and relevant solutions directly to individual clients. The digitization journey therefore needs to start by optimizing the processes of the most effective and productive client advisors — with the dual goal of improving time-to-market and customer experience. Wealth management firms also need to reduce the administrative workload of advisors by giving clients more control and functionality to be self-directed.

Turn higher value-add into more revenue — Once wealth management firms have implemented both internal and external efficiency measures, client advisors will be able to focus more time on maintaining close client contact. In turn, this should lead to more frequent discussions about other potential solutions that create greater revenue streams.

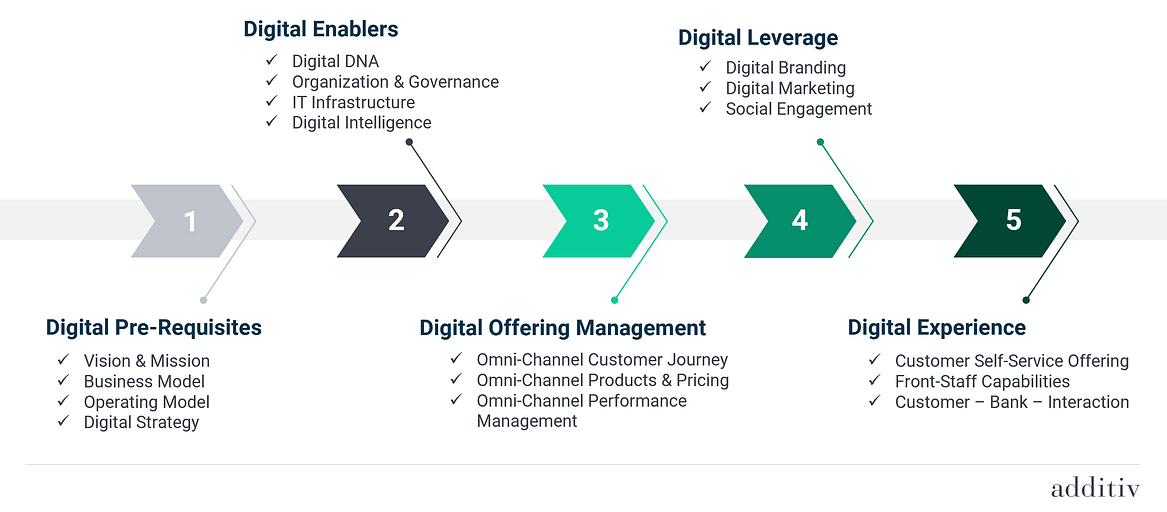

Get prepared to go digital — The success of digital transformation in wealth management is only possible if firms are ‘ready’ for it. Being prepared starts internally with a top-down process that crafts the ‘digital vision’. From here, suitable business and operational models are defined and formulated into the digital strategy.

The common approaches to digital today

The wealth management industry is faced with challenges such as intense competition, fee compression, low or negative interest rates, stricter regulations and evolving customer needs. As a result, cost-income ratios have increased for many financial institutions as high as 80%.

In a slow revenue growth environment, banks have to rethink their strategy. In order to control the bottom line, banks have to cut their expenses. The only way to do this effectively is to swap labour with technology. For the first time technology is ready and clients are ready for technology.

Although the digitization of the wealth management industry is not a new development, many financial institutions are realizing only now that they must address this topic with high priority to show again a net revenue growth in the future.

Automation goes together with standardisation. Services and solutions which are highly customised are commercially not interesting for digitization although nowadays software systems are allowing deviations within a given process.

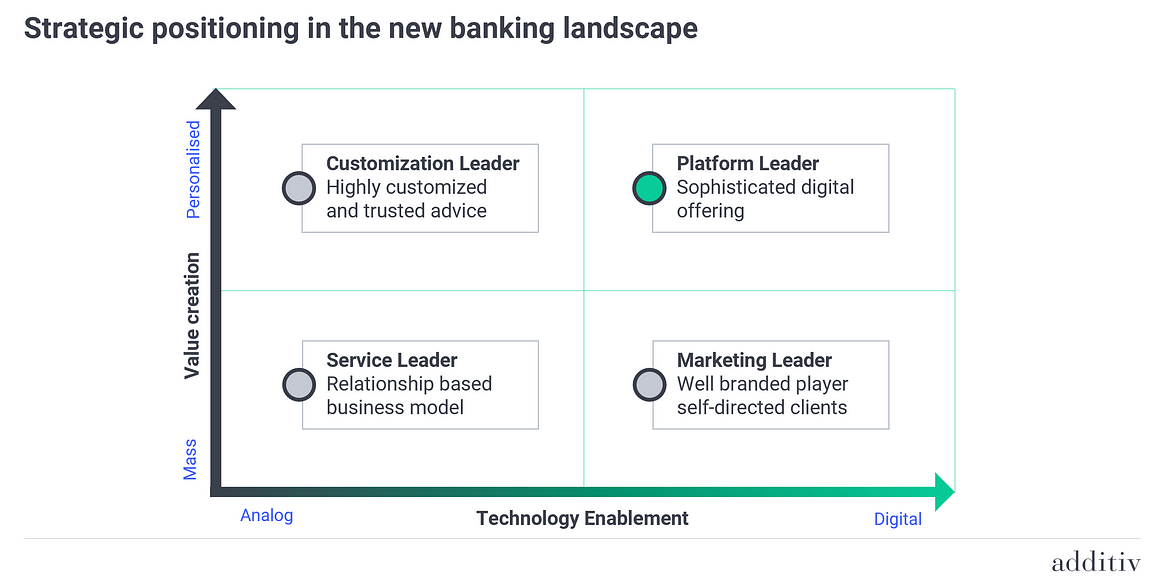

A clear strategic positioning in terms of value creation (narrow versus wide service offering) and the level of automation (machine versus people led) is of utmost importance. We are distinguishing between 4 main strategic scenarios.

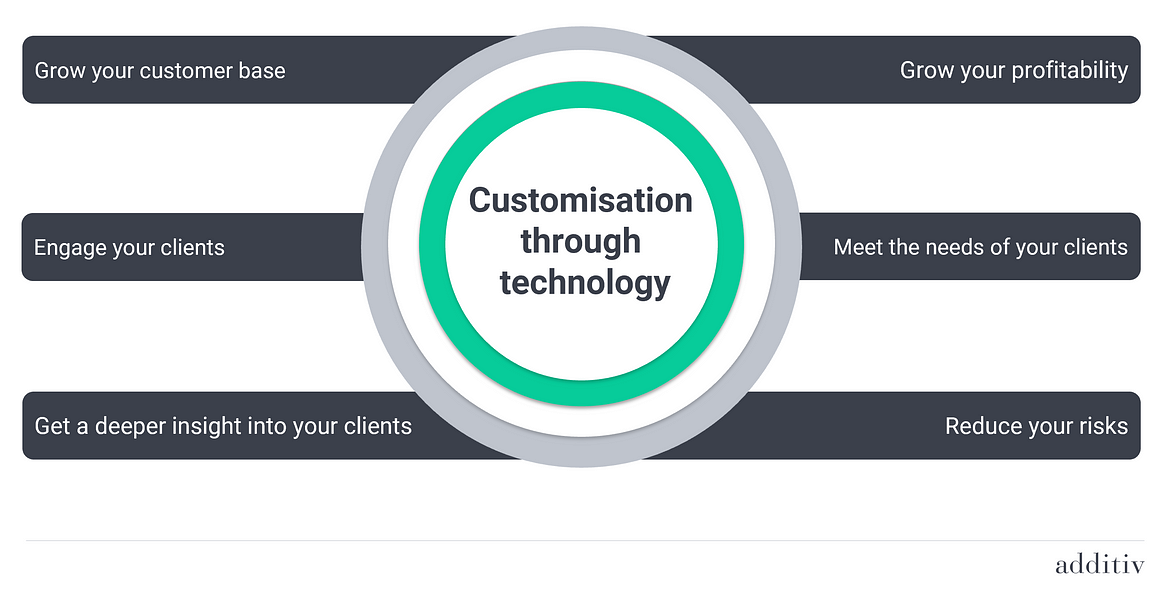

Customization through technology

There is no doubt that client advisors will continue to play an important role within all types of wealth management propositions in managing the overall client relationship. However, technology will play an ever-more critical role as an enabler for wealth management firms to offer highly customized solutions directly to clients at lower marginal costs. Helping to fuel this further, the automated analysis of structured and unstructured client data will allow banks to increasingly personalize the solutions according to specific client needs.

It is important to clarify that digitization doesn’t mean standardization. To the contrary, it is about engaging clients on a personal level and delivering additional, tailored products and services.

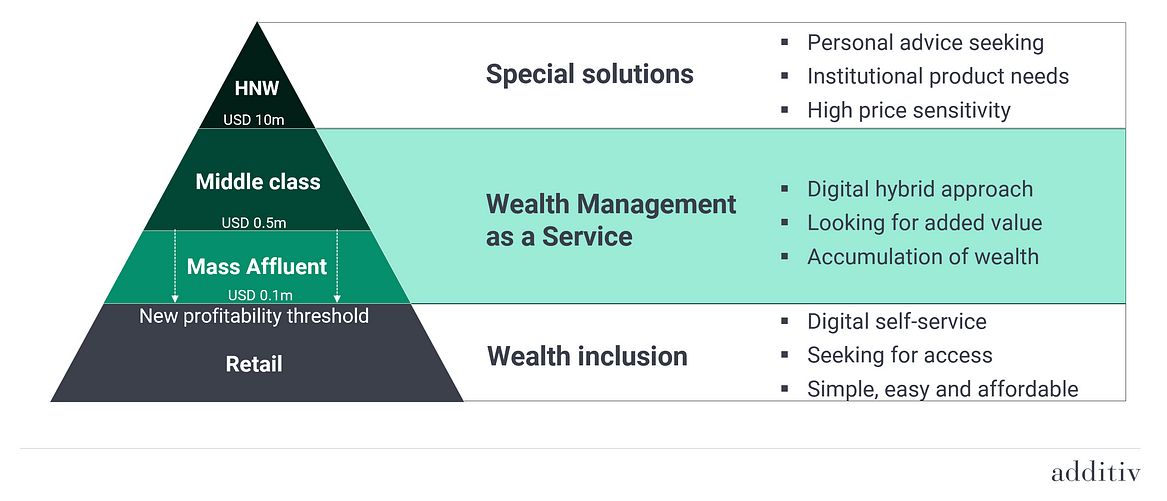

Winning next-generation and new middle class

In more developed and established wealth management markets, such as Europe, clients tend to be older. The median client age is roughly 60 years old. Further, until recent years, most of these clients had relatively straightforward needs, especially with regards to any offshore banking. This has led to next-generation clients often being neglected, with their needs not generally considered.

As a result, there has been minimal attention paid to the various behavioural differences between the generations. For example, while the first-generation wealthy typically seek more personal attention, their children are looking for greater efficiency, fairer pricing and outperformance.

Further we are observing a shifting landscape and mindset in all the emerging markets. There is a rising middle class of young professional who have embedded online services in their daily life. The expectations are driven by their experiences with online retail channels.

The 3-phase model

Unfortunately, there is no “one size fits all” solution. The key success drivers of the actual business model have to be analyzed very carefully before a digital journey can be defined.

If you don’t have a viable sourcing channel for new clients today, it is a wrong assumption that a digital journey will solve this problem. On the other hand, if you are gifted with a high number of existing clients, ideally using already some digital services, it is very likely that an additional digital offer will receive great acceptance. Further we don’t recommend to change the distribution channel drastically. If your clients are used to a high service level and to personal interaction with an advisor it is the right approach to introduce a digital journey gradually with the support of the client advisor.

How to Transform Your Organization

Digital transformation is only successful if digital readiness is prepared very diligently. This must start internally within a top-down process. From the digital vision a suitable business and operational model must be defined with leads to the digital strategy of a financial institution.

Internal Transformation: #1 Digital Pre-requisites + #2 Digital enablers | External transformation: #3 Digital Offering Management + #4 Digital Leverage + #5 Digital Experience

Closing remarks

Digital readiness from clients is increasing in today’s world very rapidly. Client behavioural patterns we see today in online retail will find their way into financial service industry. For payment services and pure brokerage this development has taken place already to a very large extend.

The question is why this has not happened yet in the wealth management business? The answer is probably simple, except for some big U.S. players the digital offering for wealth management services has not met the high expectations of these clients yet. Traditional wealth managers were simply to reluctant to change their business models and defining the right IT strategy to move away from their IT legacy system.

On the other hand, SuperApp providers are missing the know-how and required licenses to move very quickly with a superior solution. It will be interesting to see what will be stronger in the future — expertise in wealth management or the digital access to the mass affluent population. To be successful both elements are crucial and must be covered. A key element on the scales will be trust. Wealth management is not a transactional business — it is a long-term relationship between two parties.

But there is no crystal ball needed to predict that this will change now quickly. There is an increasing demand from a growing affluent population. The technical solutions are now available in the market and financial institutions globally have started to develop omni-channel client journey’s. It might still take a while before an affordable access to superior wealth management solutions is the new standard. But we are not speaking decades — we are speaking a few years!