Smarter, faster credit,

Automate the entire credit journey: from origination to servicing, for faster decisions, lower costs, and greater flexibility across every channel.

A single platform. addCredit.

Simplify lending across products, models, and channels. From mortgages and consumer loans to SME and Lombard, you can launch, automate, and scale credit services, all from a single platform.

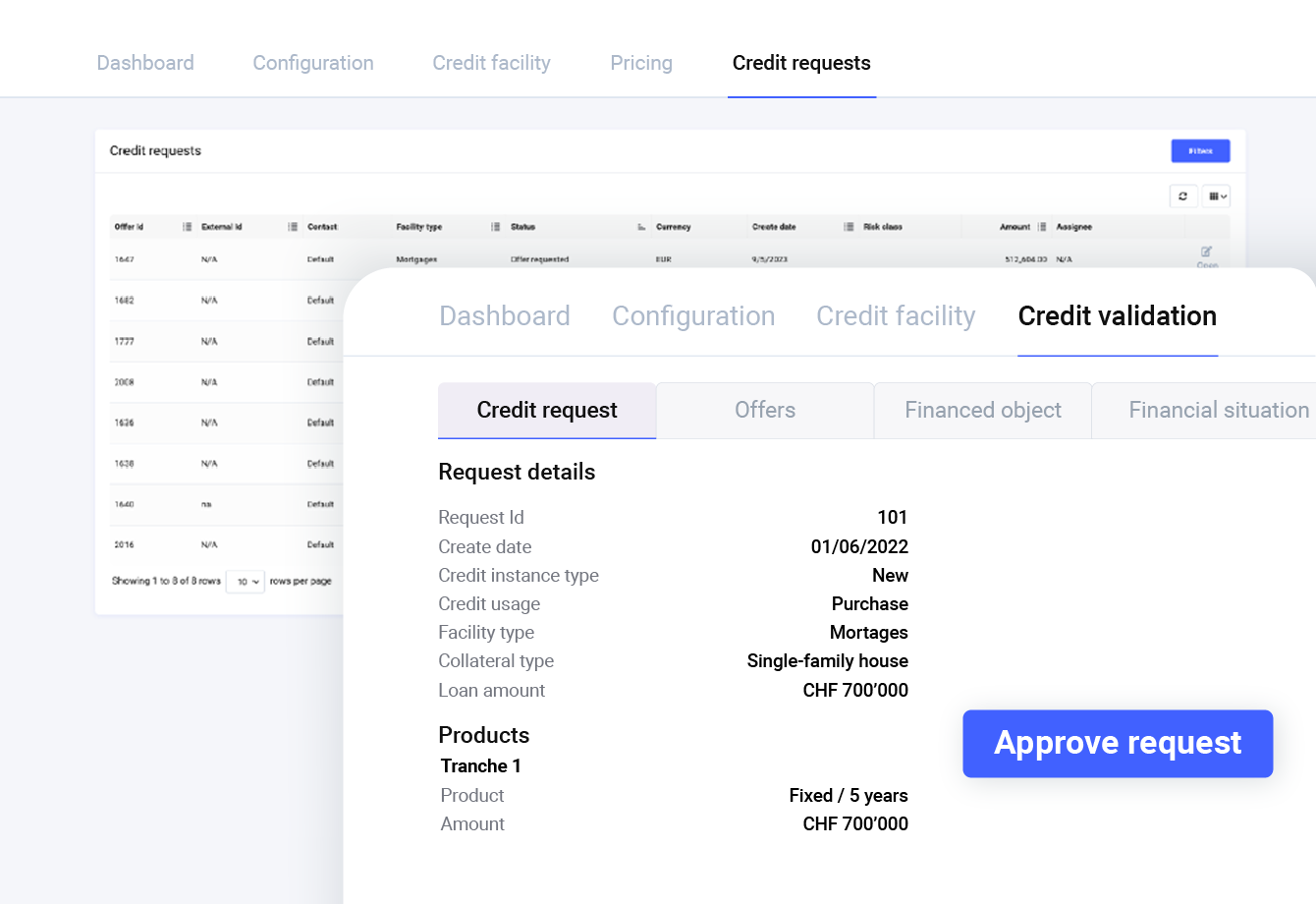

Automate everything from origination and documentation to decisioning and servicing — enabling rapid approvals, straight-through processing, and full auditability.

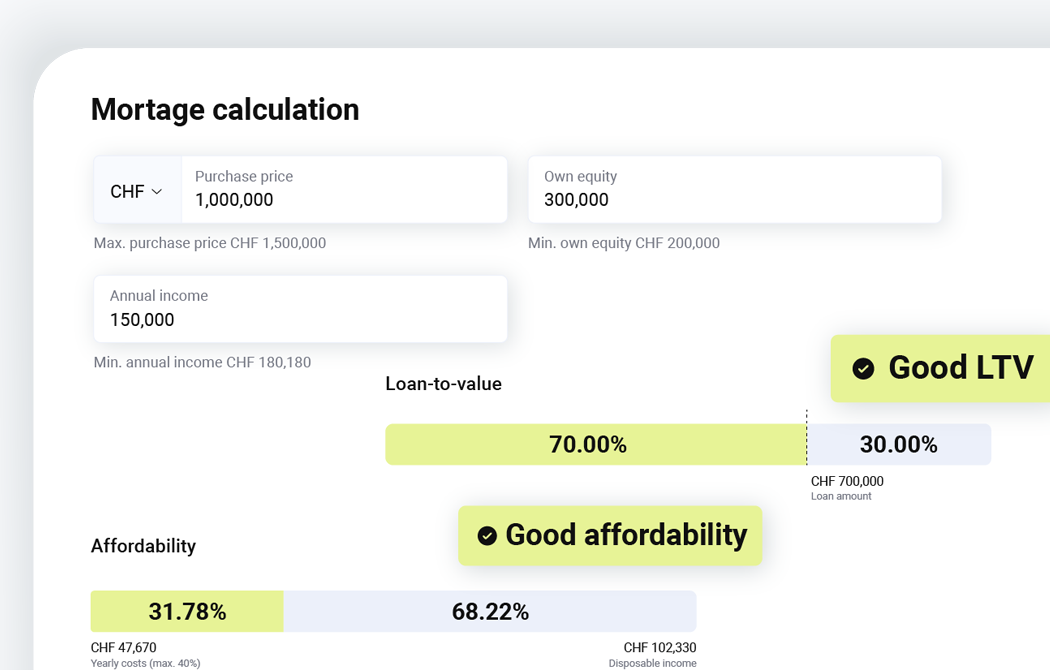

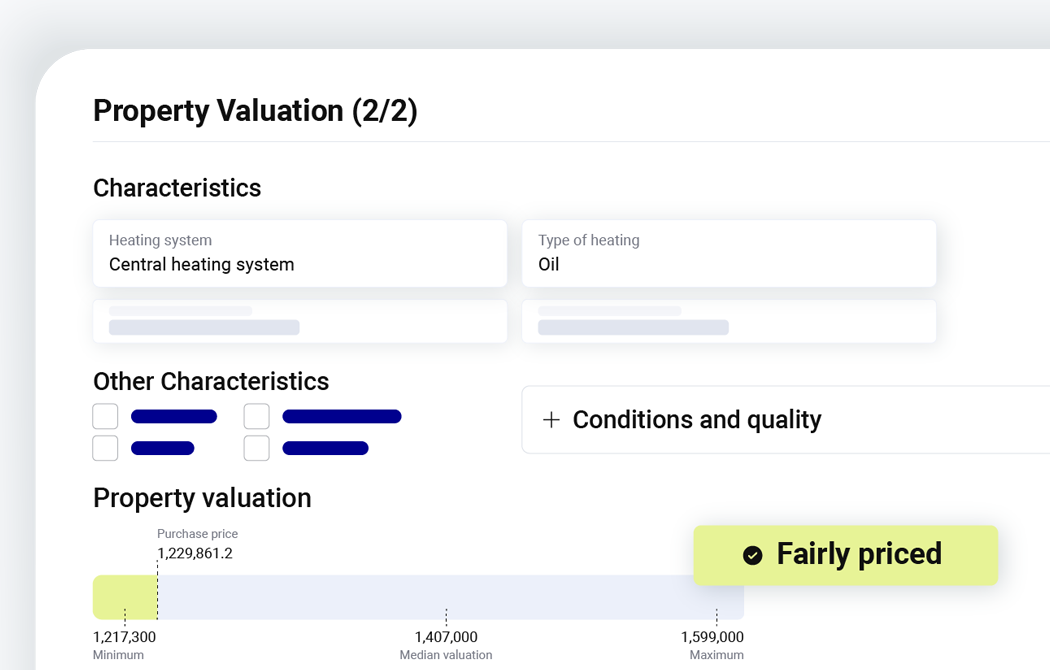

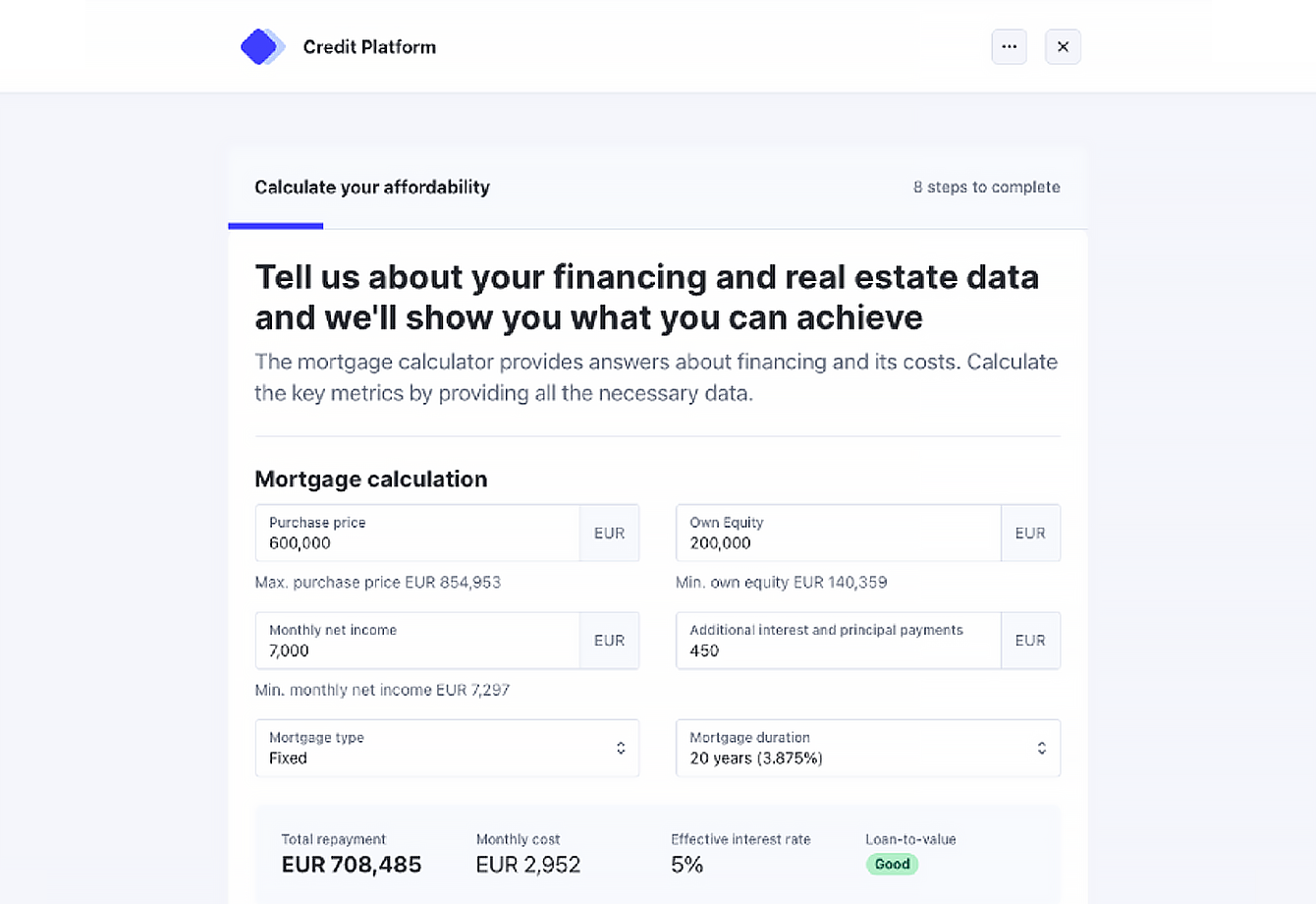

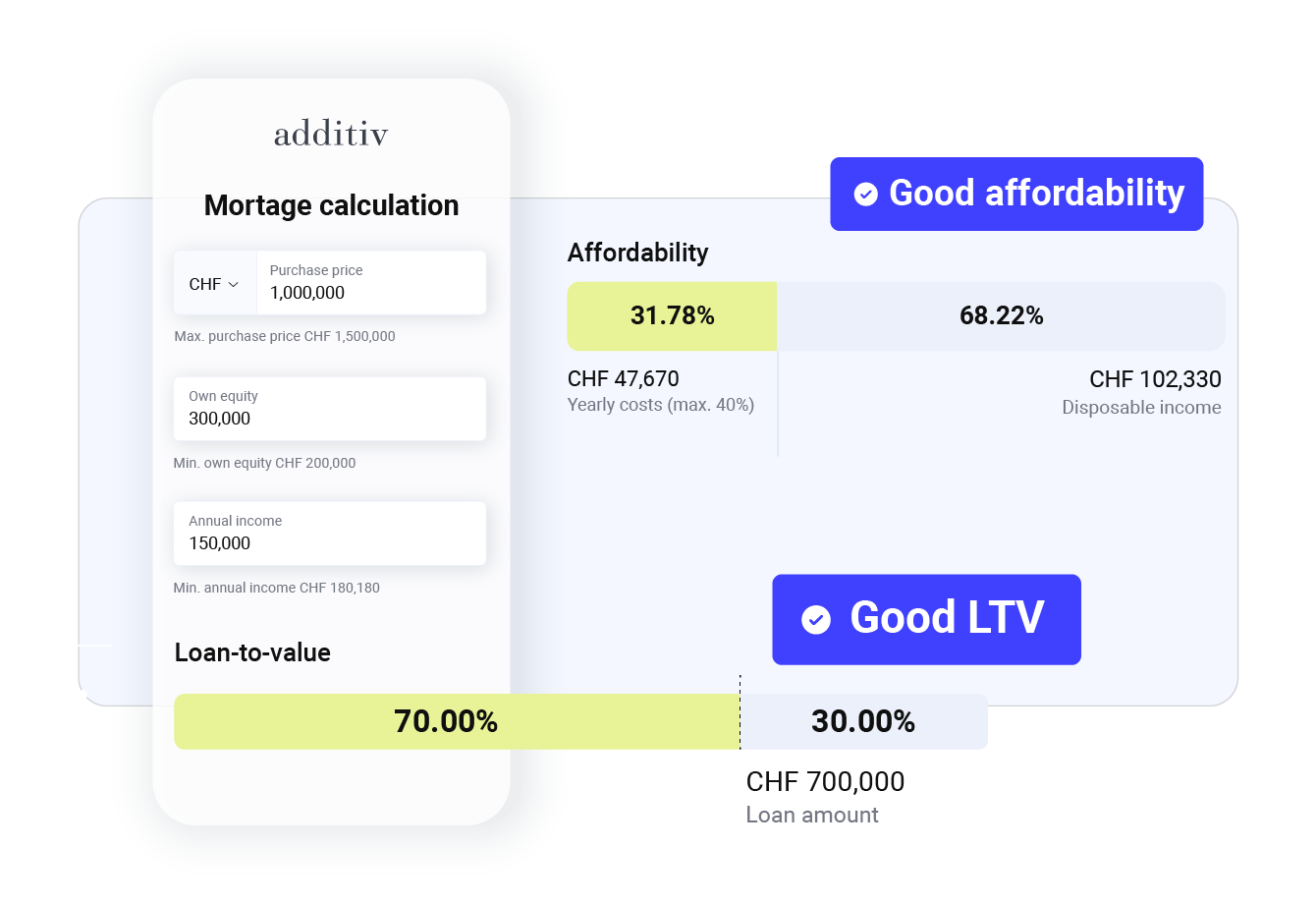

Use real-time data and AI-powered insights to tailor loan offers while embedding automated credit risk checks, affordability assessments, and regulatory compliance.

Serve customers across digital self-service, advisor-led, hybrid, and embedded models, without needing to overhaul existing infrastructure.

Operate as a white-label solution, managed service, or embedded component in third-party platforms, with full control over the experience and partner network.

Smarter lending. Faster decisions. Greater flexibility.

Personalize journeys, automate workflows, and bring new credit propositions to market — quickly and at scale.

addInnovation

Bring new credit products to market faster with pre-built workflows for mortgages, consumer, SME, and Lombard lending, adaptable to evolving customer needs, risk models, and channels.

addAutomation

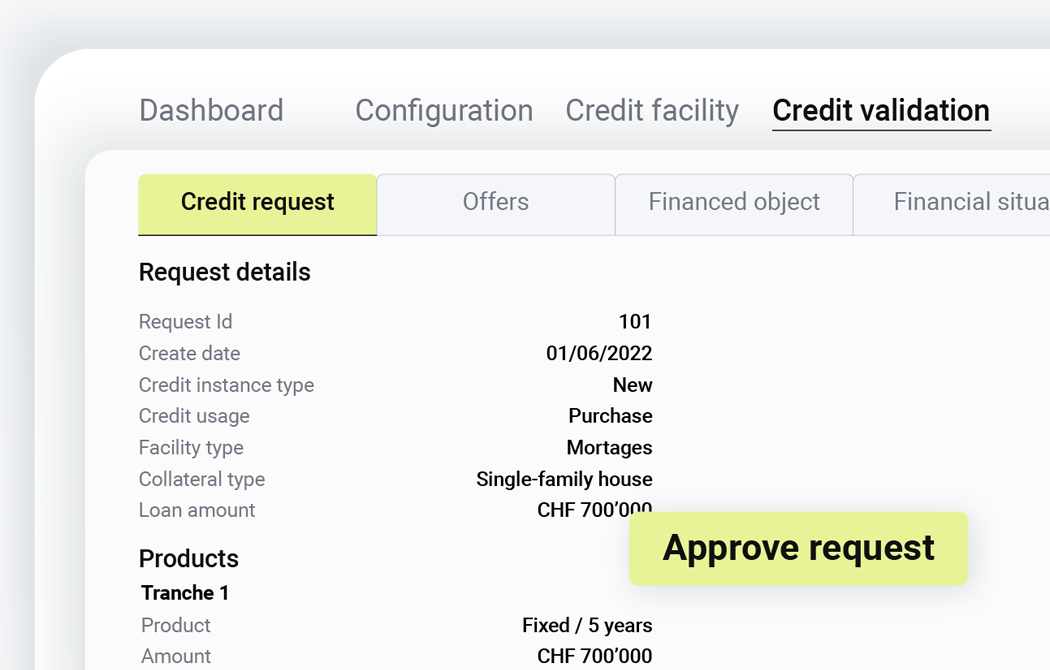

Automate the entire credit lifecycle: from origination and decisioning to servicing, with AI-driven insights and built-in controls for risk and regulatory alignment.

addOpenSourcing

Connect seamlessly to lenders, brokers and service partners using our open, API-first platform, scaling your credit ecosystem without operational or compliance complexity.

Impact across the credit value chain

Create value for every stakeholder — reducing costs, accelerating delivery, and streamlining credit experiences from origination to servicing.

Faster and more sustainable credit offerings

Optimized risk management

Configure credit parameters to match your risk appetite, with real-time scoring, compliance, and pre-checks built in.

Faster go-to-market

Launch new lending products or embedded propositions quickly, leveraging a modular, interoperable platform.

Streamlined origination journey and minimal processing effort

Flexible sourcing

Offer your customers access to the right credit products from multiple integrated lenders.

Embedded at point of need

Place credit exactly where it’s needed: within digital banking, wealth journeys, e-commerce platforms, or employer portals.

Streamlined, customer-friendly credit processes

Better-informed decisions

Present real-time comparisons and transparent terms to help customers choose the right solution for their needs.

Confidence and control

Empower customers with faster approvals, clear communication, and digital servicing tools that build trust and loyalty.

Our client partnerships

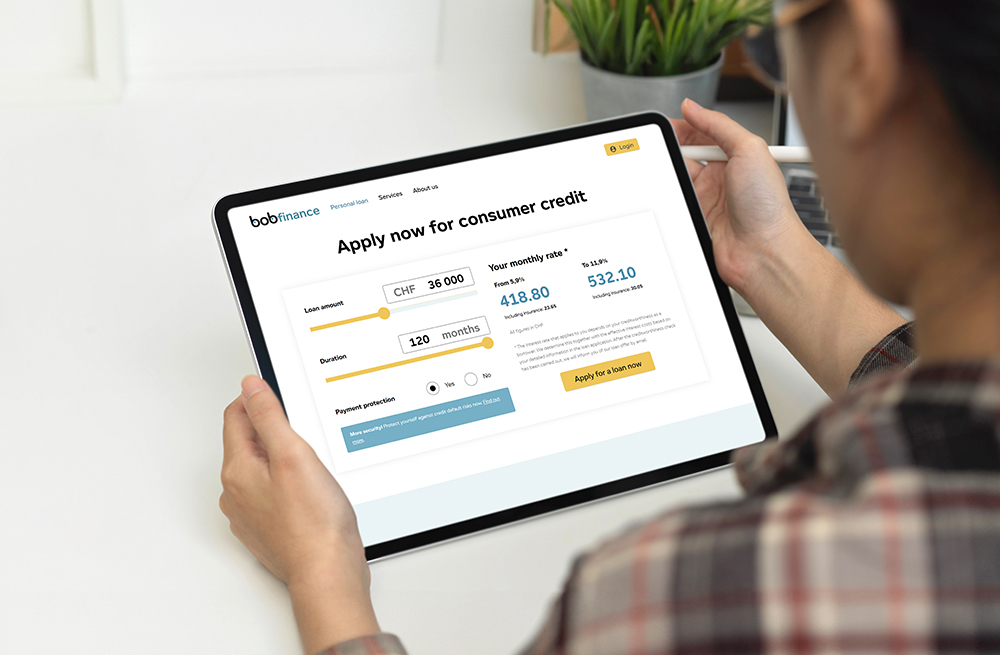

Developing a new financial services company for the retailer Valora targeting consumer finance market online and integrated at the POS.

End-to-end digital lending

From distribution, origination, refinancing till servicing on one digital platform.

Comprehensive business consulting

Business development from business case up to refinancing.