Hybrid

Manage investment and client relationships with a set of applications. These intuitive and engaging solutions provide advisor-assisted personalized advice, self-service access or a hybrid of the two.

Omni-channel by design

Our Hybrid Wealth Manager gives a rich and seamless customer experience across all client touchpoints. It empowers users to manage their investments through an intuitive Client Cockpit or work with their advisors through the Mobile Advisor app, as well as giving advisors a comprehensive suite of service and productivity tools with the Workbench.

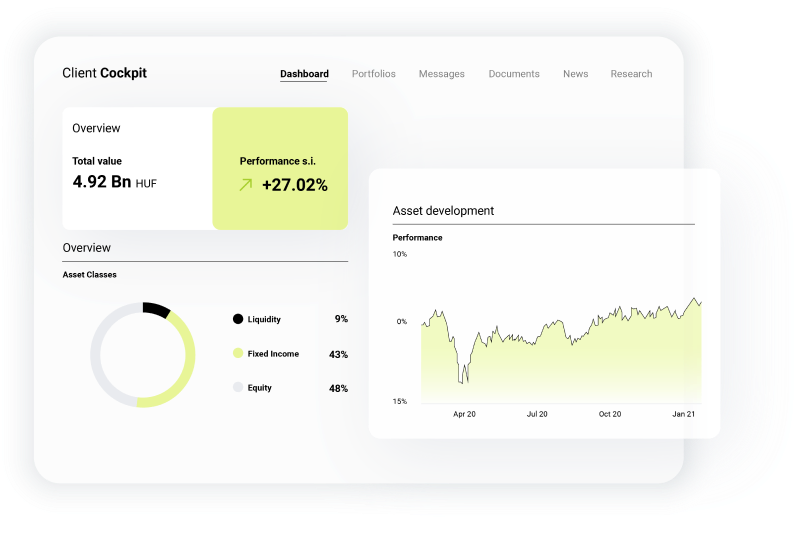

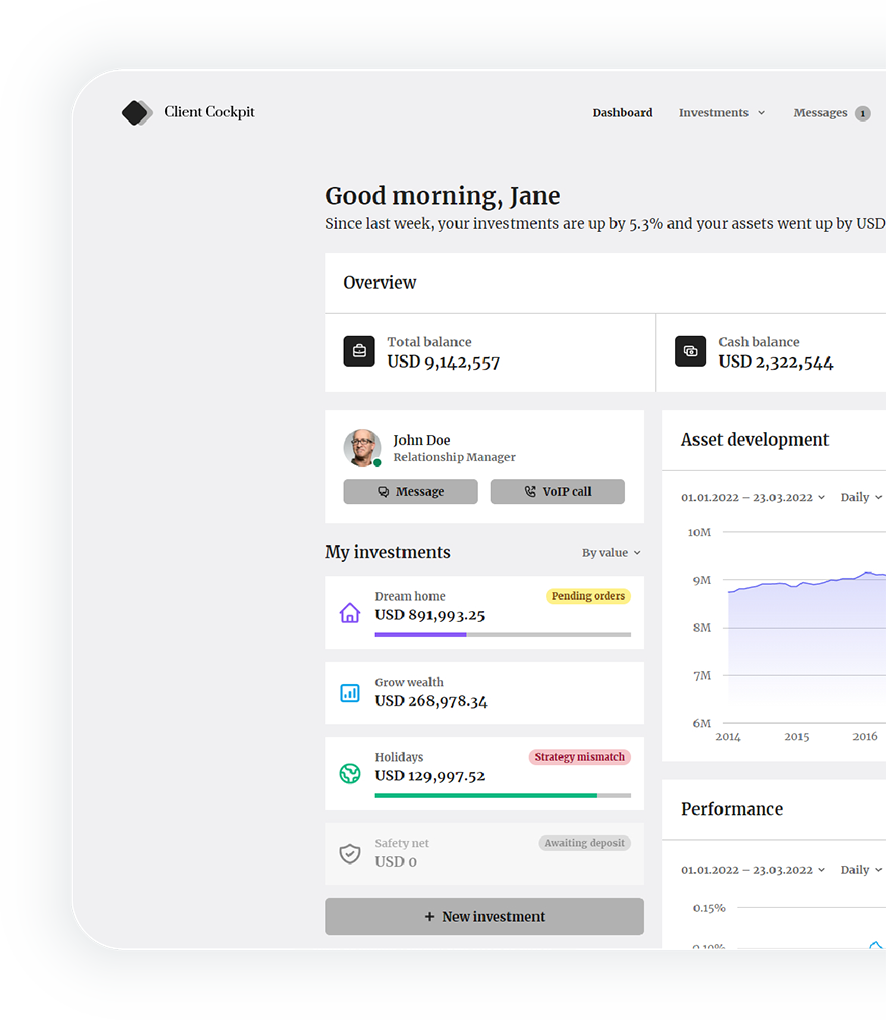

Client Cockpit

Our Client Cockpit solution combines comprehensive self-service capabilities with rich engagement tools.

Offer tools to project the impact of investment decisions on portfolios

Show interactive views of product holdings and portfolio performance

Present personalized content and idea generation

Offer quick and easy advisor proposal consent

Offer real-time, secure and collaborative advice at anytime, from anywhere

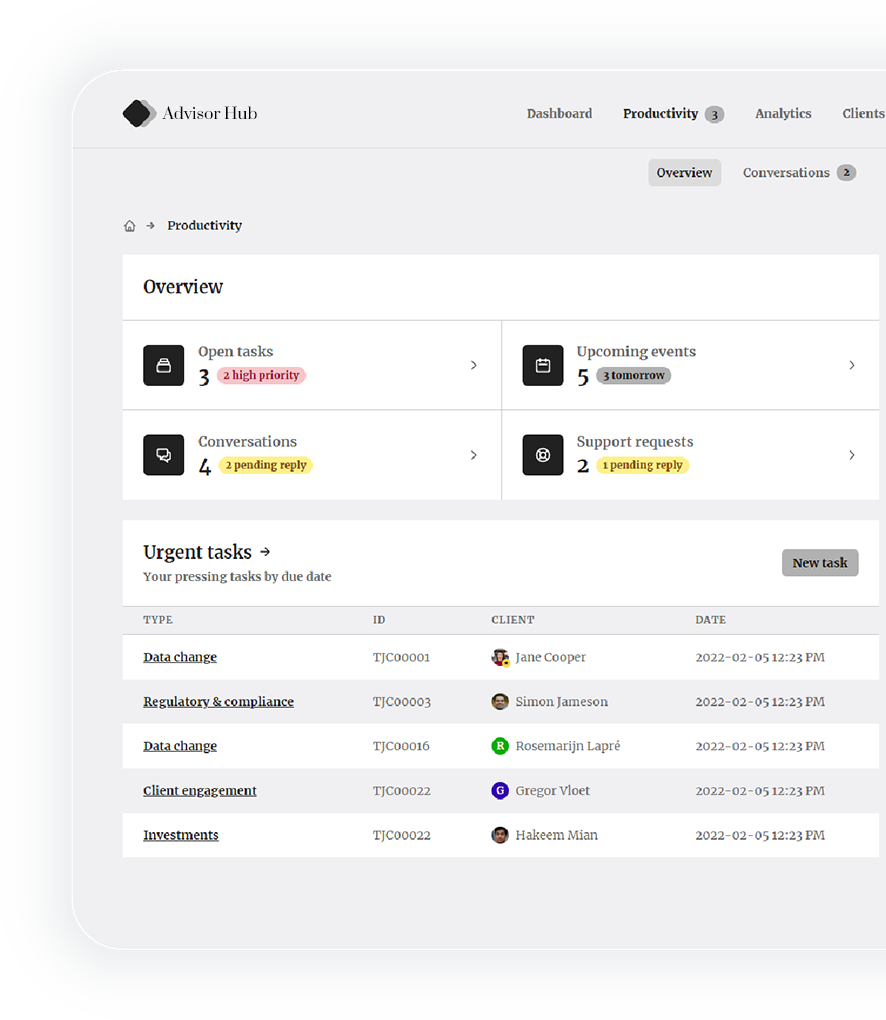

Advisor Hub

Our Advisor Hub application offers all the tools and functions needed to support advisors ‘on the go’. Reinforcing the direct advisory role, it allows relationship managers to maintain their personal relationship without losing productivity.

Ensure relationship managers remain productive and focused on key tasks

Offer in-person, remote advisor and client conversations through a multitude of channels

Enable advisors to walk through proposals, optimizations and simulations in real-time

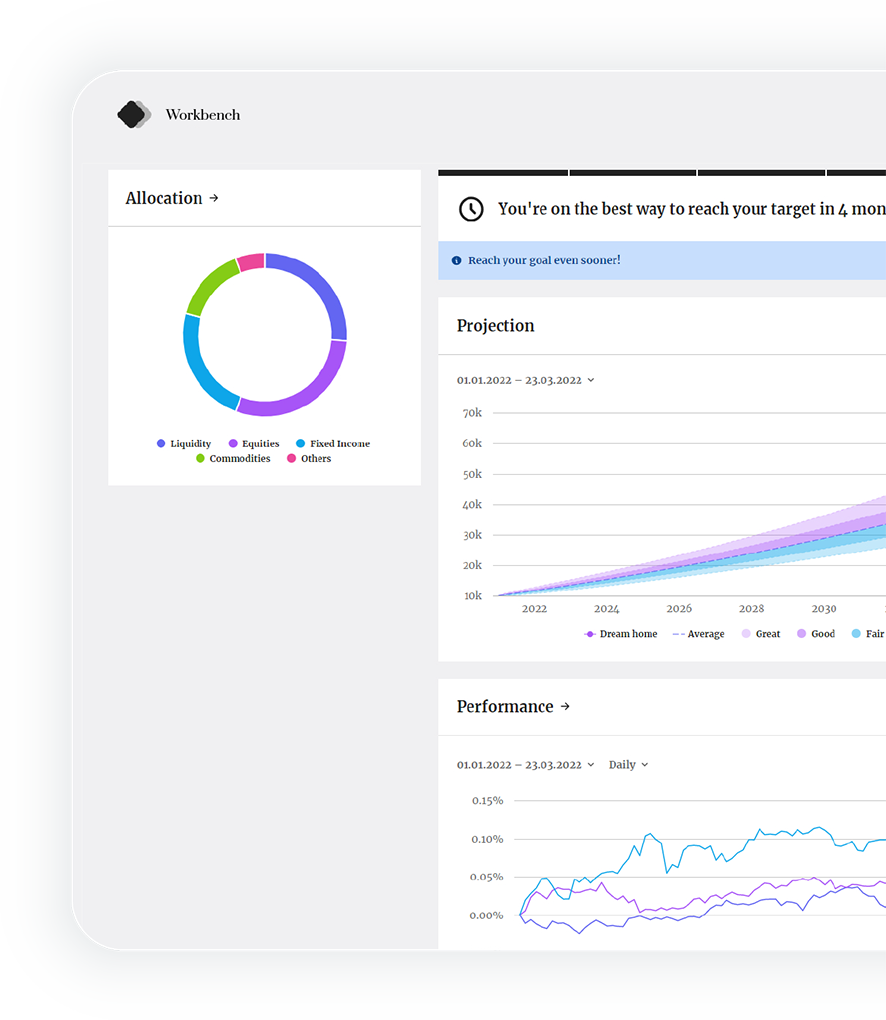

Workbench

Our Workbench solution enables quick and easy configuration; merging client relationship management and portfolio management services.

Enhance advisor customer service, productivity and performance alongside Mobile Advisor

Access CRM, portfolio management, order management, content management, management information and analytics

Manage and supervise all advisor tasks, activities and communications

Unlock your potential

with Hybrid Wealth Manager

Manage multiple client segments

Service different customer types (discretionary and advisory) from the same platform

Boost engagement

Increase cross-sales with interactive goals, personalized content and secure chat

Strengthen client loyalty

Offer high quality and consistent advice through any channel, available 24/7

Grow wallet share

Serve up relevant proposals via the integrated prospect management and rules engine

Launch new products faster

Easily configure and roll-out products and services with product builder tools

Gain valuable insight

Analyze client behavior, track processes and operational performance

Superior customer experience in

wealth management

Learn how we enable wealth managers worldwide to engage, manage and grow their customer base by using the

leading omni-channel wealth management platform.

How additiv helped PostFinance enter the digital wealth management market

In May 2020, PostFinance AG, one of the largest banking institutions in Switzerland, went live with Hybrid Wealth Manager.

Since then, 800,000 of its clients have access, on a self-service or advisory basis, to broad range of digital investment services. Onboarding takes less than 10 minutes, after which customers are free to manage their investments anywhere and anytime.

Speak with an expert

Book a session with digital wealth, embedded finance

or technology experts.