Bringing Societal Impact to Markets

Clarity AI provides a tech platform for investors to manage the key regulatory, sustainability and impact needs of their investment portfolios, leveraging big data and machine learning. It is now a market leading sustainability solution endorsed and in use by some of the world’s preeminent asset managers, asset owners, wealth managers, investment platforms and fund distribution platforms.

Clarity AI

Clarity AI’s value proposition is structured around three main pillars.

The largest and most reliable database of environmental and social impact data (~30k companies, 198 countries, 187 local governments, 135k+ funds), by combining both structured and unstructured data, applying reliability algorithms and complementing them with estimated data.

Societal / environmental impact and sustainability modules and proprietary methodologies (e.g., ESG Risk, Climate, UN SDGs), including market leading Regulatory Solutions for EU Taxonomy and SFDR reporting. Additionally, access unique scoring customization capabilities and reporting based on client’s preferences.

A technology platform that enables seamless sustainability analysis and reporting of investment portfolios.

Business impact

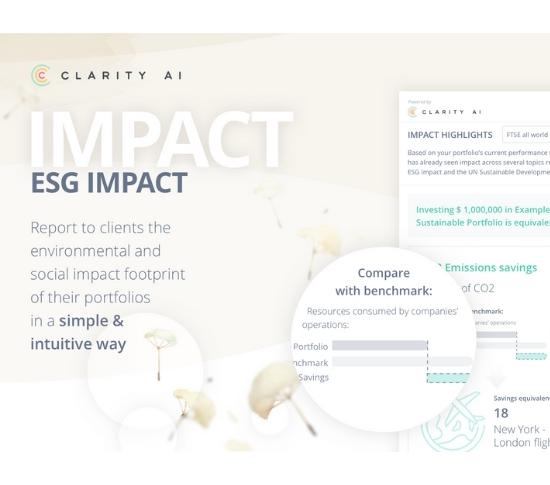

Engage with clients in new ways

Report to your clients the environmental and social impact footprint the portfolio, helping them understand how their investments have the potential to create measurable impact for people and the planet.

Reduce portfolio risk & generate alpha

Decrease risk and generate excess returns by adding valuable material information to traditional financial analysis, i.e. understand how your portfolios’ constituents are managing environmental, social, and governance (ESG) risks.

Create new investment products

Invest in funds aligned with your clients’ values, by understanding climate effects and exposures across 30+ controversial topics such as tobacco, alcohol, gambling.

Comply with sustainability regulations

Report on the key sustainability metrics as defined by the Sustainable Finance Disclosures Regulation (SFDR), EU Taxonomy, and other international standards.